Qantas 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

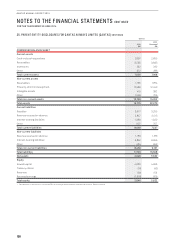

30. SUPERANNUATION CONTINUED

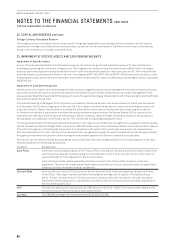

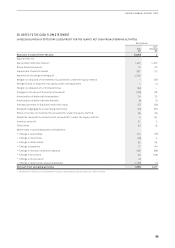

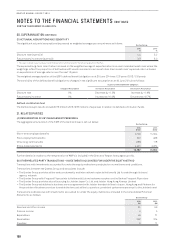

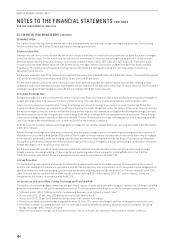

(D) ACTUARIAL ASSUMPTIONS AND SENSITIVITY

The significant actuarial assumptions (expressed as weighted averages per annum) were as follows: Qantas Group

2014

%

2013

%

Discount rate (Australia) 4.4 5.2

Future salary increases (Australia) 3.013.0

1 Nil salary increase in year 2 and year 3 and three per cent in all other years for the remaining duration of the Plan.

The expected long-term rate of return is based on the weighted average of expected returns on each individual asset class where the

weightings reflect the proportion of defined benefit assets invested in each asset class. Each asset class’ expected return is based

on expectations of average returns over the next 10 years.

The weighted average duration of the QSP’s defined benefit obligation as at 30 June 2014 was 12.6 years (2013: 12.6 years).

The sensitivity of the defined benefit obligation to changes in the significant assumption as at 30 June 2014 is as follows:

Change in Assumption

Impact on Defined Benefit Obligation

Increase in Assumption Decrease in Assumption

Discount rate 1% Decrease by 11.5% Increase by 11.6%

Future salary increase 1% Increase by 10.3% Decrease by 10.7%

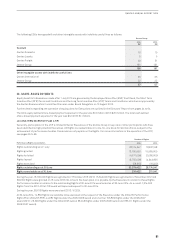

Defined contribution fund

The Qantas Group’s results include $173million (2013: $165million) of expenses in relation to defined contribution funds.

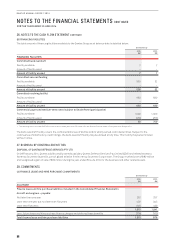

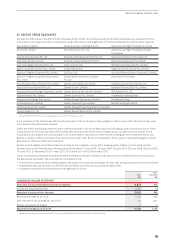

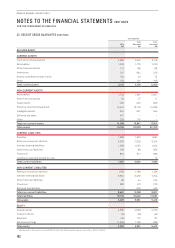

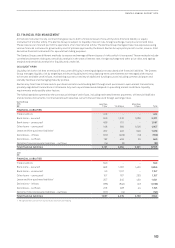

31. RELATED PARTIES

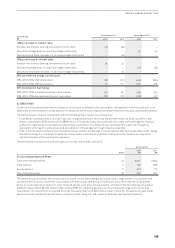

(A) REMUNERATION OF KEY MANAGEMENT PERSONNEL

The aggregate remuneration of the KMP of the Qantas Group is set out below:

Qantas Group

2014

$’000

2013

$’000

Short-term employee benefits 9,129 11,344

Post-employment benefits 522 463

Other long-term benefits (285) 118

Share-based payments 4,421 4,974

13,787 16,899

Further details in relation to the remuneration of KMPs is included in the Directors’ Report from pages 44 to 64.

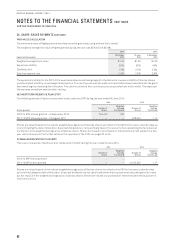

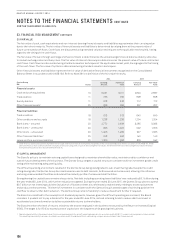

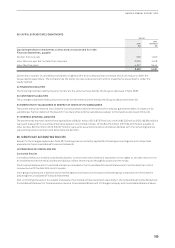

(B) OTHER RELATED PARTY TRANSACTIONS – INVESTMENTS ACCOUNTED FOR UNDER THE EQUITY METHOD

Transactions with investments accounted for under the equity method are conducted on normal terms and conditions.

Transactions between the Qantas Group and associates include:

–The Qantas Group provides airline seats on domestic and international routes to Helloworld Ltd for sale through its travel

agency network

–The Qantas Group sells Frequent Flyer points to Helloworld Ltd and redeems vouchers on the Qantas Frequent Flyer store

–The Qantas Group provides aircraft sourcing for Jetstar Japan Co. Ltd. and Jetstar Hong Kong Airways Limited

–The Qantas Group established a business service agreement with Jetstar branded airlines in Japan, Hong Kong and Vietnam for

the provision of business services to enable the low cost airline to operate a consistent customer experience for the Jetstar brand

Transactions and balances with investments accounted for under the equity method are included in the Consolidated Financial

Statements as follows:

Qantas Group

2014

$M

2013

$M

Revenue and other income 61 56

Finance income 6 5

Expenditure 49 71

Receivables 292 314

Payables 5 11