Qantas 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S

REPORT1

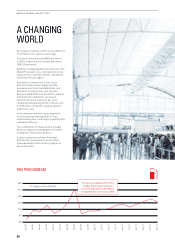

The year to 30 June 2014 was among the

most challenging Qantas has faced.

Underlying fuel costs reached a new

record of $4.5 billion, up $253 million

from 2012/2013. And capacity growth

ahead of demand led to a deterioration

in yield and passenger loads which saw

revenue decline by $550 million.

This was the culmination of a period in

which the Australian aviation market

has been one of the most world’s most

competitive.

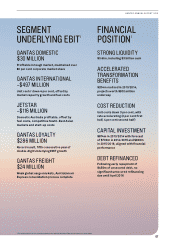

I acknowledge that the 2013/2014

result – an Underlying Loss Before Tax

of $646million – was unsatisfactory.

But I believe Qantas is taking the right

actions to secure an earnings recovery,

strengthen its financial position and

shape a profitable, sustainable future.

Shareholders have been patient and

supportive throughout a volatile period.

As we continue the necessary reform

of the business, we remain focused on

building long-term shareholder value in

everything we do.

Accelerated Transformation

The accelerated Qantas Transformation

program announced in December

2013 – targeting $2 billion in benefits to

2016/2017 – is commensurate to the size

of the challenge.

This is one of the biggest change

programs seen in the aviation industry,

building on the considerable progress

made with transformation from 2009

through to 2013. It is already delivering

results – with $204 million of benefits

in the second half of 2013/2014 – and

momentum will build throughout

2014/2015.

Change on this scale cannot be achieved

without an impact on employees. I

recognise that this has been a difficult

time for the Group’s people. They

have responded magnificently to the

challenges we face and deserve great

credit for our progress to date, as well as

for Qantas’ ongoing excellence in service,

safety and operational performance.

Structural Review

Following a wide-ranging review of the

structure of the Qantas Group, the Board

has given approval for the establishment

of a new holding structure and corporate

entity for Qantas International.

This step – following the partial repeal

of the Qantas Sale Act – creates the

long-term option for Qantas International

to source external investment and

participate in partnership opportunities

in the global aviation market.

While there are no other changes to

the core structure of the Group, we will

continue to assess options to sell non-

core assets to generate cash for debt

reduction.

Financial Position

The Group has strong liquidity of

$3.6billion, including $3 billion in cash.

At 30 June 2014, the Group was free cash

flow neutral after delivering a resilient

$1.1billion in operating cash flow.

Debt-to-EBITDA peaked in 2013/2014 and

further debt reduction will be enabled by

positive net free cash flow as we move

forward with the accelerated Qantas

Transformation program.

A series of refinancing transactions in

the unsecured markets has extended

the Group’s debt maturity profile, while

capital expenditure has been reduced

in line with financial performance,

prioritising Group fleet simplification.

Board Renewal

Qantas Board renewal is an ongoing

priority.

I would like to thank Peter Cosgrove for

his significant contribution over almost

nine years as a Director and congratulate

him on his richly-deserved appointment

as Governor-General.

In the past 12 months the Board has been

strengthened by the additions of Maxine

Brenner and Jacqueline Hey and, looking

forward, we will assess the need for

further new appointments as required.

In the meantime, all our Directors

continue to make a strong and active

contribution to Board deliberations.

Shaping Qantas’ Future

The actions taken in 2013/2014 have

better equipped Qantas to build long-

term shareholder value, provide world-

class service, serve the Australian

community, and shape its future in the

21st century aviation industry.

I thank all the Group’s employees,

shareholders, customers and partners

for their support throughout the year.

As we continue the

necessary reform

of the business, we

remain focused on

building long-term

shareholder value in

everything we do.

1 For explanations of non-statutory measures, see the Review of Operations section in this report.

2 Total annual cash benefit, realised one year after completion of initiative.

03

QANTAS ANNUAL REPORT 2014