Qantas 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

QANTAS ANNUAL REPORT 2014

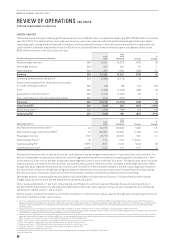

–Avalon heavy maintenance facility closed

–Line Maintenance Operations changes enacted

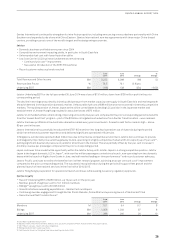

–Right-sizing fleet and network at a cost of $394million23 in financial year 2013/2014

• Qantas International network optimisation under way; exit Perth-Singapore, down-gauge aircraft to A330s on Sydney-

Singapore and Brisbane-Singapore, re-time of QF 9/10 and maintenance changes to up-gauge Sydney-Dallas/Fort Worth

to A380-800

• Qantas Domestic fleet simplification under way; exit of B737-400 aircraft and continuation of B767-300 retirement

• Over 50 aircraft deferred or sold, accelerated B747-400 and B767-300 retirement in Group fleet restructure

–Jetstar ‘Lowest Seat Cost’ program lowering unit costs with a two per cent improvement in 2013/2014

–$1.3 billion reduction24 in planned capital investment in financial years 2014/2015 and 2015/2016

–Net debt4 reduced by $96million

In December 2013, management announced it would freeze wages until the Qantas Group makes a full-year underlying profit. The

wage freeze is:

–Ongoing for executives

–Immediate for open Enterprise Bargaining Agreements (EBAs)

–Proposed for other EBA-covered staff

Discussions with respective unions on implementation of the wage freeze continue to take place.

The Qantas Group Chief Executive Officer did not receive an increase in Base Pay during 2013/2014 and elected to forego five per cent

of Base Pay from 1 January 2014. All other Qantas Airways Limited Directors also elected to forego five per cent of their fees from

1January 2014.

In addition to the wages freeze, no bonus payments will be awarded for financial year 2013/2014.

The end of financial year 2013/2014 represents the peak in costs associated with Qantas Transformation being incurred, with the full

run-rate of permanent cost reduction to flow in the financial year ahead.

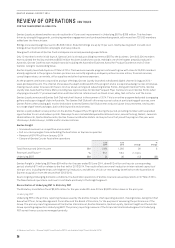

Unlocking value through a structural review

The outcomes from the review are both structural and strategic for the future direction of Qantas Group:

–Creating future optionality for Qantas International:

Qantas Sale Act

foreign ownership restrictions have been a long-standing

barrier to Qantas’ participation in industry consolidation at a Group level. The partial repeal of the Act’s 25% and 35% foreign airline

ownership caps removes a substantial barrier to consolidation that was unique to Qantas.

The decision has been made to create a new holding structure and corporate entity for Qantas International. The new structure

increases potential for future external investment, and creates long-term options for Qantas International to participate in

partnership and consolidation opportunities.

The new structure builds upon existing segmentation of Qantas International and Qantas Domestic at management and financial

reporting levels since 2012.

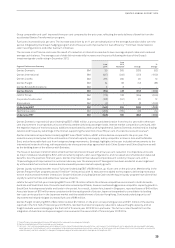

With the change to Group structure, accounting standards require a change to the Group’s Cash Generating Units (CGU) for

impairment testing.

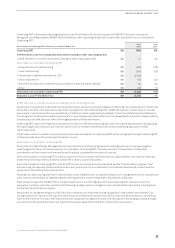

–Impact on Qantas International asset carrying values: Prior to the Board decision to change the structure of the Group, the

Qantas Brands CGU comprised the operations of the Qantas fleet and brand to collectively generate cash inflow and derive value.

As a result of the decision to create a new holding structure and corporate entity for Qantas International, Accounting Standards

require the existing ‘Qantas Brands CGU’ to be split into four separate CGUs for the purposes of assessing the carrying value of the

Group’s assets.

While there are significant surpluses in Qantas Loyalty, Qantas Domestic and Qantas Freight CGUs, an impairment of

$2,560million arose in the stand- alone Qantas International CGU. The size of the impairment loss recognised is largely the

resultof wide body aircraft being purchased through a period where the Australian dollar was significantly weaker against the

USdollar compared to recent years.

This impairment is a non-cash charge, with no impact on the economics of the business or change to cash flow forecasts. The

impairment has arisen because Qantas International CGU has been tested as a standalone CGU for the first time. Accordingly the

Qantas International fleet assets are not assessed in combination with the collective cash flows of the whole of Qantas’ operations.

Following the impairment, the carrying value of Qantas International aircraft is more reflective of current market value.

24 Compared to August 2013 planned capital expenditure.