Qantas 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

QANTAS ANNUAL REPORT 2014

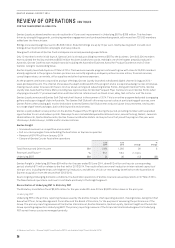

REVIEW OF OPERATIONS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

Qantas’ guiding strategic principles remain consistent

As the Group undergoes the most significant business transformation in its history, repositioning both its cost base and competitive

position in every market we operate in, our guiding strategic principles as a business remain consistent:

–Safety is always our first priority

–The first choice for customers in every market we serve

–Maintaining dual-brand strength in the Australian market

–Reshaping Qantas International to remain competitive

–Maintaining the Jetstar opportunity in Asia

–Broadening Qantas Loyalty for strong, diversified earningsgrowth

–Driving efficiency and productivity across the Group

In order to continue implementing that strategy and to deliver sustainable returns to shareholders in what will remain a very

challenging operating environment, the Group must accelerate the pace of Qantas Transformation.

With overarching targets to implement initiatives that will deliver $2 billion2 of benefits by the end of financial year 2016/2017 and

reduce net debt20 by more than $1 billion by the end of financial year 2014/2015, Qantas Transformation is the key to driving earnings

recovery and simultaneously deleveraging the Group’s balance sheet.

At the same time, the Group is focused on targeted reductions in capital investment to ensure sustainable positive free cash flow

from financial year 2014/2015 onwards. To remain the first choice for customers and maintain our brand and yield premium, key

customer-facing investments, including gateway lounges, cabin reconfigurations to the A330 and B738 fleets, and the prioritisation

of fleet simplification through the arrival of the B787-8 Dreamliner into Jetstar, are all proceeding.

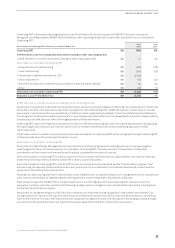

Strategic priorities delivered on in the 2013/2014 financial yearinclude:

–Dual-brand strength: number one and two most profitable Australian Domestic airlines21; maintained margin premium over

competition; market-leading on-time performance; unrivalled network and frequency; retained over 80 per cent of corporate

accounts by revenue

–First choice for customers: new and expanded lounges opened in Singapore, Hong Kong, Los Angeles and in the domestic market;

roll-out of B787-8 Dreamliner on new routes; record customer satisfaction levels; ongoing commitment to staff training

–Reshaping Qantas International: strong comparable unit cost improvement of four per cent; enhanced code share relationships

with China Eastern and China Southern; successful integration with major alliance partner Emirates after move to new hub

in Dubai

–Maintaining Jetstar opportunity in Asia: largest Low Cost Carrier (LCC) in domestic Japan market, second base in Osaka

launched, market leading OTP; Jetstar Asia ‘Best Budget Airline’ in 201422; Jetstar Pacific business recapitalisation complete;

all A320-200 fleet driving unit cost improvement

–Broadening Qantas Loyalty: customer innovation with launch of Qantas Cash and Aquire new revenue streams; reached milestone

of over 10million members16 in Qantas Frequent Flyer

Qantas Transformation strong momentum towards $2 billion target

The pillars that underpin the Group’s transformation are:

–Accelerating cost reduction

–Right-sizing fleet and network

–Working existing assets harder

–Deferring growth

–Aligning capital expenditure to financial performance

–Accelerating simplification

–Focus on customer and revenue

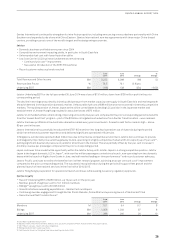

In the second half of financial year 2013/2014, $204million of Transformation benefits were realised and an even greater pipeline

of initiatives entered the implementation phase for delivery in financial year 2014/2015 and beyond. The accelerated Qantas

Transformation program builds upon the significant cost reduction and strategic achievements of recent years.

Transformation milestones achieved in the first six months of the accelerated program include:

–$204million of benefits realised, $900million worth of initiatives in implementation phase

–Accelerating comparable unit cost6 reduction: two per cent in first half, four per cent in second half of 2013/2014

–2,200 of targeted 5,000 FTE reduction exited as at 30 June2014. Redundancy, restructuring and other transformation costs

of $428million23 recognised in financial year 2013/2014

20 Net debt including operating lease liabilities includes on balance sheet debt and off balance sheet aircraft operating lease liabilities. Operating lease liability is the present value of

minimum lease payments for aircraft operating leases which, in accordance with AASB 117: Leases, is not recognised on balance sheet. The operating lease liability has been calculated

as the present value of future non-cancellable operating lease rentals of aircraft in service, using a discount rate of seven per cent applied in Standard and Poor’s methodology.

21 Based on Qantas Domestic and Jetstar earnings before interest and tax in 2013/2014. Tigerair Australia reported earnings before interest and tax, and consensus estimates for Virgin

Australia domestic earnings before interest and tax in 2013/2014.

22 AsiaOne People’s Choice Awards.

23 Included in items not included in Underlying PBT in the 2013/2014 financial year.