Qantas 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

QANTAS ANNUAL REPORT 2014

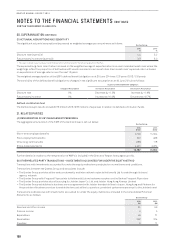

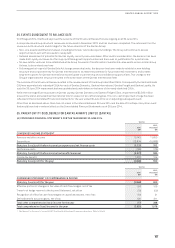

34. EVENTS SUBSEQUENT TO BALANCE DATE

On 28 August 2014, the Board approved the outcome of the Structural Review that was ongoing as at 30 June 2014.

A comprehensive Group structural review was announced in December 2013, and has now been completed. The outcomes from the

review are both structural and strategic for the future direction of the Qantas Group:

–Non-core assets identified and valued, including terminals, land and property holdings. The Group will continue to assess

opportunities to sell, with proceeds to repay debt

–Detailed assessment of potential for Qantas Loyalty minority sale undertaken. After careful consideration, the decision has been

made that Loyalty continues to offer major profitable growth opportunities and there was no justification for a partial sale

–No new Jetstar ventures to be established while Group focused on Transformation. Substantial value exists across Jetstar Group

Airlines, to be realised over time

–Following partial repeal of Qantas Sale Act foreign ownership limits, the decision has been made to establish a new holding

structure and corporate entity for Qantas International to increase the potential for future external investment, and creates

long-term options for Qantas International to participate in partnership and consolidation opportunities. This change to the

Group’s organisational structure resulted in the write-down of the Qantas International fleet

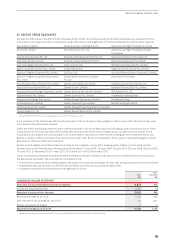

The outcome of the Structural Review resulted in the reassessment of the Group’s identified CGUs. Consequently the Qantas Brands

CGU was separated into individual CGUs for each of Qantas Domestic, Qantas International, Qantas Freight and Qantas Loyalty. As

such the 30 June 2014 impairment test was updated and undertaken on the basis of the newly identified CGUs.

While there are significant surpluses in Qantas Loyalty, Qantas Domestic and Qantas Freight CGUs, impairment of $2,560million

arose in the stand-alone Qantas International CGU in respect of aircraft and engines. This non-cash impairment charge has been

reflected in the Consolidated Financial statements for the year ended 30 June 2014 as an adjusting subsequent event.

Other than as disclosed above, there has not arisen in the interval between 30 June 2014 and the date of this Report any other event

that would have had a material effect on the Consolidated Financial Statements as at 30 June 2014.

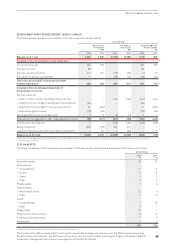

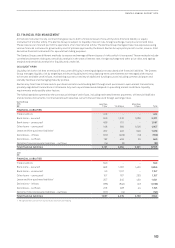

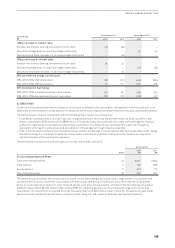

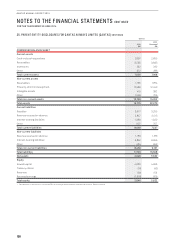

35. PARENT ENTITY DISCLOSURES FOR QANTAS AIRWAYS LIMITED (QANTAS)

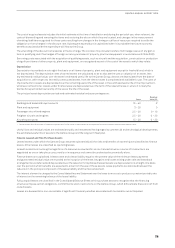

(A) CONDENSED FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2014

Qantas

2014

$M

2013

Restated1

$M

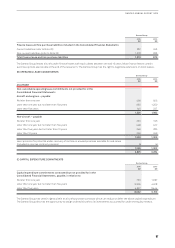

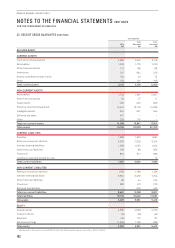

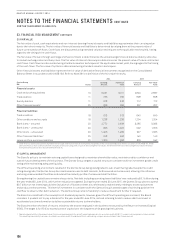

CONDENSED INCOME STATEMENT

Revenue and other income 10,143 11,650

Expenditure (13,874) (10,888)

Statutory (loss)/profit before income tax expense and net finance costs (3,731) 762

Net finance costs (190) (176)

Statutory (loss)/profit before income tax benefit/(expense) (3,921) 586

Income tax benefit 1,073 104

Statutory (loss)/profit for the year (2,848) 690

Qantas

2014

$M

2013

Restated1

$M

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

Statutory (loss)/profit for the year (2,848) 690

Effective portion of changes in fair value of cash flow hedges, net of tax (97) 106

Transfer of hedge reserve to the Income Statement, net of tax (70) (50)

Recognition of effective cash flow hedges on capitalised assets, net of tax (19) 21

Defined benefit actuarial gains, net of tax 109 311

Total other comprehensive (loss)/income for the year (77) 388

Total comprehensive (loss)/income for the year (2,925) 1,078

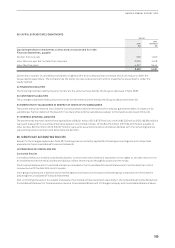

1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.