Qantas 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

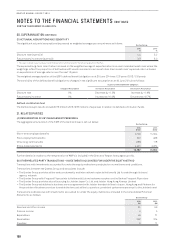

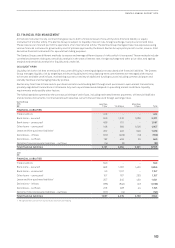

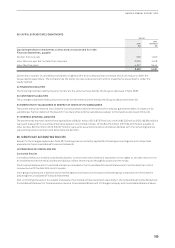

33. FINANCIAL RISK MANAGEMENT CONTINUED

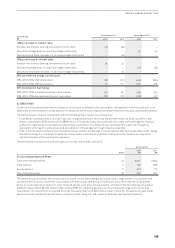

(D) FAIR VALUE

The fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value

due to their short maturity. The fair value of financial assets and liabilities is determined by valuing them at the present value of

future contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having

regard to the timing of the cash flows.

The fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by reference

to market exchange rates and fuel prices. The fair value of interest rate swaps is determined as the present value of future contracted

cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the timing

of the cash flows. The fair value of options is determined using standard valuation techniques.

Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated

Balance Sheet in accordance with AASB 139. Refer to Note 36 for a definition of the fair value hierarchy.

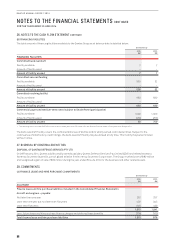

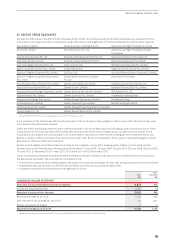

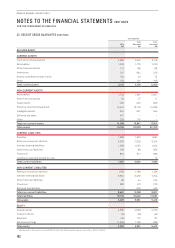

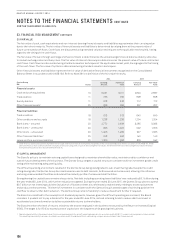

Qantas Group

$M Notes

2014 2013

Carrying

Amount

Fair Value

Total

Carrying

Amount

Fair Value

Total

Financial assets

Cash and cash equivalents 10 3,001 3,011 2,829 2,837

Trade debtors 11 736 736 898 898

Sundry debtors 11 618 618 712 712

Other financial assets125 206 206 207 207

Financial liabilities

Trade creditors 18 613 613 640 640

Other creditors and accruals 18 1,238 1,238 1,204 1,204

Bank loans – secured 20 2,772 2,608 3,285 3,393

Bank loans – unsecured 20 996 1,022 992 1,056

Other loans – unsecured 20 1,405 1,469 927 1,065

Other financial liabilities125 248 248 140 140

Lease and hire purchase liabilities 20 1,310 1,293 876 942

1 Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated Balance Sheet in accordance with AASB 139. These

derivative financial instruments have been measured at fair value using Level 2 inputs in estimating their fair values. The different methods of estimating the fair value of financial

instruments measured at fair value are defined in Note 36.

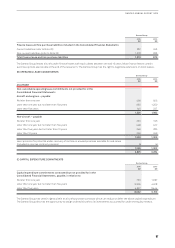

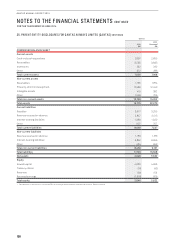

(F) CAPITAL MANAGEMENT

The Board’s policy is to maintain a strong capital base designed to maximise shareholder value, maintain creditor confidence and

sustain future development of the business. The Qantas Group targets a capital structure consistent with an investment grade credit

rating while maintaining adequate liquidity.

The difficult operating environment resulted in the Qantas Group being downgraded to sub-investment grade. Despite the credit

rating downgrade, the Qantas Group has maintained access to debt markets, both secured and unsecured, allowing it to refinance

maturing unsecured debt facilities and extend the maturity profile of unsecured debt facilities.

Strengthening the capital base remains a key priority. Net debt including operating lease liabilities1 was reduced by $0.1 billion during

the year ended 30 June 2014, with further reductions targeted. During the year ended 30 June 2015, the Qantas Group plans to spend

$0.7 billion on net investing activities (inclusive of off balance sheet aircraft leases) predominantly relating to asset replacement

and product enhancements. This level of investment is consistent with the Qantas Group’s stated target of achieving positive free

cashflow to allow further debt reduction. The Qantas Group retains flexibility to reduce investment further if required.

The Board is committed to the resumption of dividend payments, however, given the difficult operating environment, the Board

considers it prudent not to pay a dividend for the year ended 30 June 2014, instead retaining funds to reduce debt and invest in

accelerated cost transformation to deliver sustainable returns to shareholders.

The Board monitors the level of returns relative to the assets employed in the business measured by the Return on Invested Capital

(ROIC). The target is for ROIC to exceed costs of capital over the long term while growing the business.

1 Operating lease liability is the present value of minimum lease payments for aircraft operating leases which in accordance with AASB 117: Leases is not recognised on balance sheet.

This operating lease liability has been calculated in accordance with Standard and Poor’s methodology using an assumed interest rate of seven per cent