Qantas 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

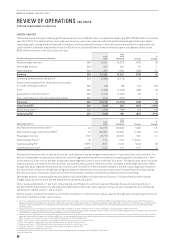

The Qantas Group’s domestic strategy

is based on simple guiding principles: to

hold a frequency and network advantage

in the premium market, and a scale and

network advantage in the price-sensitive

leisure market.

Market capacity increases above

demand between 2012 and 2014 put

intense pressure on yields and reduced

the domestic profit pool. Nevertheless,

Qantas and Jetstar have remained

consistently profitable in the domestic

market throughout this period – including

in 2013/2014, when they were the only

major domestic carriers to make a profit.

Qantas Domestic has held more than

80 per cent of the corporate market by

revenue, while we have increased our

share of the charter market to 30 per cent

– driven by Network Aviation. We have

also maintained investment in product

and service, with the refresh of our Airbus

A330 and Boeing 737-800 fleets to begin

in 2014/2015.

Looking forward, we expect the domestic

travel market to be impacted by weaker

consumer confidence and the shift in

the mining boom from construction

to production. As a result, the Group’s

planned capacity growth is flat – but

we maintain the flexibility to make

adjustments as market conditions

require. Earnings recovery will be

underpinned by delivery of cost reduction

and a stabilising operating environment.

Qantas offers the greatest frequency

of flights at the times the business

market wants to travel, across the

most number of routes. This allows

Qantas to maintain a yield premium

over the competition.

WHY IT WORKS

Jetstar offers by far the biggest

network of any domestic low-cost

carrier, meaning it has a scale

advantage over the competition.

This allows Jetstar to maintain the

lowest cost base in the domestic

market, which in turn enables it to

keep fares low and generate demand.

Qantas and Jetstar together

maintain a capacity share in the

domestic market that allows the

Group to maximise profit over the

long term.

GROUP DOMESTIC

STRATEGY

18

QANTAS ANNUAL REPORT 2014