Qantas 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

QANTAS ANNUAL REPORT 2014

Annual

Incentive

Also referred

to as the Short

Term Incentive

Plan or STIP

(continued)

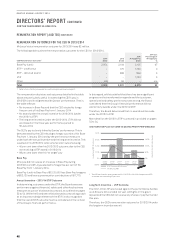

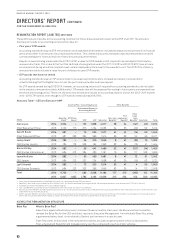

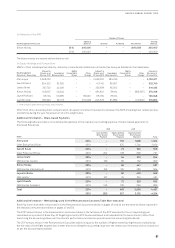

How are STIP awards calculated?

No awards were made under the 2013/14 STIP.

In years where STIP awards are made, the calculation is as follows:

Value of STIP

Award =Base Pay x“At target”

Opportunity xScorecard

Result x

Individual

Performance

Factor

How are STIP awards delivered?

No awards were made under the 2013/14 STIP.

In years where STIP awards are made, two-thirds of the STIP award is paid as a cash bonus, with the remaining

one-third deferred into Qantas shares with a two year restriction period. This is subject to the Board’s overriding

discretion as detailed on page 51.

What is the maximum outcome under the STIP?

The STIP scorecard has a hypothetical maximum outcome of 175 per cent of “at target”, which could only be

achieved if the maximum overdrive level of performance is achieved on every STIP performance measure.

For2013/2014, the STIP scorecard did not consider the possibility of an outcome above the “at target” amount.

The scorecard result is then applied to an individual’s “at target” opportunity and their Individual Performance

Factor (IPF). Hypothetically, a STIP award to Mr Joyce equal to 252 per cent times Base Pay could result (i.e. the

“at target’ opportunity for 2013/2014 of 120 per cent of Base Pay multiplied by a hypothetical Scorecard Result

of 175 per cent and multiplied by a hypothetical IPF of 1.2).

The minimum outcome is nil, which would occur if the threshold level of performance is missed on each STIP

measure. For 2013/2014, the Board determined that the Group financial performance did not warrant any

awards under the STIP and therefore no awards were made.

Long Term

Incentive Plan

Also referred to

as the LTIP

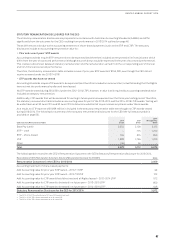

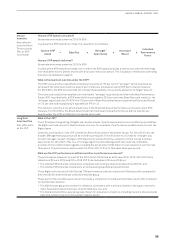

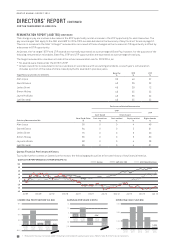

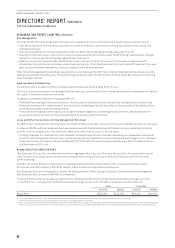

What is the LTIP?

The LTIP involves the granting of Rights over Qantas shares. If performance and service conditions are satisfied,

the Rights vest and convert to Qantas shares on a one-for-one basis. If performance conditions are not met, the

Rights lapse.

Generally, participation in the LTIP is limited to Senior Executives of the Qantas Group. For 2014/2015 only, the

broader Management population will be invited to participate. This will involve no increase to “at target” pay

for each manager, as each manager’s LTIP opportunity will be offset by a reduction in their annual incentive

opportunity for 2014/2015. This one-off change aligns the entire Management team with the immediate

priorities of the transformation agenda, including the achievement of $2 billion in cost reductions over the next

three years. The performance period under the 2015–2017 LTIP is for this same three year period.

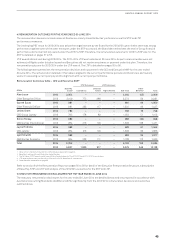

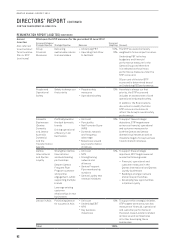

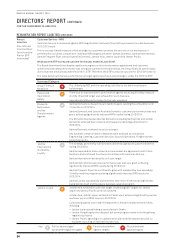

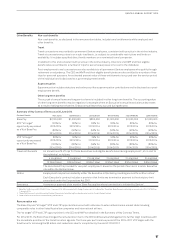

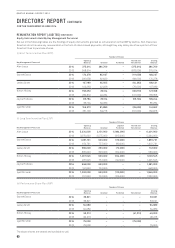

What are the LTIP performance conditions and how is performance assessed?

The performance measures for each of the 2012–2014 LTIP (tested as at 30 June 2014), 2013–2015 LTIP (to be

tested as at 30 June 2015) and 2014–2016 LTIP (to be tested as at 30 June 2016) are:

–The relative TSR of Qantas compared to companies with ordinary shares included in the ASX100, and

–The relative TSR of Qantas compared to an airline peer group (Global Listed Airlines)

These Rights will only vest in full if Qantas’ TSR performance ranks at or above the 75th percentile compared to

both the ASX100 and the Global Listed Airlines peer group.

These performance hurdles were chosen to provide a comparison of relative shareholder returns that is relevant

to most Qantas investors:

–The ASX100 peer group was chosen for relevance to investors with a primary interest in the equity market for

major Australian listed companies, of which Qantas is one, and

–The Global Listed Airlines peer group was chosen for relevance to investors, including investors based outside

Australia, whose focus is on the aviation industry sector