Qantas 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaping our Future

QANTAS ANNUAL REPORT 2014

Table of contents

-

Page 1

Shaping our Future Q A N TAS A NNUA L REPORT 2014 -

Page 2

-

Page 3

... Our Fleet Group Domestic Strategy Building Global Reach Jetstar In Asia Earning and Rewarding Loyalty Qantas and the Community 03 04 08 10 12 14 16 18 19 20 21 22 ANNUAL REPORT Board of Directors Review of Operations Corporate Governance Statement Directors' Report Financial Report Shareholder... -

Page 4

Q A N TA S A NNUA L REPOR T 2014 02 -

Page 5

... in service, safety and operational performance. As we continue the necessary reform of the business, we remain focused on building long-term shareholder value in everything we do. Financial Position The Group has strong liquidity of $3.6 billion, including $3 billion in cash. At 30 June 2014, the... -

Page 6

... we expect to report an Underlying Profit Before Tax for the first half of 2014/2015, subject to events beyond our control. Looking Forward The accelerated Qantas Transformation program is based on a clear vision for the Qantas Group as a 21st century aviation business. Our structure is now clearly... -

Page 7

Q A N TA S A NNUA L REPOR T 2014 05 -

Page 8

... August 2014, Qantas announced the outcomes of a structural review of the Group that commenced in December 2013 - including Board approval to establish a new corporate entity for the Qantas International business. Under accounting standards, this decision required a change in Qantas' Cash Generating... -

Page 9

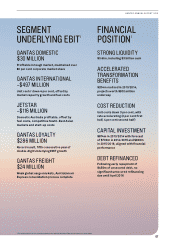

...table in tough market, maintained over 80 per cent corporate market share 1 FINANCIAL POSITION 1 STRONG LIQUIDITY $3.6bn, including $3 billion cash QANTAS INTERNATIONAL -$497 MILLION Unit costs1 down 4 per cent, offset by market capacity growth and fuel costs ACCELERATED TRANSFORMATION BENEFITS... -

Page 10

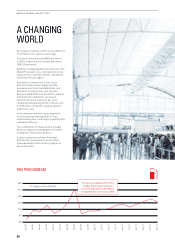

.../2014, Qantas' international competitors increased capacity into Australia by 44 per cent, compared with global growth of 29 per cent. In 2013/2014, competitor capacity growth was 9.5 per cent. In the domestic market, capacity growth has exceeded demand growth for two consecutive years, resulting... -

Page 11

... Average Market Growth FY13 +7.5% 1H15 INTERNATIONAL CAPACITY GROWTH2 Competitor Growth +2.4% 6% 4% 2% 0% Jan 13 Jan 14 Jan 15 Apr 13 Apr 14 Apr 15 Oct 12 Oct 13 Oct 14 Jul 12 Jul 13 Jul 14 FY14 +2.2% 1H15 +1% 1 BITRE (excl. Qantas Group; Qantas modelled for June 2014). 2 OAG Published Flight... -

Page 12

... years to 2016/2017. As at 30 June 2014, $204 million in accelerated transformation benefits had already been realised. Major pillars of Qantas Transformation include: - - - - - Accelerating cost reduction; Right-sizing fleet and network; Working existing assets harder; Deferring growth; Aligning... -

Page 13

...putting the right aircraft on the right route across Asia, Europe and US networks. - Exit from Perth-Singapore route > freed an A330 to operate Brisbane-Singapore > enabled retirement of a B747 (4Q FY14) - Increased domestic fleet utilisation > frees an A330 to operate Sydney-Singapore > enables the... -

Page 14

Q A N TA S A NNUA L REPOR T 2014 CUSTOMER SERVICE EXCELLENCE 12 -

Page 15

...-leading punctuality, reinventing our international premium lounges, and winning a series of awards for service and innovation. Punctuality For 18 consecutive months to June 2014, Qantas was Australia's most punctual major domestic airline, as measured by the Government's Bureau of Infrastructure... -

Page 16

... Awards: Best Airline - Australia/Pacific (2014, 2013); - National Travel Industry Awards: Best Domestic Airline (2014, 2013, 2012, 2011, 2010); and - Qantas Cash card rated maximum five stars by CANSTAR for outstanding value on a travel money card. Jetstar - AirlineRatings.com: Best Low-Cost... -

Page 17

Q A N TA S A NNUA L REPOR T 2014 Qantas Chef Neil Perry There's a certain type of comfort food a lot of travellers want. They'll have a steak sandwich or a chicken schnitzel. Or they might want a movie and a delicious three course meal. You have to make sure there is a nice variety. 15 -

Page 18

... TA S A NNUA L REPOR T 2014 RENEWING OUR FLEET Since 2008/2009, the Qantas Group has taken delivery of more than 140 new aircraft, bringing our average passenger fleet age down to 7.7 years. The benefits of fleet renewal are: - Significant reductions in cost through greater fuel efficiency and less... -

Page 19

... A320 B737-800 - - - - Young average fleet age of ~8 years in FY16 B747: 7 non-reconfigured aircraft retired by 2H FY16 B767: all 15 retired by 3Q FY15 B734: all retired by February 2014 A330 B787 A320 1 As at 31 December 2013. 2 By end of financial year 2015-2016. 4 500 Jetstar successfully... -

Page 20

...revenue, while we have increased our share of the charter market to 30 per cent - driven by Network Aviation. We have also maintained investment in product and service, with the refresh of our Airbus A330 and Boeing 737-800 fleets to begin in 2014/2015. Looking forward, we expect the domestic travel... -

Page 21

... North and South America. Through Qantas and Jetstar-operated services, a wide range of codeshare partnerships and minority shareholdings in the Jetstar airlines in Asia, we have built global reach and a strategic presence in all the world's major aviation markets. QANTAS INTERNATIONAL The Qantas... -

Page 22

...turn accounts for only 7 per cent of the total domestic air travel market in what is the world's third-largest economy. With a strong, recognised brand, enormous growth potential and the highest customer satisfaction ratings anywhere across the Jetstar Group network, Jetstar Japan is well-positioned... -

Page 23

... up a leading position in the Australian market, steadily increasing the value proposition for both members and external partners. Serving small business Over more than 25 years, Qantas has developed a unique experience in the consumer loyalty market and in the corporate travel market. Drawing on... -

Page 24

... and arts organisations that help enrich Australia's cultural life; and - We are a strategic partner for Australia's armed forces and provide the Government with logistical support in times of crisis, drawing on our 300-strong aircraft fleet and wide aviation skill base. Qantas CEO Alan Joyce As... -

Page 25

...link to Sydney. Qantas stepped in to provide daily services on a temporary basis and, after an enthusiastic campaign from the Moree community, the NSW Government awarded the contract to operate the route permanently. The end result was the resumption of a 21-year partnership between Qantas and Moree... -

Page 26

... eight years at Aer Lingus, where he held roles in sales, marketing, IT, network planning, operations research, revenue management and fleet planning. Age: 48 Maxine Brenner BA, LLB Independent Non-Executive Director Maxine Brenner was appointed to the Qantas Board in August 2013. She is a Member... -

Page 27

...and Adelaide Bank Limited and is Chairman of its Change & Technology Committee and a Member of its Audit and Risk Committees. She is also a Director of the Australian Foundation Investment Company Limited, Special Broadcasting Service, Melbourne Business School and Cricket Australia, and a Member of... -

Page 28

...He was also the Managing Director and Chief Commercial Officer of Swiss International Airlines and Executive Vice President of South African Airways responsible for sales, alliances and network management. Prior to these roles, Mr Meaney spent 11 years providing strategic advisory services at Genhro... -

Page 29

... sheet and build long-term shareholder value. Other key pillars of that strategy include: - Group capacity and network response to shifting demand and competitive environment - Targeted investment in the customer to maintain brand and yield premium - Reduced capital investment to maximise free cash... -

Page 30

... in fuel cost to the prior year. Group Underlying Income Statement Summary June 2014 June 2013 Restated7 % Change Change Net passenger revenue8 Net freight revenue Other revenue8 Revenue Operating expenses (excluding fuel)9 Share of net (loss)/profit of investments accounted for under the equity... -

Page 31

... run-rate of benefits from the integration of Australian air Express began to be received in the second half of financial year 2013/2014. 17 Fuel efficiency is measured as litres per ASK adjusted for movements in average sector length. 18 Qantas modelled share of total corporate account revenue. 19... -

Page 32

...the 2013/2014 financial year include: - Dual-brand strength: number one and two most profitable Australian Domestic airlines21; maintained margin premium over competition; market-leading on-time performance; unrivalled network and frequency; retained over 80 per cent of corporate accounts by revenue... -

Page 33

... fleet and network at a cost of $394 million23 in financial year 2013/2014 • Qantas International network optimisation under way; exit Perth-Singapore, down-gauge aircraft to A330s on SydneySingapore and Brisbane-Singapore, re-time of QF 9/10 and maintenance changes to up-gauge Sydney-Dallas... -

Page 34

...war or epidemic. Qantas is subject to a number of specific business risks which may impact the achievement of the Group's strategy and financial prospects: - Competitive intensity: Market capacity growth ahead of demand impacts industry profitability • Australia's liberal aviation policy settings... -

Page 35

...The Group continues to retain significant flexibility in its financial position, funding strategies and fleet plan to ensure that it can respond to any change in market conditions. Debt and Gearing Analysis June 2014 June 2013 Change % Change Net on balance sheet debt28 Net Debt including operating... -

Page 36

... to cost reduction. Ongoing optimisation of the network remains a key focus area. Recent examples include the exit of Perth-Singapore and down-gauge of Brisbane-Singapore and Sydney-Singapore to A330 aircraft. Qantas International continues to invest in what our customers value most, including... -

Page 37

... Australian domestic market. Unfavourable fuel cost of $86 million was not recovered in intensely competitive markets. The rapid expansion of Jetstar Japan as the airline consolidates its leading LCC position in the Japanese market and establishment of Jetstar Hong Kong resulted in associate losses... -

Page 38

... being the Chief Executive Officer, Group Management Committee and the Board of Directors, for the purpose of assessing the performance of the Group. The primary reporting measure of the Qantas International, Qantas Domestic, Qantas Loyalty, Qantas Freight and the Jetstar Group operating segments is... -

Page 39

... of Australian air Express. Fleet restructuring costs of $394 million include impairment of aircraft, together with associated support property, plant and equipment, inventory and other related costs following strategic network changes and accelerated fleet retirements resulting from the Qantas... -

Page 40

... Policies, including the Qantas Group Code of Conduct and Ethics, are detailed in the Qantas Group Business Practices document. This framework is supported by a rigorous whistleblower program which provides a protected disclosure process for employees. The Qantas Group Employee Share Trading Policy... -

Page 41

...Group has an appropriate corporate governance structure. Within that overall strategy, Management has designed and implemented a risk management and internal control system to manage Qantas' material business risks. During 2013/2014, the two Board committees responsible for oversight of risk-related... -

Page 42

... of freight services and the operation of a Frequent Flyer loyalty program. There were no significant changes in the nature of the activities of the Qantas Group during the year. DIRECTORS' MEETINGS DIVIDENDS No final dividend will be paid in relation to the year ended 30 June 2014 (2013: nil... -

Page 43

... L REPOR T 2014 DIRECTORSHIPS OF LISTED COMPANIES HELD BY MEMBERS OF THE BOARD AS AT 30 JUNE 2014 - FOR THE PERIOD 1 JULY 2011 TO 30 JUNE 2014 Leigh Clifford Alan Joyce Maxine Brenner Qantas Airways Limited Qantas Airways Limited Qantas Airways Limited Growthpoint Properties Australia Limited Orica... -

Page 44

... in Qantas shares held in trust on behalf of Mr Joyce are as follows: Deferred shares held in trust under: 2012/13 Short Term Incentive Plan 284,769 284,769 Number of Rights 2014 2013 Rights granted under: 2012-2014 Long Term Incentive Plan 2013-2015 Long Term Incentive Plan 2014-2016 Long Term... -

Page 45

... select Qantas Group Executives under the Qantas Deferred Share Plan (DSP) and the Qantas Employee Share Plan (ESP). Refer to pages 55 to 56 for further details. The following table outlines the movements in Rights during the year: Number of Rights Performance Rights Reconciliation 2014 2013 Rights... -

Page 46

... position, looking towards the Group's long-term future. 2013/2014 Remuneration Outcomes The Board recognises that Management and all employees have performed very well in accelerating the transformation agenda, in delivering record operational performance and in achieving high levels of customer... -

Page 47

...the 2012-2014 LTIP, 2013-2015 LTIP and 2014-2016 LTIP are the relative Total Shareholder Return (TSR) performance of Qantas compared to: - Companies with ordinary shares included in the S&P/ ASX 100 (ASX100), and - An airline peer group (Global Listed Airlines) Changes to the Executive Remuneration... -

Page 48

... January 2014. Base Pay (cash) is Base Pay of $2,125,000 less Base Pay foregone of $53,125 and less superannuation contributions of $17,775. Annual Incentive - 2013/14 STIP Outcome In determining outcomes under the STIP, the Board assesses performance against financial, safety and other key business... -

Page 49

... year testing period. Therefore, the statutory remuneration table includes an accounting value for part of the 2013-2015 and the 2014-2016 LTIP awards. Testing will be undertaken as at 30 June 2015 and 30 June 2016 to determine whether Mr Joyce receives any shares under these awards. As a result... -

Page 50

... to as the Long Term Incentive Plan (LTIP) The "at target" pay for the CEO and Executive KMP is set with reference to external market data including comparable roles in other listed Australian companies and in international airlines. The primary benchmark is a revenue based peer group of other... -

Page 51

... Alan Joyce Chief Executive Officer Gareth Evans Chief Financial Officer Lesley Grant CEO Group Loyalty Simon Hickey CEO Qantas International Jayne Hrdlicka CEO Jetstar Lyell Strambi CEO Qantas Domestic Total 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2,054 2,109 981... -

Page 52

... superannuation and an accrual for post-employment travel of $46,618 for Mr Joyce and $22,809 for each other Executive (2013: $38,714 for Mr Joyce and $18,857 for each other Executive). 6 Other Long-term Benefits include movement in annual leave and long service leave balances. The accounting value... -

Page 53

... NNUA L REPOR T 2014 Base Pay (continued) How is Base Pay set? In performing a Base Pay review, the Board makes reference to external market data including comparable roles in other listed Australian companies and international airlines. The primary benchmark is a revenue based peer group of other... -

Page 54

... Businesses (Qantas Domestic and Jetstar Australia Domestic) and the Transformation Agenda Qantas International and Qantas Loyalty Profitably build on the dual domestic brands Driving operational efficiency in all businesses - Unit cost - Punctuality - Net Promoter Score (NPS) - Domestic network... -

Page 55

... the future development of the business. The measure is calculated as the Group's operating cash flow divided by the Group's net debt. The Group's net debt includes interest-bearing liabilities, the fair value of hedges related to debt and off balance sheet aircraft operating lease liabilities less... -

Page 56

... Domestic) achieved their network and frequency advantage objectives for 2013/2014. Qantas Domestic achieved its unit cost target. Key business transformation milestones were achieved across Qantas Engineering, Catering, Customer Services, Ground Operations, Freight and the Corporate Centre. Qantas... -

Page 57

...2014), 2013-2015 LTIP (to be tested as at 30 June 2015) and 2014-2016 LTIP (to be tested as at 30 June 2016) are: - The relative TSR of Qantas compared to companies with ordinary shares included in the ASX100, and - The relative TSR of Qantas compared to an airline peer group (Global Listed Airlines... -

Page 58

...2014 DIRECTORS' REPORT CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 REMUNERATION REPORT (AUDITED) CONTINUED Long Term Incentive Plan Also referred to as the LTIP (continued) The vesting scale for each measure is: Companies with ordinary shares included in the ASX100 Up to one-half of the total number... -

Page 59

... external benchmark market data including comparable roles in other listed Australian companies and international airlines. The "at target" STIP and LTIP opportunities for the CEO and KMP are detailed in the Summary of Key Contract Terms. For 2014/2015, the Board has changed the remuneration mix for... -

Page 60

... accordance with accounting standards, so each year's remuneration includes a portion of the value of share-based payments awarded in previous years. Target Remuneration Mix for 2013/2014 Base Pay % STIP % LTIP % Alan Joyce Gareth Evans Lesley Grant Simon Hickey Jayne Hrdlicka Lyell Strambi 33 43... -

Page 61

... Expense by Plan STIP Awards 2011/12 $'000 2012/13 $'000 LTIP Awards 2013 - 20151 $'000 2014 - 20162 $'000 Total $'000 2015 $'000 2016 $'000 Total $'000 Future Expense by Financial Year Executives Alan Joyce Gareth Evans Lesley Grant Simon Hickey Jayne Hrdlicka Lyell Strambi - 5 3 4 4 4 143 43... -

Page 62

... Directors' fees to purchase shares. (i) Short Term Incentive Plan (STIP) Number of Shares Key Management Personnel Opening Balance Granted Forfeited Vested and Transferred Closing Balance Alan Joyce Gareth Evans Lesley Grant Simon Hickey Jayne Hrdlicka Lyell Strambi 2014 2013 2014 2013 2014 2013... -

Page 63

... Equity Settled Share-based Payment $'000 Total Alan Joyce Chief Executive Officer Gareth Evans Chief Financial Officer Lesley Grant CEO Qantas Loyalty Simon Hickey CEO Qantas International Jayne Hrdlicka CEO Jetstar Lyell Strambi CEO Qantas Domestic Total 2014 2013 2014 2013 2014 2013 2014 2013... -

Page 64

... in Qantas shares, currently valued at around two times Base Pay. The potential equity awards under the STIP and the LTIP will assist Executives in maintaining shareholdings in Qantas. Employee Share Trading Policy The Qantas Code of Conduct and Ethics contains Qantas' Employee Share Trading Policy... -

Page 65

... service. The accounting value of the travel benefit is captured in the remuneration table (as a non-cash benefit for travel during the year and as a post-employment benefit). Remuneration for the Year Ended 30 June 2014 - Non-Executive Directors Short-term Employee Benefits Base Pay (Cash) Non-cash... -

Page 66

... 2014 REMUNERATION REPORT (AUDITED) CONTINUED Equity Holdings and Transactions KMP or their related parties directly, indirectly or beneficially held shares in the Qantas Group as detailed in the table below: Key Management Personnel - Non-Executive Directors Interest in Shares as at 30 June 2012... -

Page 67

... person as an officer of Qantas. The Directors listed on page 40, the Company Secretaries listed on page 42 and certain individuals, who formerly held any of these positions, have the benefit of the indemnity in the Qantas Constitution. Members of Qantas' Executive Management team and certain former... -

Page 68

... DIRECTORS' REPORT CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 LEAD AUDITOR'S INDEPENDENCE DECLARATION UNDER SECTION 307C OF THE CORPORATIONS ACT 2001 To: the Directors of Qantas Airways Limited I declare that, to the best of my knowledge and belief, in relation to the audit for the financial year... -

Page 69

... Sheet Consolidated Statement of Changes in Equity Consolidated Cash Flow Statement Notes to the Financial Statements 1. 2. 3. 4. 5. 6. 7. 8. 9. Reporting Entity Critical Accounting Estimates and Judgements Underlying (Loss)/Profit Before Tax (Underlying PBT) and Operating Segments Other Revenue... -

Page 70

...YEAR ENDED 30 JUNE 2014 Qantas Group 2014 $M 2013 Restated1 $M Notes REVENUE AND OTHER INCOME Net passenger revenue Net freight revenue Other Revenue and other income EXPENDITURE Manpower and staff related Fuel Aircraft operating variable Depreciation and amortisation Impairment of specific assets... -

Page 71

... YEAR ENDED 30 JUNE 2014 Qantas Group 2014 $M 2013 Restated1 $M Statutory (loss)/profit for the year Items that are or may subsequently be reclassified to profit or loss Effective portion of changes in fair value of cash flow hedges, net of tax Transfer of hedge reserve to the Consolidated Income... -

Page 72

... liabilities Total liabilities Net assets EQUITY Issued capital Treasury shares Reserves Retained earnings Equity attributable to the members of Qantas Non-controlling interests Total equity 1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer... -

Page 73

... the Consolidated Income Statement, net of tax Recognition of effective cash flow hedges on capitalised assets, net of tax Defined benefit actuarial gains, net of tax Foreign currency translation of controlled entities Foreign currency translation of investments accounted for under the equity method... -

Page 74

... the Consolidated Income Statement, net of tax Recognition of effective cash flow hedges on capitalised assets, net of tax Defined benefit actuarial gains, net of tax Foreign currency translation of controlled entities Foreign currency translation of investments accounted for under the equity method... -

Page 75

... paid Dividends received from investments accounted for under the equity method Income taxes paid Net cash from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Payments for property, plant and equipment and intangible assets Interest paid and capitalised on qualifying assets Payments... -

Page 76

... TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2014 1. REPORTING ENTITY Qantas Airways Limited (Qantas) is a for-profit company limited by shares, incorporated in Australia whose shares are publicly traded on the Australian Securities Exchange (ASX) and which is subject to the operation of... -

Page 77

... are reported in the Corporate/Unallocated segment. (C) ANALYSIS BY OPERATING SEGMENT1 2014 $M Qantas Qantas Domestic International Qantas Loyalty Qantas Total Qantas Freight Eliminations Brands Jetstar Corporate/ Group Unallocated2 Eliminations Consolidated The Australian domestic passenger flying... -

Page 78

... ENDED 30 JUNE 2014 3. UNDERLYING (LOSS)/PROFIT BEFORE TAX (UNDERLYING PBT) AND OPERATING SEGMENTS CONTINUED (C) ANALYSIS BY OPERATING SEGMENT1 continued 2013 Restated2 $M Qantas Qantas Domestic International Qantas Loyalty Qantas Total Qantas Freight Eliminations Brands Jetstar Corporate/ Group... -

Page 79

...equity method is reported by the operating segment which is accountable for the management of the investment. The share of net (loss)/ profit of investments accounted for under the equity method for Qantas Airlines' investments has been equally shared between Qantas Domestic and Qantas International... -

Page 80

... STATUTORY (LOSS)/PROFIT BEFORE TAX Underlying PBT is a non-statutory measure, and is the primary reporting measure used by the Qantas Group's chief operating decision-making bodies, being the Chief Executive Officer, Group Management Committee and the Board of Directors. The objective of measuring... -

Page 81

... 119 relating to defined benefit superannuation plans. Refer to Note 38. 2 Fleet restructuring costs including impairment of aircraft, together with other aircraft associated property, plant and equipment, inventory and other related costs. (E) UNDERLYING PBT PER SHARE Qantas Group 2014 cents 2013... -

Page 82

...THE YEAR ENDED 30 JUNE 2014 3. UNDERLYING (LOSS)/PROFIT BEFORE TAX (UNDERLYING PBT) AND OPERATING SEGMENTS CONTINUED (F) ANALYSIS BY GEOGRAPHICAL AREAS (i) Revenue and other income by geographic areas Qantas Group Notes 2014 $M 2013 $M Net passenger and freight revenue Australia Overseas Total net... -

Page 83

... REPOR T 2014 5. NET FINANCE COSTS Qantas Group 2014 $M 2013 $M FINANCE INCOME Interest income on financial assets measured at amortised cost Interest income from investments accounted for under the equity method Unwind of discount on receivables Total finance income FINANCE COSTS Interest expense... -

Page 84

... Statutory (loss)/profit before income tax (benefit)/expense Income tax (benefit)/expense using the domestic corporate tax rate of 30 per cent Add/(less) adjustments for: Non-deductible share of net loss for investments accounted for under the equity method Non-deductible foreign branch losses Non... -

Page 85

... in relation to the year ended 30 June 2014. For the year ended 30 June 2014, $1 million dividends (2013: nil) were declared and paid to non-controlling interest shareholders by non-wholly owned controlled entities. (B) FRANKING ACCOUNT Qantas Group 2014 $M 2013 $M Total franking account balance at... -

Page 86

... to sell for the individual assets was determined with reference to recent sale transactions. 14. INVESTMENTS ACCOUNTED FOR UNDER THE EQUITY METHOD Qantas Group 2014 $M 2013 $M Carrying amount of investments accounted for under the equity method Share of losses from continuing operations Share of... -

Page 87

... property, plant and equipment and transfers to other balance sheet accounts. Other includes foreign exchange movements and non-cash additions of $130 million (2013: $115 million) relating to finance leases (refer to Note 20). Aircraft and engines include finance leased assets with a net book value... -

Page 88

...Net Book Value 2013 Accumulated Depreciation At Cost and Impairment Net Book Value Goodwill Airport landing slots Software Brand names and trademarks Customer contracts/relationships Total intangible assets Qantas Group 2014 $M 195 35 1,048 22 27 1,327 - - 573 - 13 586 Acquisition of Controlled... -

Page 89

... REPOR T 2014 Qantas Group 2013 $M Recognised in the Consolidated Opening Balance Income Statement Recognised in Other Comprehensive Income Acquisition of Controlled Entity Closing Balance Reconciliations Inventories Property, plant and equipment and intangible assets Payables Revenue received... -

Page 90

... the year there were non-cash financing activities relating to additions of property, plant and equipment under finance leases of $130 million (2013: $115 million). 21. PROVISIONS Qantas Group 2014 $M 2013 Restated1 $M CURRENT Employee benefits: - Annual leave - Long service leave - Redundancies... -

Page 91

... shares vest and transfer to the employee. No gain or loss is recognised in the Consolidated Income Statement on the purchase, sale, issue or cancellation of Qantas' own equity instruments. Hedge Reserve The hedge reserve comprises the effective portion of the cumulative net change in the fair value... -

Page 92

... part of the Qantas Group's net investment in a foreign controlled entity. 23. IMPAIRMENT OF SPECIFIC ASSETS AND CASH GENERATING UNITS Impairment of Specific Assets As part of the Accelerated Qantas Transformation program, the Group has performed a detailed review of its fleet and network including... -

Page 93

... Board Delegation on 12 August 2010. Further details regarding the operation of equity plans for Executives are outlined in the Directors' Report from pages 44 to 64. The total equity settled share-based payment expense for the year was $12 million (2013: $20 million). The total cash settled share... -

Page 94

... for the 2012-2014 award was determined having regard to the historical one year volatility of Qantas shares and the implied volatility on exchange traded options. The risk-free rate was the yield on an Australian Government Bond at the grant date matching the remaining life of the plan. The yield... -

Page 95

... Income, Consolidated Balance Sheet and the Consolidated Statement of Changes in Equity. (A) OTHER FINANCIAL ASSETS AND LIABILITIES Qantas Group 2014 $M 2013 $M NET OTHER FINANCIAL ASSETS/(LIABILITIES) Derivatives Designated as cash flow hedges Designated as fair value hedges De-designated... -

Page 96

...: Qantas Group 2014 $M Less than 1 Year More than 5 Years 1 to 5 Years Total Contracts to hedge Future foreign currency receipts and payments Future aviation fuel payments Future interest payments Future capital expenditure payments Tax effect Total net loss included within hedge reserve 2013... -

Page 97

... OPERATING ACTIVITIES Qantas Group 2014 $M 2013 Restated1 $M Statutory (loss)/profit for the year Adjustments for: Depreciation and amortisation Share-based payments Impairment of specific assets Impairment of cash generating unit Net gain on disposal of investments accounted for under the equity... -

Page 98

... on sale of $62 million during the year ended 30 June 2014 for the business and other related assets. 28. COMMITMENTS (A) FINANCE LEASE AND HIRE PURCHASE COMMITMENTS Qantas Group 2014 $M 2013 $M AS LESSEE Finance lease and hire purchase liabilities included in the Consolidated Financial Statements... -

Page 99

... Qantas Group 2014 $M 2013 $M 456 930 140 1,526 505 1,250 227 1,982 195 577 285 249 1,306 (4) 1,302 3,284 Capital expenditure commitments contracted but not provided for in the Consolidated Financial Statements, payable, in relation to: No later than one year Later than one year but not later... -

Page 100

...for governance of the plans, including investment decisions and plan rules, rests solely with the Trustee of the plan. The Trustee of the QSP is a corporate trustee which has a board comprising five company-appointed directors and five member-elected directors. The QSP's defined benefit plan exposes... -

Page 101

... of total plan assets of the Group's defined benefit plans are as follows: Qantas Group 2014 % 2013 % Australian equity1 Global equity - Europe - Japan - Other Private equity Fixed interest1 - Government bonds - Other Credit1 - Corporate debt - Other Hedge funds Property and infrastructure Cash and... -

Page 102

... business services to enable the low cost airline to operate a consistent customer experience for the Jetstar brand Transactions and balances with investments accounted for under the equity method are included in the Consolidated Financial Statements as follows: Qantas Group 2014 $M 2013 $M Revenue... -

Page 103

... from investments are recognised as income 2014 $M 2013 Restated1 $M CONDENSED INCOME STATEMENT Statutory (loss)/profit before income tax expense Income tax (expense)/benefit Statutory (loss)/profit for the year Retained earnings as at 1 July Defined benefit actuarial gains, net of tax Shares... -

Page 104

... STATEMENTS CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 32. DEED OF CROSS GUARANTEE CONTINUED Consolidated 2014 $M 2013 Restated1 $M 2012 Restated1 $M BALANCE SHEET CURRENT ASSETS Cash and cash equivalents Receivables Other financial assets Inventories Assets classified as held for sale Other Total... -

Page 105

... 2014 33. FINANCIAL RISK MANAGEMENT A financial instrument is any contract that gives rise to both a financial asset of one entity and a financial liability or equity instrument of another entity. The Qantas Group is subject to liquidity, interest rate, foreign exchange, fuel price and credit risks... -

Page 106

... Board. For the year ended 30 June 2014, other financial assets and liabilities include fuel derivatives totalling $120 million (asset) (2013: $17 million (asset)). These are recognised at fair value in accordance with AASB 139. (iv) Sensitivity on Interest Rate, Foreign Exchange and Fuel Price Risk... -

Page 107

... with a large number of customers and counterparties in various countries in accordance with Board approved policy. As at 30 June 2014, the credit risk of the Qantas Group to counterparties in relation to other financial assets, cash and cash equivalents, and other financial liabilities amounted to... -

Page 108

...key priority. Net debt including operating lease liabilities1 was reduced by $0.1 billion during the year ended 30 June 2014, with further reductions targeted. During the year ended 30 June 2015, the Qantas Group plans to spend $0.7 billion on net investing activities (inclusive of off balance sheet... -

Page 109

... (loss)/profit for the year Effective portion of changes in fair value of cash flow hedges, net of tax Transfer of hedge reserve to the Income Statement, net of tax Recognition of effective cash flow hedges on capitalised assets, net of tax Defined benefit actuarial gains, net of tax Total other... -

Page 110

... YEAR ENDED 30 JUNE 2014 35. PARENT ENTITY DISCLOSURES FOR Q ANTAS AIRWAYS LIMITED (Q ANTAS) CONTINUED Qantas 2014 $M 2013 Restated1 $M CONDENSED BALANCE SHEET Current assets Cash and cash equivalents Receivables Inventories Other Total current assets Non-current assets Receivables Property, plant... -

Page 111

... the date that control commences until the date that control ceases. Intra-group transactions, balances and unrealised gains and losses on transactions between group companies are eliminated in preparing the Consolidated Financial Statements. Non-controlling interests in the results and equity of... -

Page 112

... of Foreign Operations Assets and liabilities of foreign operations, including controlled entities and investments accounted for under the equity method, are translated to the functional currency at the rates of exchange prevailing at balance date. The income statements of foreign operations are... -

Page 113

... balance date. The different methods of estimating the fair value of these items have been defined in the Consolidated Financial Statements as follows: Level 1: Level 2: Level 3: quoted prices (unadjusted) in active markets for identical assets or liabilities inputs other than quoted prices included... -

Page 114

... FINANCIAL STATEMENTS CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 36. SIGNIFICANT ACCOUNTING POLICIES CONTINUED (D) REVENUE RECOGNITION Passenger and Freight Revenue Passenger and freight revenue is measured at the fair value of the consideration received, net of sales discount, passenger and freight... -

Page 115

... to, the taxation authority is included as a current asset or liability in the Consolidated Balance Sheet. Cash flows are included in the Consolidated Cash Flow Statement on a gross basis. The GST components of cash flows arising from investing and financing activities which are recoverable from, or... -

Page 116

... inventories on the basis of weighted average costs. Net realisable value is the estimated selling price in the ordinary course of business. (K) IMPAIRMENT Non-financial Assets The carrying amounts of non-financial assets are reviewed at each balance date to determine whether there is any indication... -

Page 117

... lives and residual values are reviewed annually and reassessed having regard to commercial and technological developments, the estimated useful life of assets to the Qantas Group and the long-term fleet plan. Finance Leased and Hire Purchase Assets Leased assets under which the Qantas Group assumes... -

Page 118

...CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 36. SIGNIFICANT ACCOUNTING POLICIES CONTINUED (M) PROPERTY, PLANT AND EQUIPMENT continued Operating Leases Rental payments under operating leases are charged to the Consolidated Income Statement on a straight-line basis over the term of the lease. Any gains... -

Page 119

...of future benefit that employees have earned in return for their service in the current and prior periods, which is discounted to determine its present value, and the fair value of any plan assets is deducted. The discount rate used is the yields at balance sheet date on State Government Bonds which... -

Page 120

... TA S A NNUA L REPOR T 2014 NOTES TO THE FINANCIAL STATEMENTS CONTINUED FOR THE YEAR ENDED 30 JUNE 2014 36. SIGNIFICANT ACCOUNTING POLICIES CONTINUED (P) EMPLOYEE BENEFITS continued The calculation of defined benefit obligations is performed annually by a qualified actuary using the projected unit... -

Page 121

...gains and losses on mark-to-market movement in fair value hedges. Finance income is recognised in the Consolidated Income Statement as it accrues, using the effective interest method. Finance costs are recognised in the Consolidated Income Statement as incurred, except where interest costs relate to... -

Page 122

... for the changes below, the Group has consistently applied the accounting policies set out in Note 36 to all periods presented in these Consolidated Financial Statements. The Group has adopted the following new standards and amendments to standards with a date of initial application of 1 July 2013... -

Page 123

... they are based on fair value less costs to sell and an impairment is recognised (see Note 23). Post-Employment Defined Benefit Superannuation Plans As a result of the mandatory application of AASB 119 Employee Benefits (2011), the Group has changed its accounting policy with respect to the basis... -

Page 124

... as held for sale Other Total current assets NON-CURRENT ASSETS Receivables Other financial assets Investments accounted for under the equity method Property, plant and equipment Intangible assets Other Total non-current assets Total assets CURRENT LIABILITIES Payables Revenue received in advance... -

Page 125

... as held for sale Other Total current assets NON-CURRENT ASSETS Receivables Other financial assets Investments accounted for under the equity method Property, plant and equipment Intangible assets Other Total non-current assets Total assets CURRENT LIABILITIES Payables Revenue received in advance... -

Page 126

... 119 Employee Benefits $M 30 June 2013 Restated $M Statutory profit for the period Items that are or may be subsequently reclassified to profit or loss Effective portion of changes in fair value of cash flow hedges, net of tax Transfer of hedge reserve to the Consolidated Income Statement, net of... -

Page 127

... the Directors' Report, are in accordance with the Corporations Act 2001, including: (i) giving a true and fair view of the financial position of the Qantas Group as at 30 June 2014 and of its performance for the financial year ended on that date; (ii) complying with Australian Accounting Standards... -

Page 128

...Changes in Equity and the Consolidated Cash Flow Statement for the year ended on that date, notes 1 to 38 comprising a summary of significant accounting policies and other explanatory information and the Directors' Declaration of the Group comprising Qantas and the entities it controlled at the year... -

Page 129

... Group Companies, Inc. National Australia Bank Limited4 UBS AG and its related bodies corporate Westpac Banking Corporation Group6 AXA SA7 1 2 3 4 5 6 7 Substantial shareholder notice dated 4 April 2014. Substantial shareholder notice dated 6 September 2013. Substantial shareholder notice dated... -

Page 130

... holding online through Qantas' share registry, Link Market Services, by logging on through their website at www.linkmarketservices.com.au, where you will have the option to: - - - - view your holding balance; retrieve holding statements; review your dividend payment history; and access shareholder... -

Page 131

The cover of this annual report is printed on Sovereign Silk, an FSC-certified and ISO 14001 EMS accredited paper. Text pages of this annual report are printed on Sovereign Offset and Sun Offset. Both papers are FSC-certified, ISO 14001 EMS accredited and made with elemental chlorine free pulps. -

Page 132

Q ANTAS AIRWAYS LIMITED ABN 16 009 661 901