Proctor and Gamble 2010 Annual Report Download - page 73

Download and view the complete annual report

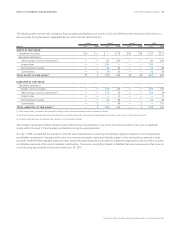

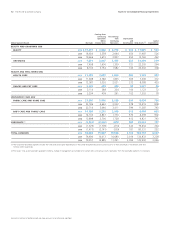

Please find page 73 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements The Procter & Gamble Company 71

Amounts in millions of dollars except per share amounts or as otherwise specified.

NOTE 11

SEGMENT INFORMATION

Effective July1, 2009, the Company implemented a number of

changes to the organization structure of the Beauty GBU, which

resulted in changes to the components of its reportable segment

structure. The following discussion and segment information reflect

the organizational changes for all periods presented. We are orga-

nized under three GBUs as follows:

• The Beauty and Grooming GBU includes the Beauty and the

Grooming businesses. The Beauty business is comprised of female

beauty products (including cosmetics, deodorants, female blades

and razors, personal cleansing and skin care), hair care (including

both retail and salon professional) and prestige fragrances. The

Grooming business includes electric hair removal devices, home

appliances, male blades and razors and male personal care products

(including deodorants, face and shave products, hair care and

personal cleansing).

• The Health and Well-Being GBU includes the Health Care and the

Snacks and Pet Care businesses. The Health Care business includes

feminine care, oral care and personal health care. The Snacks and

Pet Care business includes snacks and pet food.

• The Household Care GBU includes the Fabric Care and Home Care

as well as the Baby Care and Family Care businesses. The Fabric

Care and Home Care business includes air care, batteries, dish care,

fabric care and surface care. The Baby Care and Family Care business

includes baby wipes, bath tissue, diapers, facial tissue and paper

towels.

Under U.S. GAAP, we have six reportable segments: Beauty;

Grooming; Health Care; Snacks and Pet Care; Fabric Care and Home

Care; and Baby Care and Family Care. The accounting policies of the

businesses are generally the same as those described in Note 1.

Differences between these policies and U.S. GAAP primarily reflect

income taxes, which are reflected in the businesses using applicable

blended statutory rates, and the treatment of certain unconsolidated

investees. Certain unconsolidated investees are managed as integral

parts of our business units for management reporting purposes.

Accordingly, these partially owned operations are reflected as consoli-

dated subsidiaries in segment results, with full recognition of the

individual income statement line items through before-tax earnings.

Eliminations to adjust these line items to U.S. GAAP are included in

Corporate. In determining after-tax earnings for the businesses, we

eliminate the share of earnings applicable to other ownership interests,

in a manner similar to noncontrolling interest and apply statutory tax

rates. Adjustments to arrive at our effective tax rate are also included

in Corporate.

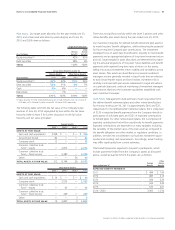

Corporate includes certain operating and non-operating activities that

are not reflected in the operating results used internally to measure

and evaluate the businesses, as well as eliminations to adjust manage-

ment reporting principles to U.S. GAAP. Operating activities in Corporate

include the results of incidental businesses managed at the corporate

level along with the elimination of individual revenues and expenses

generated by certain unconsolidated investees discussed in the pre-

ceding paragraph over which we exert significant influence, but do

not control. Operating elements also include certain employee benefit

costs, the costs of certain restructuring-type activities to maintain a

competitive cost structure, including manufacturing and workforce

rationalization and other general Corporate items. The non-operating

elements in Corporate primarily include interest expense, divestiture

gains and interest and investing income. In addition, Corporate includes

the historical results of certain divested businesses.

Total assets for the reportable segments include those assets managed

by the reportable segment, primarily inventory and fixed assets.

Other assets, primarily including cash, accounts receivable, investment

securities and goodwill, are included in Corporate.

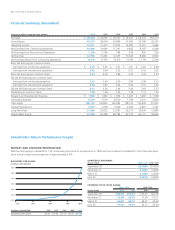

The Company had net sales in the U.S. of $30.0billion, $29.6billion

and $29.7billion for the years ended June30, 2010, 2009 and 2008,

respectively. Assets in the U.S. totaled $70.1billion and $71.9billion

as of June30, 2010 and 2009, respectively.

Our largest customer, Wal-Mart Stores, Inc. and its affiliates,

accounted for 16% of consolidated net sales in 2010, 2009 and 2008.