Proctor and Gamble 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

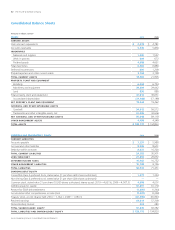

Management’s Discussion and Analysis The Procter & Gamble Company 45

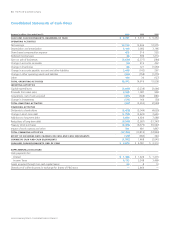

Financing Activities

Dividend Payments. Our first discretionary use of cash is dividend

payments. Dividends per common share increased 10% to $1.80 per

share in 2010. Total dividend payments to both common and preferred

shareholders were $5.5billion in 2010 and $5.0billion in 2009. The

increase in dividend payments resulted from increases in our quarterly

dividends per share, partially offset by a reduction in the number of

shares outstanding. In April 2010, the Board of Directors declared an

increase in our quarterly dividend from $0.44 to $0.4818 per share on

Common Stock and Series A and B ESOP Convertible Class A Preferred

Stock. This represents a 9.5% increase compared to the prior quarterly

dividend and is the 54th consecutive year that our dividend has

increased. We have paid a dividend in every year since our incorporation

in 1890.

$1.45

$.

$1.64

10

08

09

DIVIDENDS

(per common share)

Long-Term and Short-Term Debt. We maintain debt levels we consider

appropriate after evaluating a number of factors, including cash flow

expectations, cash requirements for ongoing operations, investment

and financing plans (including acquisitions and share repurchase

activities) and the overall cost of capital. Total debt was $29.8billion

in 2010, $37.0billion in 2009 and $36.7billion in 2008. Our total

debt decreased in 2010 mainly due to repayments funded by operat-

ing cash flow and cash provided by the global pharmaceuticals

divestiture.

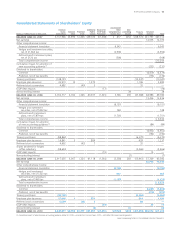

Treasury Purchases. In 2007, we began to acquire outstanding

shares under a publicly announced three-year share repurchase plan,

which expired on June30, 2010. We acquired $22.3billion of shares

under this repurchase plan. Total share repurchases were $6.0billion

in 2010 and $6.4billion in 2009, nearly all of which were made under

the publicly announced plan. We currently expect share repurchases

of $6 – 8billion in 2011.

In November 2008, we completed the divestiture of our Folgers coffee

subsidiary. In connection with this divestiture, 38.7million shares of

P&G common stock were tendered by shareholders and exchanged

for all shares of Folgers common stock, resulting in an increase of

treasury stock of $2.5billion.

Liquidity

Our current liabilities exceeded current assets by $5.5billion. We

utilize short- and long-term debt to fund discretionary items such as

acquisitions and share repurchases. We anticipate being able to

support our short-term liquidity and operating needs largely through

cash generated from operations. We have strong short- and long-term

debt ratings which have enabled and should continue to enable us to

refinance our debt as it becomes due at favorable rates in commercial

paper and bond markets. In addition, we have agreements with a

diverse group of financial institutions that, if needed, should provide

sufficient credit funding to meet short-term financing requirements.

On June30, 2010, our short-term credit ratings were P-1 (Moody’s) and

A-1+ (Standard & Poor’s), while our long-term credit ratings are Aa3

(Moody’s) and AA- (Standard & Poor’s), both with a stable outlook.

We maintain three bank credit facilities: a $6billion 5-year facility and

a $3billion 5-year facility which expire in August 2012 and a $2billion

364-day facility which expires in August 2011. The credit facilities are

in place to support our ongoing commercial paper program. These

facilities can be extended for certain periods of time as specified in, and

in accordance with, the terms of each credit agreement. We anticipate

that these facilities will remain largely undrawn for the foreseeable

future. These credit facilities do not have cross-default or ratings

triggers, nor do they have material adverse events clauses, except at

the time of signing. In addition to these credit facilities, we have an

automatically effective registration statement on Form S-3 filed with

the SEC that is available for registered offerings of short- or long-term

debt securities.

Guarantees and Other Off-Balance Sheet Arrangements

We do not have guarantees or other off-balance sheet financing

arrangements, including variable interest entities, which we believe

could have a material impact on financial condition or liquidity.