Proctor and Gamble 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements The Procter & Gamble Company 67

Amounts in millions of dollars except per share amounts or as otherwise specified.

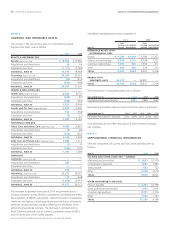

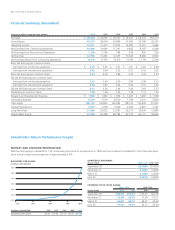

Plan Assets. Our target asset allocation for the year ended June30,

2010, and actual asset allocation by asset category as of June30,

2010 and 2009, were as follows:

Target Asset Allocation

Asset Category

Pension

Benefits

Other

Retiree

Benefits

Equity securities (1) 42% 91%

Debt securities 58% 9%

TOTAL 100% 100%

Actual Asset Allocation at June 30

Pension Benefits Other Retiree Benefits

Asset Category 2010 2009 2010 2009

Equity securities (1) 43% 42% 91% 93%

Debt securities 53% 51% 9% 7%

Cash 4% 6% ——

Real estate —1% ——

TOTAL 100% 100% 100% 100%

(1) Equity securities for other retiree benefit plan assets include Company stock, net of Series B

ESOP debt, of $2,535 and $2,084 as of June 30, 2010 and 2009, respectively.

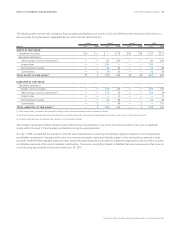

The following table sets forth the fair value of the Company’s plan

assets as of June30, 2010 segregated by level within the fair value

hierarchy (refer to Note 5 for further discussion on the fair value

hierarchy and fair value principles):

Pension Benefits

Level 1 Level 2 Level 3 Total

ASSETS AT FAIR VALUE:

Cash and cash equivalents $238 $ — $ — $ 238

Government bonds 62 — — 62

Company stock 12 — — 12

Common collective trust

fund — equity — 2,814 — 2,814

Common collective trust

fund — fixed income — 3,380 — 3,380

Other — — 56 56

TOTAL ASSETS AT FAIR VALUE 312 6,194 56 6,562

Other Retiree Benefits

Level 1 Level 2 Level 3 Total

ASSETS AT FAIR VALUE:

Cash and cash equivalents $ 14 $ — $ — $ 14

Company stock — 2,535 — 2,535

Common collective trust

fund — equity — 43 — 43

Common collective trust

fund — fixed income — 249 — 249

Other — — 2 2

TOTAL ASSETS AT FAIR VALUE 14 2,827 2 2,843

There was no significant activity within the Level 3 pension and other

retiree benefits plan assets during the year ended June30, 2010.

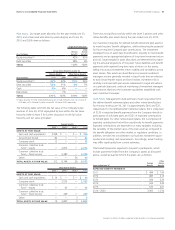

Our investment objective for defined benefit retirement plan assets is

to meet the plans’ benefit obligations, while minimizing the potential

for future required Company plan contributions. The investment

strategies focus on asset class diversification, liquidity to meet benefit

payments and an appropriate balance of long-term investment return

and risk. Target ranges for asset allocations are determined by match-

ing the actuarial projections of the plans’ future liabilities and benefit

payments with expected long-term rates of return on the assets,

taking into account investment return volatility and correlations across

asset classes. Plan assets are diversified across several investment

managers and are generally invested in liquid funds that are selected

to track broad market equity and bond indices. Investment risk is

carefully controlled with plan assets rebalanced to target allocations

on a periodic basis and continual monitoring of investment managers’

performance relative to the investment guidelines established with

each investment manager.

Cash Flows. Management’s best estimate of cash requirements for

the defined benefit retirement plans and other retiree benefit plans

for the year ending June30, 2011 is approximately $441 and $25,

respectively. For the defined benefit retirement plans, this is comprised

of $120 in expected benefit payments from the Company directly to

participants of unfunded plans and $321 of expected contributions

to funded plans. For other retiree benefit plans, this is comprised of

expected contributions that will be used directly for benefit payments.

Expected contributions are dependent on many variables, including

the variability of the market value of the plan assets as compared to

the benefit obligation and other market or regulatory conditions. In

addition, we take into consideration our business investment oppor-

tunities and resulting cash requirements. Accordingly, actual funding

may differ significantly from current estimates.

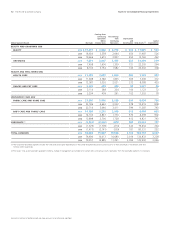

Total benefit payments expected to be paid to participants, which

include payments funded from the Company’s assets, as discussed

above, as well as payments from the plans, are as follows:

Years ending June 30

Pension

Benefits

Other

Retiree

Benefits

EXPECTED BENEFIT PAYMENTS

2011 $ 494 $ 195

2012 487 213

2013 500 230

2014 524 245

2015 537 261

2016 – 2020 3,063 1,530