Proctor and Gamble 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 The Procter & Gamble Company Management’s Discussion and Analysis

The economic downturn which began in fiscal 2009 resulted in a

disproportionate decline in the Salon Professional business, given the

more discretionary nature of salon visits and purchases. Over time,

we believe the Salon Professional business will return to sales and

earnings growth rates consistent with our long-term business plans.

Failure to achieve these business plans or a further deterioration of

the macroeconomic conditions could result in an impairment of the

goodwill and intangible assets of the Salon Professional business.

See the discussion of Acquisitions, Goodwill and Intangibles in the

Significant Accounting Policies and Estimates section for additional

information.

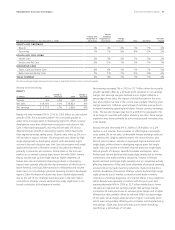

GROOMING

($millions) 2010

Change vs.

Prior Year 2009

Change vs.

Prior Year

Volume n/a +1% n/a -5%

Net sales $7,631 +3% $7,408 -9%

Net earnings $1,477 +9% $1,359 -14%

Grooming net sales increased 3% to $7.6billion in 2010 on a 1%

increase in unit volume. Price increases, taken primarily in developing

regions to offset currency devaluations and across blades and razors,

added 4% to net sales. Product mix had a negative 2% impact on net

sales due mainly to disproportionate growth in developing regions

and of disposable razors, both of which have lower than segment

average selling prices. Organic sales grew 3%. Volume in developing

regions increased low single digits, while volume in developed regions

was in line with the prior year. Volume in Male Grooming was up low

single digits mainly due to growth of disposable razors in developing

regions. Mach3 shipments declined high single digits, while Gillette

Fusion shipments increased double digits behind the launch of the new

Fusion ProGlide. On a constant currency basis, global market share

of the blades and razors category was down about half a point versus

the prior year. Volume in Appliances was down low single digits behind

a mid-single-digit decline in developing regions, due mostly to market

contractions and volume share losses in home and hair care appliances.

Global value share of the dry shaving market was up half a point on a

constant currency basis.

Net earnings increased 9% to $1.5billion in 2010 behind sales growth

and net earnings margin expansion. Net earnings margin increased

100 basis points driven by gross margin expansion and a lower tax

rate, partially offset by higher SG&A as a percentage of net sales. Gross

margin increased mainly due to price increases and manufacturing

cost savings. The reduction in the tax rate was mainly due to a shift in

the geographic mix of earnings to developing regions which generally

have lower statutory tax rates. The increase in SG&A as a percentage

of net sales was driven by higher marketing spending and incremental

foreign currency exchange costs, partially offset by lower overhead

spending as a percentage of net sales.

Grooming net sales declined 9% in 2009 to $7.4billion on a 5%

decline in unit volume. Unfavorable foreign exchange reduced net

sales by 6%. Product mix had a negative 2% impact on net sales as

favorable product mix from growth of the premium-priced Gillette

Fusion brand was more than offset by a disproportionate decline of

Appliances, both of which have higher than segment average selling

prices. Price increases, taken across most product lines and in part to

offset foreign exchange impacts in developing regions, added 4% to

net sales. Organic sales were down 2% versus the prior year on a 5%

decline in organic volume, mainly due to the sharp decline of the

Appliances business. Volume in both developed and developing regions

declined mid-single digits. Male Grooming volume declined low

single digits primarily driven by market contractions in developed

regions and trade inventory reductions. Growth of Gillette Fusion was

more than offset by declines in legacy shaving systems. Global value

share of male blades and razors was up less than half a point versus

the prior year. Volume in Appliances was down double digits due to

market contractions, trade inventory reductions and the exits of the

U.S. home appliance and Tassimo coffee appliance businesses. Global

value share of the male dry shaving market was down less than half a

point. Net earnings were down 14% in 2009 to $1.4billion primarily

on the decline in net sales and a 120-basis point reduction in net

earnings margin. Net earnings margin was down due to a higher

effective tax rate and reduced gross margin, partially offset by lower

SG&A as a percentage of net sales. Gross margin declined due to

unfavorable product mix resulting from disproportionate growth of

disposable razors, higher commodity costs and volume scale delever-

age which were partially offset by price increases and manufacturing

cost savings.

The economic downturn in fiscal 2009 resulted in a disproportionate

decline in the Appliances business, particularly in developing geogra-

phies, given the more discretionary nature of home and personal

grooming appliance purchases. Over time, we believe the Appliances

business will return to sales and earnings growth rates consistent with

our long-term business plans. Failure to achieve these business plans

or a further deterioration of the macroeconomic conditions could

result in an impairment of the goodwill and intangible assets of the

Appliance business. See the discussion of Acquisitions, Goodwill and

Intangibles in the Significant Accounting Policies and Estimates section

for additional information.

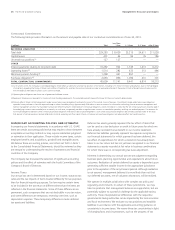

Health and Well-Being

HEALTH CARE

($millions) 2010

Change vs.

Prior Year 2009

Change vs.

Prior Year

Volume n/a +3% n/a -3%

Net sales $11,493 +2% $11,288 -7%

Net earnings $ 1,860 +1% $ 1,835 -9%

Health Care net sales increased 2% in 2010 to $11.5billion on unit

volume growth of 3%. Price increases, taken mainly in developing

regions to offset currency devaluations, added 1% to net sales.

Unfavorable mix reduced net sales by 2% mainly due to disproportion-

ate growth of developing regions, which have lower than segment

average selling prices. Organic sales increased 2%. Volume grew mid-

single digits in developing regions and low single digits in developed

regions. Oral Care volume grew mid-single digits behind initiative