Proctor and Gamble 2010 Annual Report Download - page 57

Download and view the complete annual report

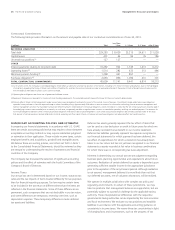

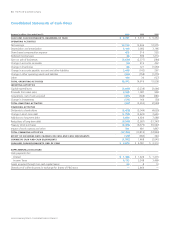

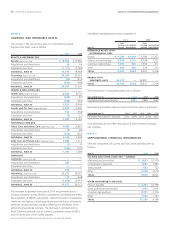

Please find page 57 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amounts in millions of dollars except per share amounts or as otherwise specified.

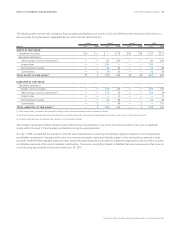

NOTE 1

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations

The Procter& Gamble Company’s (the “Company,” “we” or “us”)

business is focused on providing branded consumer packaged goods

of superior quality and value. Our products are sold in more than

180 countries primarily through retail operations including mass

merchandisers, grocery stores, membership club stores, drug stores,

department stores, salons and high-frequency stores. We have on-

the-ground operations in approximately 80 countries.

Basis of Presentation

The Consolidated Financial Statements include the Company and its

controlled subsidiaries. Intercompany transactions are eliminated.

Use of Estimates

Preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America (U.S. GAAP)

requires management to make estimates and assumptions that affect

the amounts reported in the Consolidated Financial Statements and

accompanying disclosures. These estimates are based on management’s

best knowledge of current events and actions the Company may

undertake in the future. Estimates are used in accounting for, among

other items, consumer and trade promotion accruals, pensions, post-

employment benefits, stock options, valuation of acquired intangible

assets, useful lives for depreciation and amortization of long-lived assets,

future cash flows associated with impairment testing for goodwill,

indefinite-lived intangible assets and other long-lived assets, deferred

tax assets, uncertain income tax positions and contingencies. Actual

results may ultimately differ from estimates, although management

does not generally believe such differences would materially affect

the financial statements in any individual year. However, in regard to

ongoing impairment testing of goodwill and indefinite-lived intangible

assets, significant deterioration in future cash flow projections or other

assumptions used in valuation models, versus those anticipated at the

time of the valuations, could result in impairment charges that may

materially affect the financial statements in a given year.

Revenue Recognition

Sales are recognized when revenue is realized or realizable and has

been earned. Most revenue transactions represent sales of inventory.

The revenue recorded is presented net of sales and other taxes we

collect on behalf of governmental authorities. The revenue includes

shipping and handling costs, which generally are included in the list

price to the customer. Our policy is to recognize revenue when title

to the product, ownership and risk of loss transfer to the customer,

which can be on the date of shipment or the date of receipt by the

customer. A provision for payment discounts and product return

allowances is recorded as a reduction of sales in the same period that

the revenue is recognized.

Trade promotions, consisting primarily of customer pricing allowances,

merchandising funds and consumer coupons, are offered through

various programs to customers and consumers. Sales are recorded net

of trade promotion spending, which is recognized as incurred, generally

at the time of the sale. Most of these arrangements have terms of

approximately one year. Accruals for expected payouts under these

programs are included as accrued marketing and promotion in the

accrued and other liabilities line item in the Consolidated Balance Sheets.

Cost of Products Sold

Cost of products sold is primarily comprised of direct materials and

supplies consumed in the manufacture of product, as well as manu-

facturing labor, depreciation expense and direct overhead expense

necessary to acquire and convert the purchased materials and supplies

into finished product. Cost of products sold also includes the cost to

distribute products to customers, inbound freight costs, internal transfer

costs, warehousing costs and other shipping and handling activity.

Selling, General and Administrative Expense

Selling, general and administrative expense (SG&A) is primarily comprised

of marketing expenses, selling expenses, research and development

costs, administrative and other indirect overhead costs, depreciation

and amortization expense on non-manufacturing assets and other

miscellaneous operating items. Research and development costs are

charged to expense as incurred and were $1,950 in 2010, $1,864

in 2009 and $1,946 in 2008. Advertising costs, charged to expense

as incurred, include worldwide television, print, radio, internet and

in-store advertising expenses and were $8,576 in 2010, $7,519 in

2009 and $8,520 in 2008. Non-advertising related components of

the Company’s total marketing spending include costs associated with

consumer promotions, product sampling and sales aids, all of which

are included in SG&A, as well as coupons and customer trade funds,

which are recorded as reductions to net sales.

Other Non-Operating Income/(Expense), Net

Other non-operating income/(expense), net, primarily includes net

divestiture gains, interest and investment income and the provision

for income attributable to noncontrolling interests.

Currency Translation

Financial statements of operating subsidiaries outside the United States

of America (U.S.) generally are measured using the local currency as

the functional currency. Adjustments to translate those statements

into U.S. dollars are recorded in other comprehensive income (OCI).

Currency translation adjustments in accumulated OCI were a loss of

$861 at June30, 2010 and a gain of $3,333 at June30, 2009. For

subsidiaries operating in highly inflationary economies, the U.S. dollar

is the functional currency. Remeasurement adjustments for financial

statements in highly inflationary economies and other transactional

exchange gains and losses are reflected in earnings.

Notes to Consolidated Financial Statements

The Procter & Gamble Company 55