Proctor and Gamble 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 The Procter & Gamble Company Management’s Discussion and Analysis

SIGNIFICANT ACCOUNTING POLICIES AND ESTIMATES

In preparing our financial statements in accordance with U.S. GAAP,

there are certain accounting policies that may require a choice between

acceptable accounting methods or may require substantial judgment

or estimation in their application. These include income taxes, certain

employee benefits and acquisitions, goodwill and intangible assets.

We believe these accounting policies, and others set forth in Note1

to the Consolidated Financial Statements, should be reviewed as they

are integral to understanding the results of operations and financial

condition of the Company.

The Company has discussed the selection of significant accounting

policies and the effect of estimates with the Audit Committee of the

Company’s Board of Directors.

Income Taxes

Our annual tax rate is determined based on our income, statutory tax

rates and the tax impacts of items treated differently for tax purposes

than for financial reporting purposes. Tax law requires certain items

to be included in the tax return at different times than the items are

reflected in the financial statements. Some of these differences are

permanent, such as expenses that are not deductible in our tax return,

and some differences are temporary, reversing over time, such as

depreciation expense. These temporary differences create deferred

tax assets and liabilities.

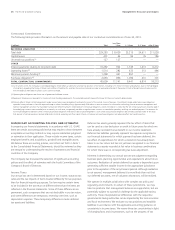

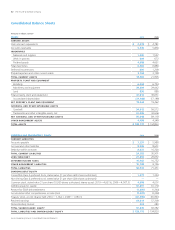

Contractual Commitments

The following table provides information on the amount and payable date of our contractual commitments as of June30, 2010.

($millions) Total

Less Than

1 Year 1 – 3 Years 3 – 5 Years After 5 Years

RECORDED LIABILITIES

Total debt $29,283 $ 8,429 $5,215 $4,611 $11,028

Capital leases 401 44 95 76 186

Uncertain tax positions (1) 127 127 — — —

OTHER

Interest payments relating to long-term debt 10,292 922 1,745 1,413 6,212

Operating leases (2) 1,514 282 433 313 486

Minimum pension funding (3) 1,298 441 857 — —

Purchase obligations (4) 2,694 896 1,096 401 301

TOTAL CONTRACTUAL COMMITMENTS 45,609 11,141 9,441 6,814 18,213

(1) As of June30, 2010, the Company’s Consolidated Balance Sheet reflects a liability for uncertain tax positions of $2.5billion, including $711million of interest and penalties. Due to the high degree

of uncertainty regarding the timing of future cash outflows of liabilities for uncertain tax positions beyond one year, a reasonable estimate of the period of cash settlement beyond twelve months

from the balance sheet date of June30, 2010, cannot be made.

(2) Operating lease obligations are shown net of guaranteed sublease income.

(3) Represents future pension payments to comply with local funding requirements. The projected payments beyond fiscal year 2013 are not currently determinable.

(4) Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of business. Commitments made under take-or-pay obligations

represent future purchases in line with expected usage to obtain favorable pricing. Approximately 45% relates to service contracts for information technology, human resources management and

facilities management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if

the underlying contracts were canceled prior to maturity. In such cases, we generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do

not include obligations related to other contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase orders at fair value

that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such purchase obligations will adversely affect our liquidity position.

Deferred tax assets generally represent the tax effect of items that

can be used as a tax deduction or credit in future years for which we

have already recorded the tax benefit in our income statement.

Deferred tax liabilities generally represent tax expense recognized in

our financial statements for which payment has been deferred, the

tax effect of expenditures for which a deduction has already been

taken in our tax return but has not yet been recognized in our financial

statements or assets recorded at fair value in business combinations

for which there was no corresponding tax basis adjustment.

Inherent in determining our annual tax rate are judgments regarding

business plans, planning opportunities and expectations about future

outcomes. Realization of certain deferred tax assets is dependent upon

generating sufficient taxable income in the appropriate jurisdiction

prior to the expiration of the carry-forward periods. Although realization

is not assured, management believes it is more likely than not that

our deferred tax assets, net of valuation allowances, will be realized.

We operate in multiple jurisdictions with complex tax policy and

regulatory environments. In certain of these jurisdictions, we may

take tax positions that management believes are supportable, but are

potentially subject to successful challenge by the applicable taxing

authority. These interpretational differences with the respective

governmental taxing authorities can be impacted by the local economic

and fiscal environment. We evaluate our tax positions and establish

liabilities in accordance with the applicable accounting guidance on

uncertainty in income taxes. We review these tax uncertainties in light

of changing facts and circumstances, such as the progress of tax