Proctor and Gamble 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements The Procter & Gamble Company 69

Amounts in millions of dollars except per share amounts or as otherwise specified.

coverage. As a result of the change in taxability of the federal subsidy,

we were required to make adjustments to deferred tax asset bal-

ances, resulting in a $152 charge to income tax expense.

Tax benefits credited to shareholders’ equity totaled $5 and $556 for

the years ended June30, 2010 and 2009, respectively. These primarily

relate to the tax effects of net investment hedges, excess tax benefits

from the exercise of stock options and the impacts of certain adjust-

ments to pension and other retiree benefit obligations recorded in

shareholders’ equity.

We have undistributed earnings of foreign subsidiaries of approxi-

mately $30billion at June30, 2010, for which deferred taxes have

not been provided. Such earnings are considered indefinitely invested

in the foreign subsidiaries. If such earnings were repatriated, additional

tax expense may result, although the calculation of such additional

taxes is not practicable.

On July1, 2007, we adopted accounting guidance on the accounting

for uncertainty in income taxes. The adoption of the guidance resulted

in a decrease to retained earnings as of July1, 2007 of $232, which

was reflected as a cumulative effect of a change in accounting principle

with a corresponding increase to the net liability for uncertain tax

positions. The impact primarily reflects the accrual of additional statutory

interest and penalties as required by accounting guidance, partially

offset by adjustments to existing balances for uncertain tax positions

to comply with measurement principles. The implementation of the

guidance also resulted in a reduction in our net tax liabilities for uncer-

tain tax positions related to prior acquisitions accounted for under

purchase accounting, resulting in an $80 decrease to goodwill.

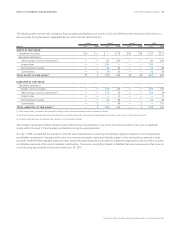

A reconciliation of the beginning and ending liability for uncertain tax

positions is as follows:

2010 2009 2008

BEGINNING OF YEAR $ 2,003 $ 2,582 $ 2,971

Increases in tax positions for prior years 128 116 164

Decreases in tax positions for prior years (146) (485) (576)

Increases in tax positions for current year 193 225 375

Settlements with taxing authorities (216) (172) (260)

Lapse in statute of limitations (45) (68) (200)

Currency translation (120) (195) 108

END OF YEAR 1,797 2,003 2,582

The Company is present in over 150 taxable jurisdictions and, at any

point in time, has 50 – 60 audits underway at various stages of

completion. We evaluate our tax positions and establish liabilities for

uncertain tax positions that may be challenged by local authorities

and may not be fully sustained, despite our belief that the underlying

tax positions are fully supportable. Uncertain tax positions are reviewed

on an ongoing basis and are adjusted in light of changing facts and

circumstances, including progress of tax audits, developments in

case law and closing of statute of limitations. Such adjustments are

reflected in the tax provision as appropriate. The Company is making

a concerted effort to bring its audit inventory to a more current

position. We have done this by working with tax authorities to con-

duct audits for several open years at once. We have tax years open

ranging from 1997 and forward. We are generally not able to reliably

estimate the ultimate settlement amounts until the close of the audit.

While we do not expect material changes, it is possible that the

amount of unrecognized benefit with respect to our uncertain tax

positions will significantly increase or decrease within the next 12

months related to the audits described above. At this time, we are

not able to make a reasonable estimate of the range of impact on the

balance of uncertain tax positions or the impact on the effective tax

rate related to these items.

Included in the total liability for uncertain tax positions at June30, 2010

is $1,318 that, depending on the ultimate resolution, could impact the

effective tax rate in future periods.

We recognize accrued interest and penalties related to uncertain tax

positions in income tax expense. As of June30, 2010 and 2009,

we had accrued interest of $622 and $636 and penalties of $89 and

$100, respectively, that are not included in the above table. During

the fiscal years ended June30, 2010 and 2009, we recognized $38

and $119 in interest and $(8) and $(4) in penalties, respectively.

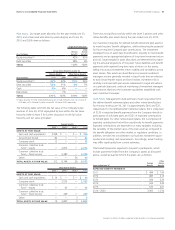

Deferred income tax assets and liabilities were comprised of the

following:

June 30 2010 2009

DEFERRED TAX ASSETS

Pension and postretirement benefits $ 1,717 $ 1,395

Stock-based compensation 1,257 1,182

Loss and other carryforwards 595 439

Goodwill and other intangible assets 312 331

Accrued marketing and promotion 216 167

Fixed assets 102 114

Unrealized loss on financial and foreign

exchange transactions 88 577

Accrued interest and taxes 88 120

Advance payments 16 15

Inventory 35 97

Other 757 885

Valuation allowances (120) (104)

TOTAL 5,063 5,218

DEFERRED TAX LIABILITIES

Goodwill and other intangible assets 11,760 11,922

Fixed assets 1,642 1,654

Other 269 146

TOTAL 13,671 13,722

Net operating loss carryforwards were $1,875 and $1,428 at June30,

2010 and 2009, respectively. If unused, $567 will expire between 2011

and 2030. The remainder, totaling $1,308 at June30, 2010, may be

carried forward indefinitely.