Proctor and Gamble 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Core earnings per share grew 6%, roughly double our

going-in objective for the year.2

• Adjusted free cash flow was 125% of net earnings,

well above our target level.

We also made substantial progress toward profitable share

growth, a key priority. A year ago, our global market share

was down about half a point versus prior-year levels; today,

as I write this, our global market share is up nearly half a point

and accelerating. Last year, we were building market share

in businesses accounting for only about 33% of sales; today,

we are building share in brands and countries accounting

for about 66% of sales and P&G’s market share is growing in

14 of our top 17 countries.

In addition, we reached an additional 200 million

consumers, bringing the total served to 4.2 billion—on track

toward our goal of reaching 5 billion consumers by fiscal

2015. Average per capita spending on P&G products increased

in 70% of our top countries, up from 60% in fiscal 2009. And,

global household penetration—the percentage of households

using at least one P&G product—increased nearly two

percentage points, to 61%.

On the strength of these results, we paid approximately

$5.5 billion in dividends and returned $6 billion to

shareholders through the repurchase of P&G stock. Based

on our current market capitalization, dividends and share

repurchases provide shareholders with an effective cash

yield of more than 6%, with additional potential for capital

appreciation.

In April, we increased our quarterly dividend by 9.5%,

making this the 120th consecutive year that P&G has paid a

dividend and the 54th consecutive year that the dividend has

increased. Over those 54 years, the dividend has increased at

an annual compound average rate of approximately 9.5%.

Last year, we updated P&G’s growth strategy to connect

it explicitly to our Company’s Purpose. We focused on three

specific choices: to grow P&G’s core brands and categories

with an unrelenting focus on innovation; to build our

business with unserved and underserved consumers; and

to continue to grow and develop faster-growing, higher-

margin businesses with global leadership potential.

These strategic choices are unified by one simple, over-

arching growth strategy: to touch and improve the lives

of MORE CONSUMERS in MORE PARTS OF THE WORLD, MORE

COMPLETELY. We’ve made this the centerpiece of our

leadership agenda because we believe a Purpose-inspired

growth strategy is intrinsically rewarding and motivating.

It unleashes creativity, commitment and peak performance

in P&G people. It attracts talent and partners. It builds

goodwill with external stakeholders.

We are executing across all three dimensions of this

growth strategy on all of our businesses around the world.

The Company’s performance in the 2010 fiscal year, and the

strength with which we have entered the 2011 fiscal year,

demonstrate that our Purpose-inspired growth strategy

is working.

Substantial Progress toward Growth Goals

We also renewed our growth goals last year. Our fundamental

objective is the creation of value for shareholders at industry

leadership levels on a consistent basis. More specifically,

our goal is to deliver total shareholder return that consistently

ranks P&G among the top-third of our peers—the best

performing consumer products companies in the world.

In addition, we measure our progress through a combination

of consumer and financial goals. We made substantial

progress in fiscal 2010:

• Organic sales grew 3%, in line with Company expectations.1

2 The Procter & Gamble Company

Purpose-inspired Growth Strategy: Our path forward

(1) Organic sales growth is sales growth excluding the impacts of acquisitions, divestitures and foreign exchange

from year-over-year comparisons. See page 49 for a reconciliation of organic sales growth to net sales growth.

(2) Core EPS is a measure of the Company’s diluted net earnings per share from continuing operations excluding

charges for potential competition law fines, a charge related to a tax provision for retiree healthcare subsidy

payments in the recently enacted U.S. healthcare reform legislation and incremental Corporate restructuring

charges incurred in fiscal 2009 versus 2008 to offset the dilutive impact of the Folgers divestiture. See page 50

for a reconciliation of Core EPS to diluted net earnings per share from continuing operations.

(3) Adjusted free cash flow productivity is defined as the ratio of adjusted free cash flow to net earnings excluding

the gains on the divestiture of the global pharmaceuticals business. For 2010, adjusted free cash flow of

$13,985 million is operating cash flow of $16,072 million less capital spending of $3,067 million plus the tax

payments made on the gains from the global pharmaceuticals divestitures of $980 million. Adjusted free cash

flow productivity of 125% is adjusted free cash flow of $13,985 million divided by net earnings of $12,736

million less gains of $1,585 million from the global pharmaceuticals divestitures.

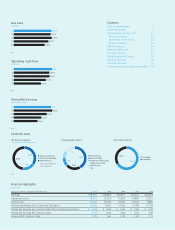

ORGANIC SALES GROWTH (1)

CORE EPS GROWTH (2)

ADJUSTED FREE CASH FLOW (3)

FY 2010

3%

6%

125% of net earnings

ANNUAL GROWTH TARGETS

1-2% above global market growth rates

High single to low double digits

90% of net earnings