Proctor and Gamble 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60 The Procter & Gamble Company Notes to Consolidated Financial Statements

Amounts in millions of dollars except per share amounts or as otherwise specified.

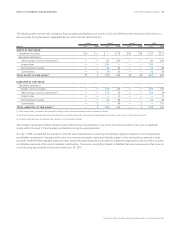

Interest Rate Risk Management

Our policy is to manage interest cost using a mixture of fixed-rate and

variable-rate debt. To manage this risk in a cost-efficient manner, we

enter into interest rate swaps whereby we agree to exchange with the

counterparty, at specified intervals, the difference between fixed and

variable interest amounts calculated by reference to an agreed-upon

notional amount.

Interest rate swaps that meet specific accounting criteria are accounted

for as fair value or cash flow hedges. For fair value hedges, the

changes in the fair value of both the hedging instruments and the

underlying debt obligations are immediately recognized in interest

expense. For cash flow hedges, the effective portion of the changes in

fair value of the hedging instrument is reported in OCI and reclassified

into interest expense over the life of the underlying debt. The ineffective

portion for both cash flow and fair value hedges, which is not material

for any year presented, is immediately recognized in earnings.

Foreign Currency Risk Management

We manufacture and sell our products and finance operations in a

number of countries throughout the world and, as a result, are exposed

to movements in foreign currency exchange rates. The purpose of our

foreign currency hedging program is to manage the volatility associated

with short-term changes in exchange rates.

To manage this exchange rate risk, we have historically utilized a

combination of forward contracts, options and currency swaps. As of

June30, 2010, we had currency swaps with maturities up to five years,

which are intended to offset the effect of exchange rate fluctuations

on intercompany loans denominated in foreign currencies. These swaps

are accounted for as cash flow hedges. The Company may utilize

and designate forward contracts and options to offset the effect of

exchange rate fluctuations on forecasted sales, inventory purchases

and intercompany royalties denominated in foreign currencies. The

effective portion of the changes in fair value of these instruments is

reported in OCI and reclassified into earnings in the same financial

statement line item and in the same period or periods during which

the related hedged transactions affect earnings. The ineffective portion,

which is not material for any year presented, is immediately recognized

in earnings.

The change in value of certain non-qualifying instruments used to

manage foreign exchange exposure of intercompany financing trans-

actions, income from international operations and certain balance sheet

items subject to revaluation is immediately recognized in earnings,

substantially offsetting the foreign currency mark-to-market impact

of the related exposure.

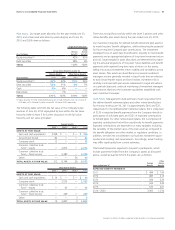

Net Investment Hedging

We hedge certain net investment positions in major foreign subsidiaries.

To accomplish this, we either borrow directly in foreign currencies and

designate all or a portion of foreign currency debt as a hedge of the

applicable net investment position or enter into foreign currency swaps

that are designated as hedges of our related foreign net investments.

Changes in the fair value of these instruments are immediately

recognized in OCI to offset the change in the value of the net invest-

ment being hedged. Currency effects of these hedges reflected in OCI

were after-tax gains of $789 and $964 in 2010 and 2009, respectively.

Accumulated net balances were after-tax losses of $3,270 and $4,059

as of June30, 2010 and 2009, respectively.

Commodity Risk Management

Certain raw materials used in our products or production processes

are subject to price volatility caused by weather, supply conditions,

political and economic variables and other unpredictable factors.

To manage the volatility related to anticipated purchases of certain

of these materials, we may use futures and options with maturities

generally less than one year and swap contracts with maturities up

to five years. These market instruments generally are designated as

cash flow hedges. The effective portion of the changes in fair value

for these instruments is reported in OCI and reclassified into earnings

in the same financial statement line item and in the same period or

periods during which the hedged transactions affect earnings. The

ineffective and non-qualifying portions, which are not material for

any year presented, are immediately recognized in earnings.

Insurance

We self-insure for most insurable risks. However, we purchase insurance

for Directors and Officers Liability and certain other coverage in

situations where it is required by law, by contract or deemed to be in

the best interest of the Company.

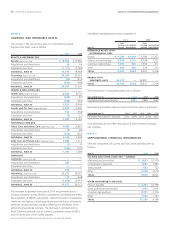

Fair Value Hierarchy

Accounting guidance on fair value measurements for certain financial

assets and liabilities requires that financial assets and liabilities carried

at fair value be classified and disclosed in one of the following three

categories:

Level 1: Quoted market prices in active markets for identical assets

or liabilities.

Level 2: Observable market-based inputs or unobservable inputs

that are corroborated by market data.

Level 3: Unobservable inputs reflecting the reporting entity’s own

assumptions or external inputs from inactive markets.

When applying fair value principles in the valuation of assets and

liabilities, we are required to maximize the use of quoted market prices

and minimize the use of unobservable inputs. We calculate the fair

value of our Level 1 and Level 2 instruments based on the exchange

traded price of similar or identical instruments where available or

based on other observable instruments. The fair value of our Level 3

instruments is calculated as the net present value of expected cash

flows based on externally provided or obtained inputs. Certain assets

may also be based on sales prices of similar assets. These valuations

take into consideration the credit risk of both the Company and our

counterparties. The Company has not changed its valuation techniques

in measuring the fair value of any financial assets and liabilities during

the year.