Porsche 2005 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

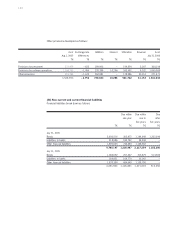

Segment information by business division

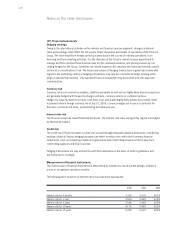

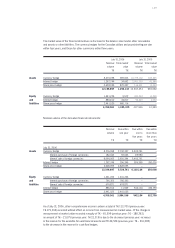

The balance sheets of the divisions also include assets that are not allocable to segment assets pursuant

to IAS 14. Most of these are income tax items and financial assets. Ignoring the concept of maturities pur-

suant to IAS 1, the balances are as follows if all assets and liabilities are allocated:

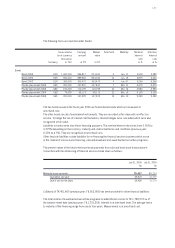

(31) Related Parties

In accordance with IAS 24, persons or entities which are in control of or controlled by Porsche AG

must be disclosed. Pursuant to a consortium agreement, the Porsche and Piëch families have direct and

indirect control respectively of Porsche AG.

The disclosure requirements under IAS 24 also extend to persons who have the power to exercise

significant influence over the Company, i.e. who have the power to participate in the financial and operating

policies of the Company, but do not control it, including close family members. In the fiscal year 2005/06

this concerns members of the Supervisory Board and the Executive Board of Porsche AG as well as their

close family members.

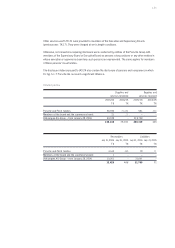

The volume of trade in the course of ordinary operations in the vehicles and parts business with the

Porsche and Piëch families and their affiliated entities came to EUR 79.6 million (previous year:

EUR 74.6 million), and trade in the design business to EUR 1.2 million (previous year: EUR 1.1 million)

as well as financing arrangement services of EUR 10.1 million (previous year: EUR 0.0 million).

The arm’s length principle was applied without exception.

Apart from that, the Porsche and Piëch families provided automotive services and delivered clocks and

related spare parts to Porsche AG. These deliveries and services are not material for the Porsche Group

and were charged at arm's length conditions without exception.

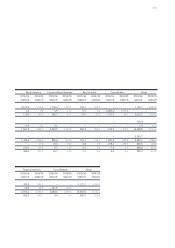

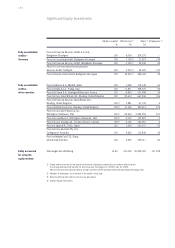

Vehicles Financial services Consolidation Group

July 31, 2006 July 31, 2005 July 31, 2006 July 31, 2005 July 31, 2006 July 31, 2005 July 31, 2006 July 31, 2005

million € million € million € million € million € million € million € million €

Assets

Fixed assets 5,944.0 1,977.9 998.4 1,013.0 – 1,261.6 – 562.5 5,680.8 2,428.4

Current assets 6,410.3 5,400.2 1,955.0 1,868.9 582.7 12.6 8,948.0 7,281.7

12,354.3 7,378.1 2,953.4 2,881.9 – 678.9 – 549.9 14,628.8 9,710.1

Equity and liabilities

Equity 5,294.7 3,374.4 268.0 238.5 – 186.7 – 192.7 5,376.1 3,420.2

Debt capital 7,059.6 4,003.7 2,685.4 2,643.4 – 492.2 – 357.2 9,252.7 6,289.9

12,354.3 7,378.1 2,953.4 2,881.9 – 678.9 – 549.9 14,628.8 9,710.1

Balance sheets of the divisions