Porsche 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

Accounting Principles and Measurement

The assets and liabilities of Porsche AG and the German and foreign subsidiaries included by way of full

consolidation are recognized and measured uniformly according to the recognition and measurement

methods applicable in the Porsche Group as of July 31, 2006. The same applies to the investment included

in the consolidated financial statements using the equity method.

The comparative information for fiscal year 2004/05 is based on the same accounting and measurement

methods that were applicable for the fiscal year 2005/06.

The preparation of consolidated financial statements is subject to assumptions and estimates that have

an effect on recognition, measurement and disclosure of assets, liabilities, income and expenses.

All findings currently available are taken into account. Significant assumptions and estimates are made

for uniform useful lives within the Group and the recoverable amounts recognized for non-current assets,

the recoverability of receivables, determination of the percentage of completion for long-term construction

contracts and the recognition and measurement of provisions. In individual cases, actual amounts may

differ from the estimates. The carrying amounts of the assets and liabilities affected by estimates can be

gathered from the break-downs of the individual balance sheet items.

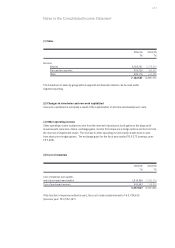

Intangible assets

Intangible assets include goodwill and recognized development costs, patents, software, licenses and simi-

lar rights with a finite useful life. They are recognized if a future inflow of economic benefits is probable and

expenses can be clearly allocated.

Patents, software, licenses and similar rights are recognized at cost pursuant to IAS 38 and amortized

over their useful life on a straight-line basis unless there are any impairments. The useful life generally ran-

ges from three to five years.

Acquired goodwill is reported as an asset. Goodwill is not amortized on a systematic basis. Development

costs are capitalized for vehicles provided that clear allocation of expenses is possible and all the other

criteria of IAS 38 are met. The development costs capitalized include all production overheads allocable

directly and indirectly to the development process that are incurred as of the time at which all recognition

criteria are met. Capitalized development costs are amortized from the production start using the straight-

line method over the expected product life cycle of usually six years. Research and non-capitalizable

development costs are expensed as incurred.

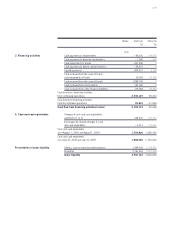

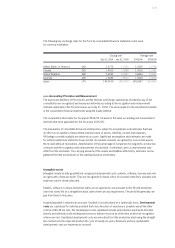

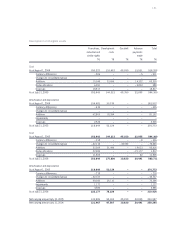

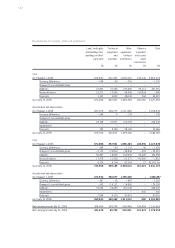

The following key exchange rates for the Porsche consolidated financial statements were used

for currency translation:

Closing rate Average rate

July 31, 2006 July 31, 2005 2005/06 2004/05

United States of America USD 1.2772 1.2120 1.2226 1.2705

Canada CAD 1.4413 1.4888 1.4119 1.5761

United Kingdom GBP 0.6842 0.6899 0.6844 0.6863

Australia AUD 1.6689 1.5937 1.5566 1.6802

Japan JPY 146.0100 136.0700 140.8397 136.0043