Porsche 2005 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

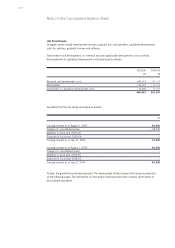

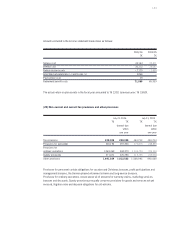

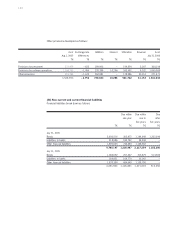

2005/06 2004/05

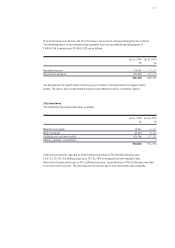

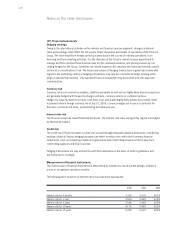

Discount rate 4.50% 4.00%

Future increase in salaries 3.50% 3.50%

Increase in pensions 1.75% 1.75%

Actuarial assumptions (Germany only)

On aggregate, the benefit obligations of foreign entities are not material.

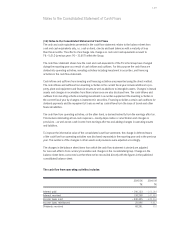

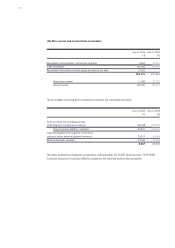

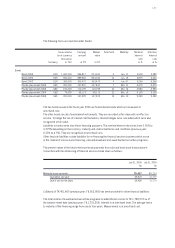

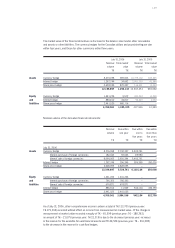

(22) Pension provisions

Employees of the entities included in the consolidated financial statements are entitled to benefits under

the company pension plan. The benefits vary according to local legal, economic and tax conditions and

are usually based on the employee service period and the beneficiary’s salary. The direct and indirect

obligations include both current pension obligations and future pension and retirement benefit obligations.

The company pension plan of the Group essentially relates to defined benefit plans, but there are also

some defined contribution plans. The defined contribution plans principally concern German entities that

are required by law to transfer contributions to the national pension insurance company. Contributions of

T€ 49,974 were paid to the national pension insurance company in Germany (previous year: T€ 49,181).

The defined benefit plans are calculated using the projected unit credit method in accordance with IAS 19.

The benefit obligations are recognized at service cost as of the measurement date. The benefit obligation

for active employees increases annually by the interest cost plus the present value of the new benefit entit-

lements earned in the current fiscal year.

The majority of the benefits pertain to Porsche AG. In addition, personal retirement capital is accumulated

in Germany by employee contributions to Porsche VarioRente.

The benefit obligations are calculated using actuarial methods. These include assumptions concerning

future wage and salary trends and pension increases. These parameters are estimated annually by the

Company. The measurement is based on the following assumptions for German entities: