Porsche 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

140

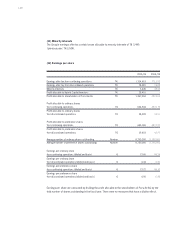

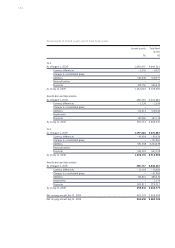

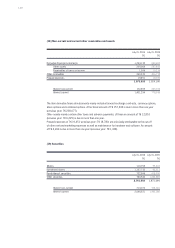

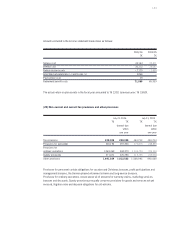

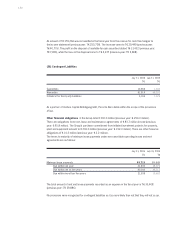

Payment of a dividend of EUR 8.94 (EUR 5.94 + EUR 3.00 extra dividend)

per ordinary share ISIN no. DE0006937709

(securities ident. no. 693770) on

8,750,000 ordinary shares for fiscal year 2005/06 € 78,225,000

Payment of a dividend of EUR 9.00 (EUR 6.00 + EUR 3.00 extra dividend)

per preference share ISIN no. DE0006937733

(securities ident. no. 693773) on

8,750,000 preference shares for fiscal year 2005/06 € 78,750,000

Transfers to revenue reserves € 470,025,000

Retained earnings € 627,000,000

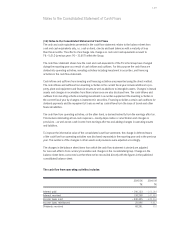

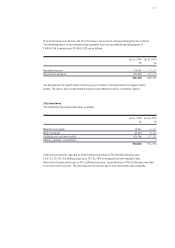

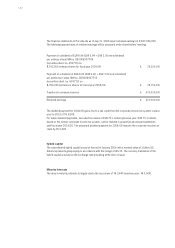

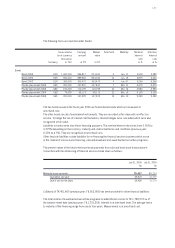

The dividend payment for 2004/05 gives rise to a tax credit from the corporate income tax system in place

prior to 2001 of T€ 5,009.

For future dividend payments, tax reduction claims of EUR 70.1 million (previous year: EUR 75.1 million),

based on the former corporate income tax system, can be realized in proportionate annual installments

until fiscal year 2019/20. The proposed dividend payment for 2005/06 reduces the corporate income tax

claim by T€ 5,009

Hybrid capital

The subordinated hybrid capital issued at the end of January 2006 with a nominal value of 1 billion US

dollars represents group equity in accordance with the rulings of IAS 32. The currency translation of the

hybrid capital is based on the exchange rate prevailing at the time of issue.

Minority interests

The drop in minority interests is largely due to the loss share of T€ 3,445 (previous year: T€ 3,504).

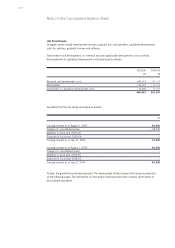

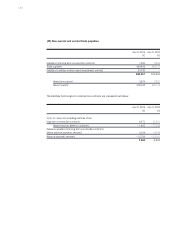

The financial statements of Porsche AG as of July 31, 2006 report retained earnings of € 627,000,000.

The following appropriation of retained earnings will be proposed at the shareholders’ meeting.