Porsche 2005 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.151

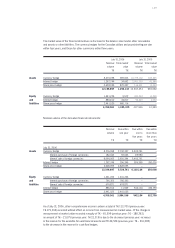

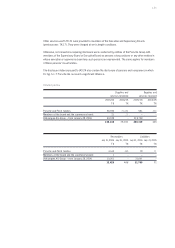

(29) Events after the Balance Sheet Date

After the close of the fiscal year 2005/06, Dr. Ing. h.c. F. Porsche Aktiengesellschaft, Stuttgart, Germany,

sold 100% of the shares in Porsche Engineering Services Inc., Wilmington/Delaware, USA to Magna

International Inc. Ontario, Canada. This did not have a material effect on the net assets, financial situation

and results of operations. It was therefore decided not to present Porsche Engineering Services Inc.,

Wilmington/Delaware, USA, as assets and liabilities held for sale in accordance with IFRS 5.

(30) Notes to the Segment Reporting

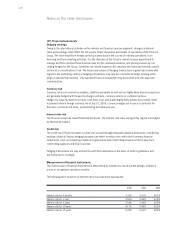

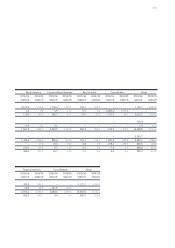

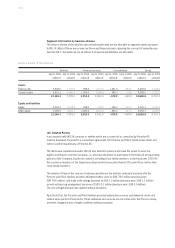

The objective of the segment reporting is to provide information about the main divisions of the Group.

In accordance with IAS 14, the Group’s activities are broken down by geographical region as the primary

reporting format and by business division as the secondary reporting format. Segmentation is based on

the internal reporting and organizational structure, taking account of the different risk and income

structures of the various regions and divisions. The segmentation by region is based on the location of

the customers. According to the different risk and income structure, the Group is divided into the regions

Germany, North America, Europe without Germany and Rest of the world.

Segmentation by business division shows the vehicles and financial services divisions. The vehicles

division includes the development, production and sale of vehicles as well as related services.

The financial services division comprises the financing and leasing business for customers and dealers.

Intersegment receivables and liabilities, provisions, income and expenses as well as intersegment profits

and losses are eliminated in the column “consolidation”. This column also includes the items not allocable

to the individual segments.

The segment figures have been determined in accordance with the recognition and measurement methods

used in the consolidated financial statements. The business relations between the entities of the Porsche

Group are generally based on prices as agreed with third parties. Third-party sales show the share of each

division in the Porsche Group’s sales revenues.

Intersegment sales shows the sales effected between the segments.

Earnings before financial result and income tax constitute the segment result without the gain on sale

from companies removed from the consolidated group. The segment result includes the result from lease

transactions as well as the result from customer and dealer financing.

Segment assets include all assets except for income tax claims and assets allocable to financial trans-

actions. Segment liabilities include all liabilities except for income tax liabilities and financial liabilities

unless they were incurred directly for operating purposes.

Non-cash expenses mainly include additions to provisions and unrealized losses from measurement at

market value.