Porsche 2005 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

152

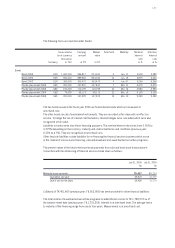

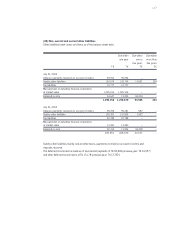

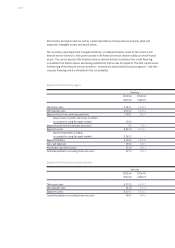

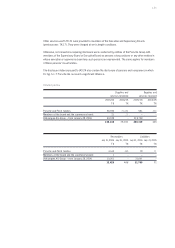

Amortization and depreciation as well as capital expenditure primarily relate to property, plant and

equipment, intangible assets and leased assets.

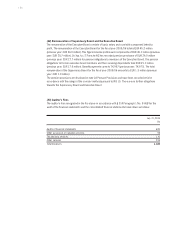

The secondary reporting format is supplemented by a condensed balance sheet for the vehicles and

financial services divisions. Non-current assets in the financial services division mainly consist of leased

assets. The current assets of the financial services division include receivables from credit financing,

receivables from finance leases and leasing installments that are due for payment. The debt capital shows

the financing of the financial services business – primarily via asset-backed security programs – and inter-

company financing which is eliminated in the consolidation.

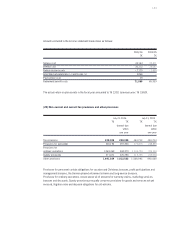

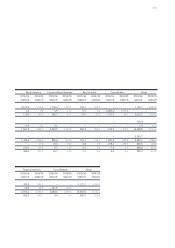

Germany

2005/06 2004/05

million € million €

Third-party sales 2,187.1 1,934.5

Intersegment sales 4,074.7 3,558.4

Segment result from continuing operations 1,788.1 881.8

thereof share of profits and losses of entities

accounted for using the equity method 203.4 –

Segment result from discontinued operations 2.1 20.3

Segment assets 8,397.3 5,313.1

thereof investments in entities

accounted for using the equity method 3,263.7 –

Segment liabilities 5,769.0 2,897.8

Non-cash expenses 765.2 328.7

Amortization and depreciation 331.8 346.1

Capital expenditures (excluding financial assets) 437.0 409.3

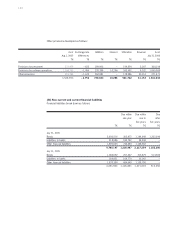

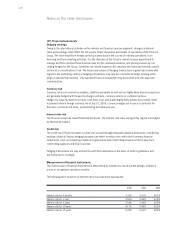

Vehicles

2005/06 2004/05

million € million €

Third-party sales 6,733.2 5,902.7

Intersegment sales 141.0 151.2

Segment assets 8,610.7 5,536.1

Capital expenditures (excluding financial assets) 399.7 368.9

Segment information by region

Segment information by business division