Porsche 2005 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

143

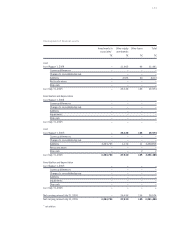

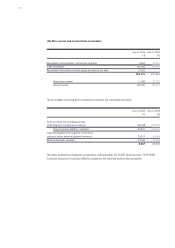

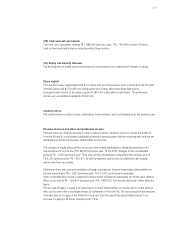

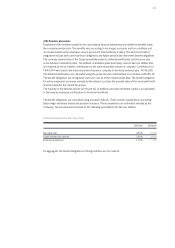

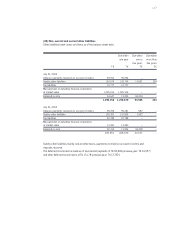

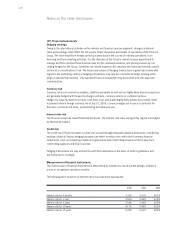

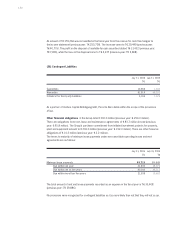

Provisions for personnel contain obligations for vacation and Christmas bonuses, profit participations and

management bonuses, the German phased retirement scheme and long-service bonuses.

Provisions for ordinary operations consist above all of amounts for warranty claims, marketing services,

bonuses and discounts. Sundry provisions principally comprise provisions for goods and services not yet

invoiced, litigation risks and disposal obligations for old vehicles.

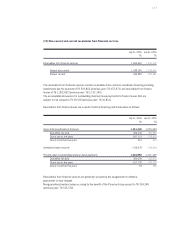

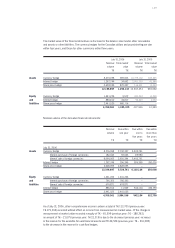

Amounts included in the income statement break down as follows:

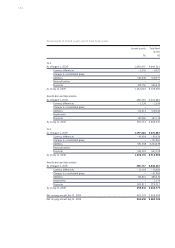

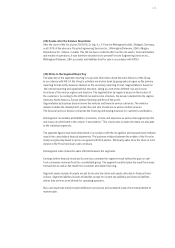

The actual return on plan assets in the fiscal year amounted to T€ 2,811 (previous year: T€ 3,659).

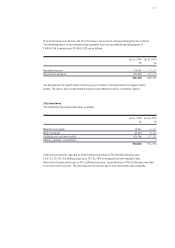

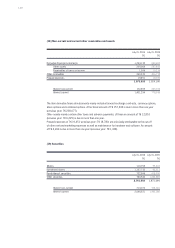

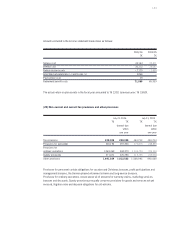

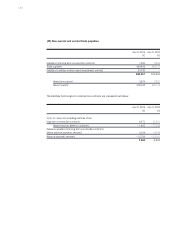

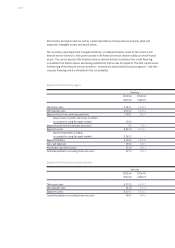

(23) Non-current and current tax provisions and other provisions

2005/06 2004/05

T€ T€

Service cost 39,143 22,871

Interest cost 30,172 28,087

Return on plan assets – 2,125 – 1,655

Amortized actuarial gains (–) and losses (+) 3,866 –

Past service cost 29 –

Retirement benefit costs 71,085 49,303

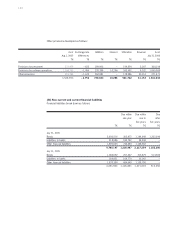

July 31, 2006 July 31, 2005

T€ T€ T€ T€

thereof due thereof due

within within

one year one year

Tax provisions 238,026 238,026 163,713 163,713

Provisions for personnel 300,194 297,356 272,475 248,883

Provisions for

ordinary operations 1,069,369 444,370 1,034,753 374,103

Sundry provisions 271,471 270,796 219,765 219,034

Other provisions 1,641,034 1,012,522 1,526,993 842,020