Porsche 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

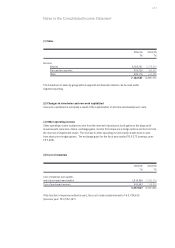

Contingent liabilities

A contingent liability is a possible obligation to third parties that arises from past events and whose

existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future

events not wholly within the control of the Porsche Group. A contingent liability may also be a present

obligation that arises from past events but is not recognized because an outflow of resources is not

probable or the amount of the obligation cannot be measured with sufficient reliability.

New Accounting Policies

a) Accounting policies adopted for the first time in the fiscal year

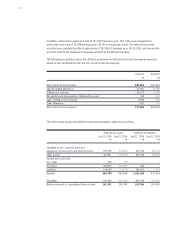

The following accounting provisions were mandatory for the first time for the 2005/06 fiscal year:

Improvements Project

The following standards were revised by the IASB as part of the “Improvement Project” and adopted for

the first time in the consolidated financial statements as of July 31, 2006:

IAS 1 “Presentation of Financial Statements”

IAS 2 “Inventories”

IAS 24 “Related Party Disclosures”

IAS 31 “Interests in Joint Ventures”

IAS 40 “Investment Property”

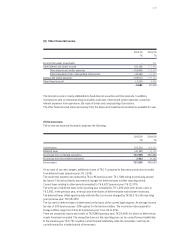

The most important changes from the improvement project pertain to the application of IAS 1

“Presentation of Financial Statements” according to which production companies have to classify their

balance sheet by maturity. Assets and liabilities are split into short and long-term items according to their

residual term and whether they belong to the normal business cycle. The main changes include:

Receivables from financial services, trade receivables, securities and other receivables and assets were

subdivided into current and non-current positions. In this context, prepaid expenses were reclassified to

other receivables and assets in accordance with customary international practice and split by maturity.

Provisions, financial liabilities, trade payables and other liabilities were subdivided into current and

non-current positions. In this context, the deferred income item was reclassified to other liabilities in

accordance with customary international practice and split by maturity.