Pfizer 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

•In the fourth quarter of 2008, we completed the acquisition of a number of animal health product lines from Schering-Plough

Corporation (Schering-Plough) for approximately $170 million.

•In September 2008, we announced an agreement with Medivation, Inc. (Medivation) to develop and commercialize Latrepirdine

(Dimebon), Medivation’s investigational drug for treatment of Alzheimer’s disease and Huntington’s disease. Following the expiration of

the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act, the agreement went into effect in October 2008.

Latrepirdine currently is being evaluated in a Phase 3 trial in patients with mild-to-moderate Alzheimer’s disease and in a Phase 3 trial

in patients with Huntington’s disease. Under the collaboration agreement with Medivation, we made an upfront payment of $225 million,

which is included in Research and development expenses in 2008. We also may make additional payments of up to $500 million based

upon development and regulatory milestones, as well as additional milestone payments based upon the successful commercialization

of the product.

•In the second quarter of 2008, we acquired Encysive Pharmaceuticals Inc. (Encysive), a biopharmaceutical company, through a tender

offer, for approximately $200 million, including transaction costs. In addition, in the second quarter of 2008, we acquired Serenex, Inc.

(Serenex), a privately held biotechnology company. In connection with these acquisitions, we recorded approximately $170 million in

Acquisition-related in-process research and development charges and approximately $450 million in intangible assets in 2008.

•In the second quarter of 2008, we entered into an agreement with a subsidiary of Celldex for an exclusive worldwide license to

CDX-110, an experimental therapeutic vaccine in Phase 2 development for the treatment of glioblastoma multiforme, and exclusive

rights to the use of EGFRvIII vaccines in other potential indications. Under the license and development agreement, an upfront

payment was made in 2008. Additional payments exceeding $390 million potentially could be made to Celldex based on the successful

development and commercialization of CDX-110 and additional EGFRvIII vaccine products.

•In the first quarter of 2008, we acquired CovX, a privately held biotherapeutics company, and we acquired all the outstanding shares of

Coley Pharmaceutical Group, Inc., (Coley), a biopharmaceutical company. In connection with these and two smaller acquisitions

related to Animal Health, we recorded approximately $440 million in Acquisition-related in-process research and development charges

in 2008. In 2009, we resolved certain contingencies associated with CovX and recorded $68 million in Acquisition-related in-process

research and development charges.

•In the second quarter of 2007, we entered into a collaboration agreement with Bristol-Myers Squibb Company (BMS) to further develop

and commercialize apixaban, an oral anticoagulant compound discovered by BMS. We made an initial payment to BMS of $250 million

and additional payments to BMS related to product development efforts, which are included in Research and development expenses in

2007. We also may make additional payments of up to $780 million to BMS, based on development and regulatory milestones. In a

separate agreement, we also are collaborating with BMS on the research, development and commercialization of a Pfizer discovery

program, which includes preclinical compounds with potential applications for the treatment of metabolic disorders, including diabetes.

•In April 2007, we agreed with OSI Pharmaceuticals, Inc. (OSI) to terminate a 2002 collaboration agreement to co-promote Macugen, for

the treatment of age-related macular degeneration, in the U.S. We also agreed to amend and restate a 2002 license agreement for

Macugen and to return to OSI all rights to develop and commercialize Macugen in the U.S. In return, OSI granted us an exclusive right

to develop and commercialize Macugen in the rest of the world.

•In the first quarter of 2007, we acquired BioRexis, a privately held biopharmaceutical company with a novel technology platform for

developing new protein drug candidates, and Embrex, an animal health company that possesses a unique vaccine delivery system

known as Inovoject that improves consistency and reliability by inoculating chicks while they still are inside the eggs. In connection with

these and other smaller acquisitions, we recorded $283 million in Acquisition-related in-process research and development charges in

2007.

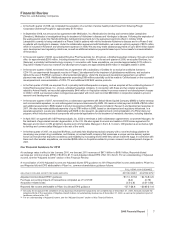

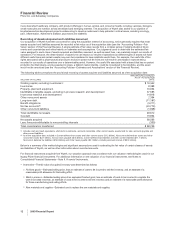

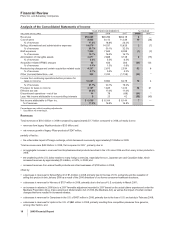

Our Financial Guidance for 2010

At exchange rates in effect in late January 2010, we forecast 2010 revenues of $67.0 billion to $69.0 billion, Reported diluted

earnings per common share (EPS) of $0.95 to $1.10 and Adjusted diluted EPS of $2.10 to $2.20. For an understanding of Adjusted

income, see the “Adjusted Income” section of this Financial Review.

A reconciliation of 2010 Adjusted income and Adjusted diluted EPS guidance to 2010 Reported Net income attributable to Pfizer Inc.

and Reported diluted EPS attributable to Pfizer Inc. common shareholders guidance follows:

FULL-YEAR 2010 GUIDANCE

(BILLIONS OF DOLLARS, EXCEPT PER SHARE AMOUNTS) NET INCOME(a) DILUTED EPS(a)

Adjusted income/diluted EPS(b) guidance ~$17.0 -$17.8 ~$2.10-$2.20

Purchase accounting impacts of transactions completed as of 12/31/09 (6.4) (0.79)

Acquisition-related costs (2.5-2.9) (0.31-0.36)

Reported Net income attributable to Pfizer Inc./diluted EPS guidance ~$7.7-$8.9 ~$0.95-$1.10

(a) Amounts do not assume the completion of any business-development transactions not completed as of December 31, 2009. Amounts exclude the

potential effects of the resolution of litigation-related matters not substantially resolved as of December 31, 2009, as well as the potential impactof

healthcare reform in the U.S.

(b) For an understanding of Adjusted income, see the “Adjusted Income” section of this Financial Review.

2009 Financial Report 7