Pfizer 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

Our 2009 Performance

In 2009, there were significant events and factors impacting almost all income statement elements. Our 2009 revenues increased

compared to 2008, primarily due to the addition of legacy Wyeth products from the closing of the acquisition on October 15, 2009

through Pfizer’s international and domestic year-ends. Also, in 2009, we continued to face an extremely competitive environment in

the biopharmaceutical industry. Details of our 2009 performance follow:

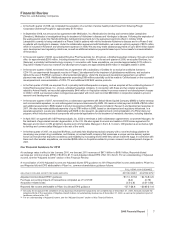

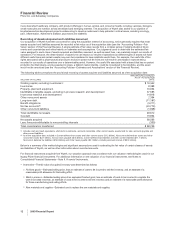

•Revenues of $50.0 billion increased by approximately $1.7 billion compared to 2008, primarily due to:

Orevenues from legacy Wyeth products of $3.3 billion; and

Onet revenue growth of legacy Pfizer products of $247 million,

partially offset by:

Othe unfavorable impact of foreign exchange, which decreased revenues by approximately $1.8 billion in 2009.

The significant impacts on revenues for 2009, compared to 2008, are as follows:

2009 vs. 2008

(MILLIONS OF DOLLARS)

INCREASE/

(DECREASE) % CHANGE

Lipitor(a) $(967) (8)

Norvasc(b) (271) (12)

Camptosar(b) (231) (41)

Chantix/Champix(c) (146) (17)

Zyrtec(b) (129) (100)

Celebrex (106) (4)

Detrol/Detrol LA (60) (5)

Aricept(d) (50) (10)

Viagra (42) (2)

Revatio 114 34

Sutent 117 14

Hemophilia family(e) 145 *

Zosyn/Tazocin(e) 184 *

Premarin family(e) 213 *

Lyrica 267 10

Prevnar/Prevenar 7(e) 287 *

Enbrel (outside the U.S. and Canada)(e) 378 *

Effexor(e) 520 *

Alliance revenues(f) 674 30

Animal heath products(g) (61) (2)

Consumer healthcare products(e) 494 *

Nutrition products(e) 191 *

(a) Lipitor was unfavorably impacted primarily by foreign exchange, as well as competitive pressures and other factors.

(b) Zyrtec/Zyrtec D lost U.S. exclusivity in late January 2008, at which time we ceased selling this product. Camptosar lost exclusivity in the U.S. in

February 2008 and in Europe in July 2009. Norvasc lost exclusivity in Japan in July 2008 and Canada in July 2009.

(c) Chantix/Champix has been negatively impacted by changes to its label in 2008 and additional label changes in July 2009 (see the

“Revenues—Biopharmaceutical—Selected Product Descriptions” section of this Financial Review).

(d) Represents direct sales under our license agreement with Eisai Co., Ltd.

(e) Legacy Wyeth products and operations.

(f) 2009 includes Enbrel sales in the U.S. and Canada.

(g) Includes legacy Wyeth products.

* Calculation not meaningful.

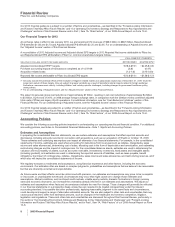

•Income from continuing operations was $8.6 billion in 2009 compared to $8.0 billion in 2008, reflecting:

Oincreased revenues, primarily as a result of revenues from legacy Wyeth products;

Othe non-recurrence of a $2.3 billion, pre-tax and after-tax, charge in 2008 related to the resolution of certain investigations concerning

Bextra and various other products and the non-recurrence of a $640 million after-tax charge in 2008 related to the resolution of

certain litigation involving our non-steroidal anti-inflammatory drugs (NSAID); and

Olower costs incurred in connection with our cost-reduction initiatives,

largely offset by:

Othe unfavorable impact of foreign exchange;

2 2009 Financial Report