Pfizer 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

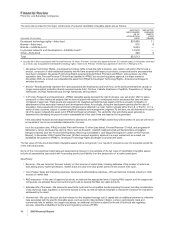

Financial Review

Pfizer Inc. and Subsidiary Companies

Our Strategy

Wyeth Acquisition

In response to the challenging operating environment, we have taken many steps to strengthen our Company and better position

ourselves for the future. The most important of these steps was the acquisition of Wyeth, which has transformed us into a more

diversified healthcare company, with product offerings in human, animal and consumer health, including vaccines, biologics, small

molecules and nutrition across developed and emerging markets. We believe that our acquisition and integration of Wyeth

meaningfully advances, in a single transaction, each of the strategic priorities that we have identified and pursued over the last two

years, including:

•Enhancing our in-line and patent-protected pipeline portfolio in key “invest to win” areas where there exist significant unmet medical

needs and significant opportunities for innovation and market leadership, such as oncology, pain, inflammation, Alzheimer’s disease,

psychoses and diabetes, as well as the critical technologies of vaccines and biologics;

•Becoming a top-tier biotherapeutics company by 2015;

•Accelerating growth in emerging markets;

•Creating new opportunities for established products;

•Investing in complementary businesses; and

•Creating a lower, more flexible cost base for the combined company.

We believe the realization of these strategic priorities through the acquisition of Wyeth enhances opportunities for us to:

•Drive improved performance through our unique and flexible business model—which is built on a group of agile, highly accountable

units all backed by the scale and resources of our global enterprise.

•Strengthen the opportunity for consistent and stable revenue and earnings growth through product offerings in numerous growing

therapeutic areas and a diversified product portfolio in which it is expected that no drug will account for more than 10% of our revenues

in 2012.

•Strengthen our ability to deliver on the true growth driver in our business—meeting the unmet medical needs of patients, doctors and

other customers through a robust and growing pipeline of biopharmaceutical development projects, the combination of top scientists

from both legacy companies, leading scientific and manufacturing capabilities, a global network of proof-of-concept clinical

development centers, and a newly reorganized research and development organization.

•Take advantage of rapidly advancing scientific innovation into new and more complex areas in order to address continuing substantial

unmet medical needs.

•Take advantage of current demographics of developed countries which indicate that people are living longer and, therefore, have a

growing demand for high-quality healthcare and the most effective medicines.

Other Responses to Industry-Specific Challenges

We believe that our medicines provide significant value for both healthcare providers and patients, not only from the improved

treatment of diseases but also from a reduction in other healthcare costs, such as emergency room or hospitalization costs, as well

as improvements in health, wellness and productivity. We continue to actively engage in dialogues about the value of our products

and how we can best work with patients, physicians and payers to prevent and treat disease and improve outcomes. We will work

within the current legal and pricing structures, as well as continue to review our pricing arrangements and contracting methods with

payers, to maximize access to patients and minimize any adverse impact on our revenues.

We continue to be a constructive force in helping to shape healthcare policy and the appropriate regulation of our products. Although

we cannot predict the outcome of U.S. healthcare reform initiatives, we remain committed and actively engaged in discussions to

reform healthcare in a way that expands coverage for those currently uninsured; does not erode coverage for those currently

insured; improves quality; rewards innovation; and provides value for patients. During the second quarter of 2009, the

Pharmaceutical Research and Manufacturers of America (PhRMA), of which we are a member, announced an $80 billion

commitment over the next decade to support healthcare reform in the U.S. Among other things, that commitment includes reducing

the cost of medicines for seniors and disabled Americans who are affected by the coverage gap in the Medicare prescription drug

program. The PhRMA commitment is intended to be part of any federal healthcare reform legislation in the U.S.

We continue to aggressively defend our patent rights against increasingly aggressive infringement whenever appropriate (see Notes

to Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies), and we will continue to support efforts that

strengthen worldwide recognition of patent rights while taking necessary steps to ensure appropriate patient access. In addition, we

will continue to employ innovative approaches to prevent counterfeit pharmaceuticals from entering the supply chain and to achieve

greater control over the distribution of our products, and we will continue to participate in the generics market for our products,

whenever appropriate, once they lose exclusivity.

4 2009 Financial Report