Pfizer 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

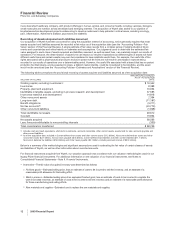

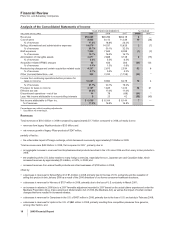

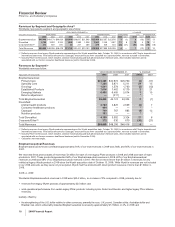

The amounts recorded for the major components of acquired inventory are as follows:

(MILLIONS OF DOLLARS)

AMOUNTS

RECOGNIZED AS OF

ACQUISITION DATE

Finished goods $2,692

Work in process(a) 5,286

Raw materials 410

Total Inventory $8,388

(a) As of the acquisition date, includes pre-launch inventory associated with Prevnar/Prevenar 13 Infant which did not launch until 2010. Prevnar/

Prevenar 13 Infant was approved by the EU member states in December 2009 and in the U.S. in February 2010.

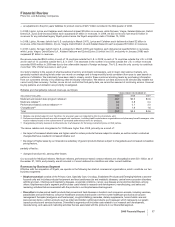

The fair value of inventory will be recognized in our results of operations as the inventory is sold. Based on internal forecasts and

estimates of months of inventory on hand (and excluding inventories associated with Prevnar/Prevenar 13 Infant), we expect that

the acquisition date inventory will be substantially sold and recognized in cost of sales over a weighted average estimated period

of approximately 14 months after the acquisition date.

Some of the more significant estimates and assumptions inherent in the estimate of the fair value of inventory include stage of

completion, costs to complete, costs to dispose and selling price. All of these judgments and estimates can materially impact our

results of operations.

•Property, Plant and Equipment—The fair value of acquired property, plant and equipment is determined using a variety of valuation

approaches, depending on the nature of the asset and the quality of available information. If multiple approaches are used for a single

asset or a group of assets, those approaches are compared and reconciled to arrive at a single estimate of fair value. The fair value of

acquired property, plant and equipment was primarily determined as follows:

OLand––Market, a sales comparison approach that measures value of an asset through an analysis of sales and offerings of

comparable property.

OBuildings—Replacement cost, an approach that measures the value of an asset by estimating the cost to acquire or construct

comparable assets. For buildings that are not highly specialized or that could be income producing if leased to a third party, we also

considered market and income factors.

OMachinery and Equipment—Replacement cost.

OFurniture and Fixtures—Replacement cost.

OConstruction in Progress—Replacement cost, generally assumed to equal historical book value.

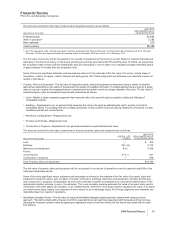

The amounts recorded for the major components of acquired property, plant and equipment are as follows:

(MILLIONS OF DOLLARS)

USEFUL LIFE

(YEARS)

AMOUNTS

RECOGNIZED AS OF

ACQUISITION DATE

Land — $ 303

Buildings 33

1

⁄

3

-50 5,215

Machinery and equipment 8-20 3,156

Furnitu

re and fixtures 3-12

1

⁄

2

501

Construction in progress — 879

Total Property, plant and equipment $10,054

The fair value of property, plant and equipment will be recognized in our results of operations over the expected useful life of the

individual depreciable assets.

Some of the more significant inputs, estimates and assumptions inherent in the estimate of the fair value of property, plant and

equipment include the nature, age, condition or location of the land, buildings, machinery and equipment, furniture and fixtures,

and construction in progress, as applicable, as well as the estimate of market and replacement cost and the determination of the

appropriate valuation premise, in-use or in-exchange. The in-use valuation premise assesses the value of an asset when used in

combination with other assets (for example, on an installed basis), while the in-exchange valuation assesses the value of an asset

on a stand alone basis. Assets to be disposed of were valued on an in-exchange basis. All of these judgments and estimates can

materially impact our results of operations.

•Identifiable Intangible Assets—The fair value of acquired identifiable intangible assets generally is determined using an income

approach. This method starts with a forecast of all of the expected future net cash flows associated with the asset and then involves

adjusting the forecast to present value by applying an appropriate discount rate that reflects the risk factors associated with the cash

flow streams.

2009 Financial Report 13