Pfizer 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

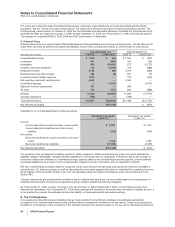

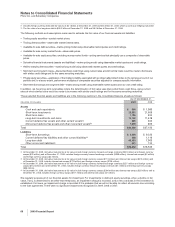

B. Other Intangible Assets

The components of identifiable intangible assets, primarily included in Biopharmaceutical follow:

AS OF DECEMBER 31,

2009 2008

(MILLIONS OF DOLLARS)

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORTIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

Finite-lived intangible assets:

Developed technology rights $68,870 $(21,223) $47,647 $31,484 $(17,673) $13,811

Brands 1,637 (535) 1,102 1,016 (487) 529

License agreements 622 (119) 503 246 (78) 168

Trademarks 113 (73) 40 118 (78) 40

Other(a) 488 (231) 257 531 (291) 240

Total amortized finite-lived

intangible assets 71,730 (22,181) 49,549 33,395 (18,607) 14,788

Indefinite-lived intangible assets:

Brands 12,562 — 12,562 2,860 — 2,860

In-process research and

development 5,834 — 5,834 ———

Trademarks 68 — 68 70 — 70

Other 2—23—3

Total indefinite-lived intangible

assets 18,466 — 18,466 2,933 — 2,933

Total identifiable intangible assets $90,196 $(22,181) $68,015(b) $36,328 $(18,607) $17,721(b)

(a) Includes patents, non-compete agreements and customer contracts.

(b) Increase primarily relates to the acquisition of Wyeth’s identifiable intangible assets, which were recorded at fair value (see Note 2. Acquisition of

Wyeth), partially offset by amortization.

All of these assets are subject to our review for impairment, explained in Note 1L. Significant Accounting Policies: Amortization of

Intangible Assets, Depreciation and Certain Long-Lived Assets.

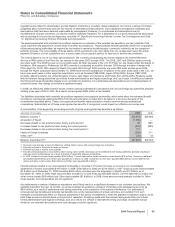

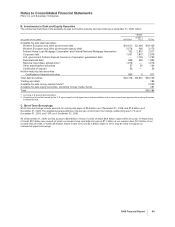

Developed Technology Rights

Developed technology rights represent the amortized cost associated with developed technology, which has been acquired from

third parties and which can include the right to develop, use, market, sell and/or offer for sale the product, compounds and

intellectual property that we have acquired with respect to products, compounds and/or processes that have been completed. We

possess a well-diversified portfolio of hundreds of developed technology rights across therapeutic categories, primarily representing

the commercialized products included in our Biopharmaceutical segment. Virtually all of these assets were acquired in connection

with our Wyeth acquisition in 2009 and our Pharmacia acquisition in 2003. The more significant components of developed

technology rights are the following (in order of significance): Enbrel and Prevnar/Prevenar 13 Infant and, to a lesser extent,

Celebrex, Premarin, Effexor, Pristiq, BeneFIX, BMP-2, Refacto, Genotropin, Tygacil, Detrol/Detrol LA, Xalatan, Prevnar/Prevenar 7

and Zyvox.

Also included in this category are the post-approval milestone payments made under our alliance agreements for certain

Biopharmaceutical products, such as Rebif and Spiriva.

Brands

Brands represent the amortized or unamortized cost associated with tradenames and know-how, as the products themselves no

longer receive patent protection. Most of these assets are associated with our Diversified segment. Virtually all of these assets were

acquired in connection with our Wyeth acquisition in 2009 and our Pharmacia acquisition in 2003. The more significant components

of indefinite-lived brands are the following (in order of significance): Advil, 3rd Age Nutritionals, Xanax, 1st Age Nutritionals,

Centrum, Medrol, 2nd Age Nutritionals, Robitussin, Caltrate, Preparation H and ChapStick. The more significant components of

finite-lived brands are the following (in order of significance): Depo-Provera, Advil Cold and Sinus and Dimetapp.

In-Process Research and Development

IPR&D assets represent research and development assets that have not yet received regulatory approval and are required to be

classified as indefinite-lived assets until the successful completion or the abandonment of the associated research and development

effort. Accordingly, during the development period after the date of acquisition, these assets will not be amortized until approval is

obtained in a major market, typically either the U.S. or the EU, or in a series of other countries, subject to certain specified conditions

and management judgment. At that time, we will determine the useful life of the asset, reclassify the asset out of in-process research

and development and begin amortization. In 2009, Prevnar/Prevenar 13 Infant received regulatory approval in a major market, and

as a result, we reclassified the asset from IPR&D to Developed Technology Rights and began to amortize the asset.

If the associated research and development effort is abandoned, the related IPR&D assets will likely be written off and we will record

an impairment loss in our consolidated statements of income.

74 2009 Financial Report