Pfizer 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

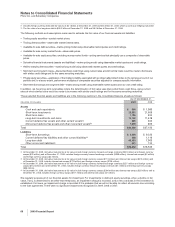

A one-percentage-point increase or decrease in the healthcare cost trend rate assumed for postretirement benefits would have the

following effects as of December 31, 2009:

(MILLIONS OF DOLLARS) INCREASE DECREASE

Effect on total service and interest cost components $ 16 $ (14)

Effect on postretirement benefit obligation 360 (307)

C. Obligations and Funded Status

The following table presents an analysis of the changes in 2009 and 2008 in the benefit obligations, plan assets and accounting

funded status of our U.S. qualified, U.S. supplemental (non-qualified) and international pension plans and our postretirement plans:

YEAR ENDED DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED

U.S. SUPPLEMENTAL

(NON-QUALIFIED) INTERNATIONAL

POSTRETIREMENT

PLANS

(MILLIONS OF DOLLARS) 2009 2008 2009 2008 2009 2008 2009 2008

Change in benefit obligation:

Benefit obligation at beginning of year $ 7,783 $ 7,456 $ 876 $ 973 $ 5,851 $ 7,839 $ 1,966 $ 2,178

Service cost 252 236 24 23 188 249 39 39

Interest cost 526 459 53 38 342 388 145 141

Employee contributions ————12 21 49 39

Plan amendments (1) (6) —(1) (2) 18 (151) (33)

Increases/(decreases) arising primarily

from changes in actuarial assumptions 9172 33 102 1,136 (1,005) 108 (221)

Foreign exchange impact ————844 (1,234) 10 (11)

Acquisitions(a) 4,785 —364 —1,062 71,798 —

Curtailments (196) (48) (29) (6) (25) (74) (26) 11

Settlements (325) (212) (32) (202) (53) (58) ——

Special termination benefits 61 30 137 —825 24 17

Benefits paid (316) (304) (58) (51) (301) (325) (229) (194)

Benefit obligation at end of year(a),(b) 12,578 7,783 1,368 876 9,062 5,851 3,733 1,966

Change in plan assets:

Fair value of plan assets at beginning of

year 5,897 7,989 ——4,394 6,579 303 413

Actual gain/(loss) on plan assets 800 (1,576) ——646 (1,249) 67 (107)

Company contributions 2—90 253 448 471 180 152

Employee contributions ————12 21 49 39

Foreign exchange impact ————574 (1,048) ——

Acquisitions(a) 3,919 ———804 3——

Settlements (325) (212) (32) (202) (53) (58) ——

Benefits paid (316) (304) (58) (51) (301) (325) (229) (194)

Fair value of plan assets at end of year(a) 9,977 5,897 ——6,524 4,394 370 303

Funded status (plan assets less than the

benefit obligation) at end of year(a) $ (2,601) $(1,886) $(1,368) $(876) $(2,538) $(1,457) $(3,363) $(1,663)

(a) Increase in 2009 primarily due to acquisition of Wyeth (see Note 2. Acquisition for Wyeth, for additional information).

(b) For the U.S. and international pension plans, the benefit obligation is the projected benefit obligation. For the postretirement plans, the benefit

obligation is the accumulated postretirement benefit obligation.

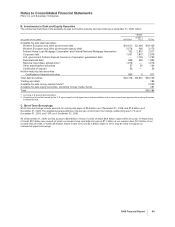

The unfavorable change in our U.S. qualified plans’ projected benefit obligations funded status from $1.9 billion underfunded in the

aggregate as of December 31, 2008, to $2.6 billion underfunded in the aggregate as of December 31, 2009, was largely driven by

the acquisition of the Wyeth U.S. qualified pension plans and the 0.1 percentage-point reduction in discount rate, which was partially

offset by the increase in plan assets due to investment gains earned from the securities market recovery during 2009. In 2009,

contributions to our U.S. qualified plans were $2 million. In 2008, contributions to our U.S. qualified plans were not significant. In the

aggregate, the U.S. qualified pension plans are underfunded on a projected benefit measurement basis and on an accumulated

benefit obligation measurement basis as of December 31, 2009 and 2008.

The unfavorable change in our U.S. supplemental (non-qualified) pension plans’ projected benefit obligations funded status from $876

million underfunded in the aggregate as of December 31, 2008 to $1.4 billion underfunded in the aggregate as of December 31, 2009,

was largely driven by the acquisition of the Wyeth U.S. supplemental (non-qualified) pension plans and recognition of special

termination benefits for certain executives as part of Wyeth-related restructuring initiatives. The U.S. supplemental (non-qualified)

pension plans are not generally funded, as there is no tax or other incentives that exist, and these obligations, which are substantially

greater than the annual cash outlay for these liabilities, are paid from cash generated from operations.

78 2009 Financial Report