Pfizer 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

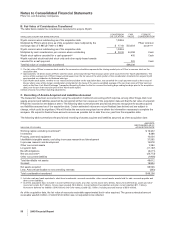

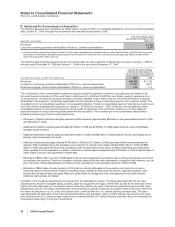

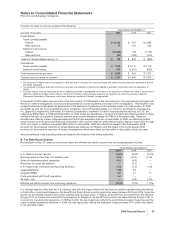

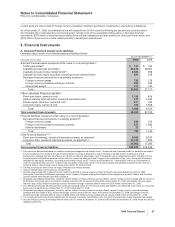

Provision for taxes on income consists of the following:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2009 2008 2007

United States:

Taxes currently payable:

Federal $ 10,169 $ 707 $ 1,393

State and local 71 154 243

Deferred income taxes:

Federal (10,002) 106 (1,774)

State and local (93) (136) (212)

Total U.S. tax (benefit)/provision(a), (b) $ 145 $ 831 $ (350)

International:

Taxes currently payable $ 1,539 $ 2,115 $ 2,175

Deferred income taxes 513 (1,301) (802)

Total international tax provision $ 2,052 $ 814 $ 1,373

Total provision for taxes on income(c) $ 2,197 $ 1,645 $ 1,023

(a) The increase in Federal current tax payable in 2009 was due to increased tax costs associated with certain business decisions executed to finance

the Wyeth acquisition.

(b) The decrease in Federal deferred income taxes was due to a reduction of deferred tax liabilities recorded in connection with our acquisition of

Wyeth.

(c) Excludes federal, state and international net tax liabilities assumed or established on the date of the acquisition of Wyeth (see Note 2. Acquisition of

Wyeth for additional details) and $4 million in 2008 and $1 million in 2007 primarily related to the resolution of certain tax positions related to

Pharmacia Corporation (Pharmacia), which were debited or credited to Goodwill, as appropriate.

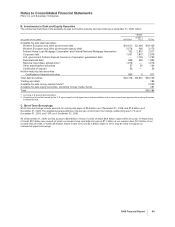

A tax benefit of $174 million was recorded in the third quarter of 2009 related to the final resolution of an agreement-in-principle with

the DOJ to settle investigations of past promotional practices concerning Bextra and certain other investigations. This resulted in the

receipt of information that raised our assessment of the likelihood of prevailing on the technical merits of our tax position. In 2009

and 2008, we sold two of our biopharmaceutical companies, Vicuron Pharmaceuticals, Inc. (Vicuron) and Esperion Therapeutics,

Inc. (Esperion), respectively. Both sales, for nominal consideration, resulted in a loss for tax purposes that reduced our U.S. tax

expense by $556 million in 2009 and $426 million in 2008. These tax benefits are a result of the significant initial investment in these

entities at the time of acquisition, primarily reported as an income statement charge for IPR&D at acquisition date. These tax

benefits were offset by certain costs associated with the Wyeth acquisition that are not deductible. In 2008, we effectively settled

certain issues common among multinational corporations with various foreign tax authorities primarily relating to years 2000 through

2005. As a result, in 2008 we recognized $305 million in tax benefits. 2008 also reflects the impact of the third-quarter 2008

provision for the proposed resolution of certain Bextra and Celebrex civil litigation and the impact of the fourth-quarter 2008

provision for the proposed resolution of certain investigations, which were either not deductible or deductible at lower tax rates.

Amounts reflected in the preceding tables are based on the location of the taxing authorities.

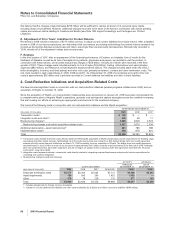

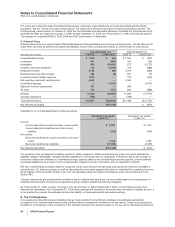

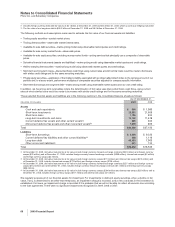

B. Tax Rate Reconciliation

Reconciliation of the U.S. statutory income tax rate to our effective tax rate for income from continuing operations follows:

YEAR ENDED DECEMBER 31,

2009 2008 2007

U.S. statutory income tax rate 35.0% 35.0% 35.0%

Earnings taxed at other than U.S. statutory rate (9.3) (20.2) (21.6)

Sales of biopharmaceutical companies (5.1) (4.3) —

Resolution of certain tax positions —(3.1) —

U.S. research tax credit and manufacturing deduction (1.3) (1.2) (1.5)

Legal settlements (1.6) 9.0 —

Acquired IPR&D 0.2 2.1 1.1

Costs associated with Wyeth acquisition 2.4 ——

All other—net —(0.3) (2.0)

Effective tax rate for income from continuing operations 20.3% 17.0% 11.0%

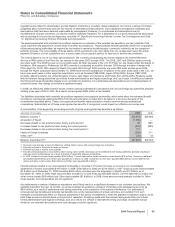

For earnings taxed at other than the U.S. statutory rate, this rate impact reflects the fact that we operate manufacturing subsidiaries

in Puerto Rico, Ireland and Singapore. We benefit from Puerto Rican incentive grants that expire between 2013 and 2029. Under the

grants, we are partially exempt from income, property and municipal taxes. In Ireland, we benefit from an incentive tax rate effective

through 2010 on income from manufacturing operations. In Singapore, we benefit from incentive tax rates effective through 2031 on

income from manufacturing operations. In 2008 and 2009, the rate impact also reflects the jurisdictional location of earnings and the

costs of certain repatriation decisions. In 2008, the rate impact also reflects the realization of approximately $711 million (tax effect)

in net operating losses.

2009 Financial Report 63