Pfizer 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

Our financial instrument holdings at year-end were analyzed to determine their sensitivity to foreign exchange rate changes. The fair

values of these instruments were determined using various methodologies. For additional details, see Notes to Consolidated

Financial Statements—Note 9A. Financial Instruments: Selected Financial Assets and Liabilities. In this sensitivity analysis, we

assumed that the change in one currency’s rate relative to the U.S. dollar would not have an effect on other currencies’ rates relative

to the U.S. dollar; all other factors were held constant.

If the dollar were to devalue against all other currencies by 10%, the expected adverse impact on net income related to our financial

instruments would be immaterial. For additional details, see Notes to Consolidated Financial Statements—Note 9E. Financial

Instruments: Derivative Financial Instruments and Hedging Activities.

Interest Rate Risk—Our U.S. dollar interest-bearing investments, loans and borrowings are subject to interest rate risk. We also are

subject to interest rate risk on euro debt, investments and currency swaps, U.K. debt and currency swaps, Japanese yen short and

long-term borrowings and currency swaps, and, prior to 2009, Swedish krona currency swaps. We seek to invest, loan and borrow

primarily on a short-term or variable-rate basis. From time to time, depending on market conditions, we will fix interest rates either

through entering into fixed-rate investments and borrowings or through the use of derivative financial instruments such as interest

rate swaps. In light of current market conditions, our current borrowings are primarily on a long-term, fixed-rate basis. We may

change this practice as market conditions change.

Our financial instrument holdings at year-end were analyzed to determine their sensitivity to interest rate changes. The fair values of

these instruments were determined using various methodologies. For additional details, see Notes to Consolidated Financial

Statements—Note 9A. Financial Instruments: Selected Financial Assets and Liabilities. In this sensitivity analysis, we used a one

hundred basis point parallel shift in the interest rate curve for all maturities and for all instruments; all other factors were held

constant. If there were a one hundred basis point decrease in interest rates, the expected adverse impact on net income related to

our financial instruments would be immaterial.

Legal Proceedings and Contingencies

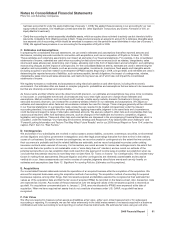

We and certain of our subsidiaries are involved in various patent, product liability, consumer, commercial, securities, environmental

and tax litigations and claims; government investigations; and other legal proceedings that arise from time to time in the ordinary

course of our business. We do not believe any of them will have a material adverse effect on our financial position (see Notes to

Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies).

We record accruals for income tax contingencies to the extent that we conclude that a tax position is not sustainable under a “more

likely than not” standard and we record our estimate of the potential tax benefits in one tax jurisdiction that could result from the

payment of income taxes in another tax jurisdiction when we conclude that the potential recovery is more likely than not (see Notes

to Consolidated Financial Statements—Note 1P. Significant Accounting Policies: Income Tax Contingencies). We record accruals

for all other contingencies to the extent that we conclude their occurrence is probable and the related damages are estimable, and

we record anticipated recoveries under existing insurance contracts when assured of recovery. If a range of liability is probable and

estimable and some amount within the range appears to be a better estimate than any other amount within the range, we accrue

that amount. If a range of liability is probable and estimable and no amount within the range appears to be a better estimate than

any other amount within the range, we accrue the minimum of such probable range. Many claims involve highly complex issues

relating to causation, label warnings, scientific evidence, actual damages and other matters. Often these issues are subject to

substantial uncertainties and, therefore, the probability of loss and an estimation of damages are difficult to ascertain. Consequently,

we cannot reasonably estimate the maximum potential exposure or the range of possible loss in excess of amounts accrued for

these contingencies. These assessments can involve a series of complex judgments about future events and can rely heavily on

estimates and assumptions (see Notes to Consolidated Financial Statements—Note 1C. Significant Accounting Policies: Estimates

and Assumptions). Our assessments are based on estimates and assumptions that have been deemed reasonable by

management. Litigation is inherently unpredictable, and excessive verdicts do occur. Although we believe we have substantial

defenses in these matters, we could in the future incur judgments or enter into settlements of claims that could have a material

adverse effect on our results of operations in any particular period.

Patent claims include challenges to the coverage and/or validity of our patents on various products or processes. Although we

believe we have substantial defenses to these challenges with respect to all our material patents, there can be no assurance as to

the outcome of these matters, and a loss in any of these cases could result in a loss of patent protection for the drug at issue, which

could lead to a significant loss of sales of that drug and could materially affect future results of operations.

2009 Financial Report 41