Pfizer 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

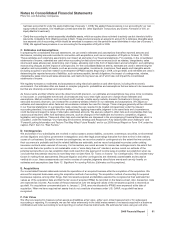

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

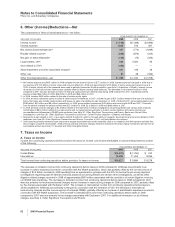

In the ordinary course of business, Wyeth incurs liabilities for environmental, legal and tax matters, as well as guarantees and

indemnifications. These matters can include contingencies. Except as specifically excluded by the relevant accounting standard,

contingencies are required to be measured at fair value as of the acquisition date, if the acquisition-date fair value of the asset or

liability arising from a contingency can be determined. If the acquisition-date fair value of the asset or liability cannot be determined,

the asset or liability would be recognized at the acquisition date if both of the following criteria were met: (i) it is probable that an

asset existed or that a liability had been incurred at the acquisition date, and (ii) the amount of the asset or liability can be

reasonably estimated.

•Environmental Matters—In the ordinary course of business, Wyeth incurs liabilities for environmental matters such as remediation work,

asset retirement obligations and environmental guarantees and indemnifications. Virtually all liabilities for environmental matters,

including contingencies, have been measured at fair value and approximate $550 million as of the acquisition date.

•Legal Matters—Wyeth is involved in various legal proceedings, including product liability, patent, commercial, environmental, antitrust

matters and government investigations, of a nature considered normal to its business (see Note 19. Legal Proceedings and

Contingencies). Due to the uncertainty of the variables and assumptions involved in assessing the possible outcomes of events related

to these items, an estimate of fair value is not determinable. As such, these contingencies have been measured under the same

“probable and estimable” standard previously used by Wyeth. Liabilities for legal contingencies approximate $650 million as of the

acquisition date, which includes the recording of additional adjustments of approximately $150 million for legal matters that we intend to

resolve in a manner different from what Wyeth had planned or intended. See below for items pending finalization.

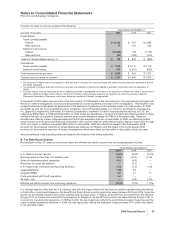

•Tax Matters—In the ordinary course of business, Wyeth incurs liabilities for income taxes. Income taxes are exceptions to both the

recognition and fair value measurement principles associated with the accounting for business combinations. Reserves for income tax

contingencies continue to be measured under the benefit recognition model as previously used by Wyeth (see Note 1P. Significant

Accounting Policies: Income Tax Contingencies). Net liabilities for income taxes approximate $24.8 billion as of the acquisition date,

which includes $1.8 billion for uncertain tax positions. The net tax liability includes the recording of additional adjustments of

approximately $15.0 billion for the tax impact of fair value adjustments and $10.6 billion for income tax matters that we intend to resolve

in a manner different from what Wyeth had planned or intended. For example, because we plan to repatriate certain overseas funds,

we provided deferred taxes on Wyeth’s unremitted earnings, as well as on certain book/tax basis differentials related to investments in

certain foreign subsidiaries for which no taxes have been previously provided by Wyeth as it was Wyeth’s intention to permanently

reinvest those earnings and investments. See below for items pending finalization.

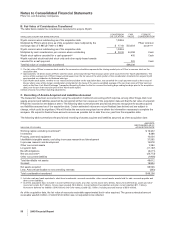

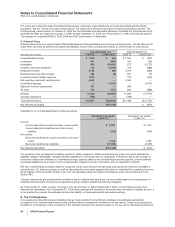

Goodwill is calculated as the excess of the consideration transferred over the net assets recognized and represents the future

economic benefits arising from other assets acquired that could not be individually identified and separately recognized. Specifically,

the goodwill recorded as part of the acquisition of Wyeth includes the following:

•the expected synergies and other benefits that we believe will result from combining the operations of Wyeth with the operations of

Pfizer,

•any intangible assets that do not qualify for separate recognition, as well as future, as yet unidentified projects and products, and

•the value of the going-concern element of Wyeth’s existing businesses (the higher rate of return on the assembled collection of net

assets versus if Pfizer had acquired all of the net assets separately).

Goodwill is not amortized and is not deductible for tax purposes. While the allocation of goodwill among reporting units is not

complete, we expect the majority of the goodwill will be related to our Biopharmaceutical segment (see Note 12. Goodwill and Other

Intangible Assets for additional information).

The recorded amounts are provisional and subject to change. The following items still are subject to change:

•Amounts for intangibles, inventory and PP&E, pending finalization of valuation efforts for acquired intangible assets as well as the

completion of certain physical inventory counts and the confirmation of the physical existence and condition of certain property, plant

and equipment assets.

•Amounts for legal contingencies, pending the finalization of our examination and valuation of the portfolio of filed cases.

•Amounts for income tax assets, receivables and liabilities pending the filing of Wyeth pre-acquisition tax returns and the receipt of

information from taxing authorities which may change certain estimates and assumptions used.

•The allocation of goodwill among reporting units.

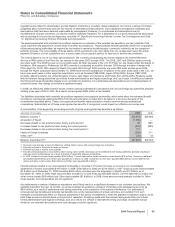

A single estimate of fair value results from a complex series of judgments about future events and uncertainties and relies heavily on

estimates and assumptions. Our judgments used to determine the estimated fair value assigned to each class of assets acquired

and liabilities assumed, as well as asset lives, can materially impact our results of operations.

2009 Financial Report 57