Pfizer 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

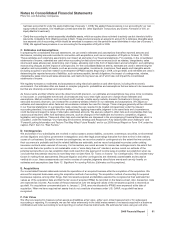

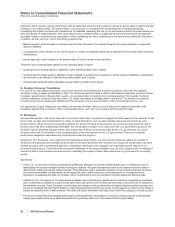

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

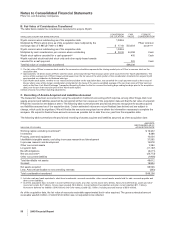

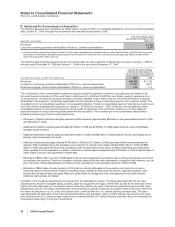

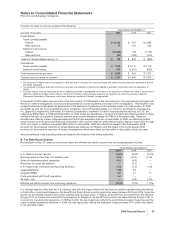

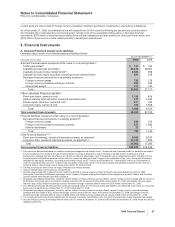

D. Actual and Pro Forma Impact of Acquisition

The following table presents information for Wyeth that is included in Pfizer’s consolidated statements of income from the acquisition

date, October 15, 2009, through Pfizer’s domestic and international year-ends in 2009:

(MILLIONS OF DOLLARS)

WYETH’S OPERATIONS

INCLUDED IN PFIZER’S 2009

RESULTS

Revenues $ 3,303

Loss from continuing operations attributable to Pfizer Inc. common shareholders(a) (2,191)

(a) Includes purchase accounting charges related to the fair value adjustments for acquisition-date inventory that has been sold ($904 million pre-tax),

amortization of identifiable intangible assets acquired from Wyeth ($512 million pre-tax), and restructuring charges and additional depreciation—

asset restructuring ($2.1 billion pre-tax).

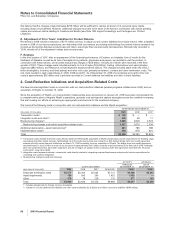

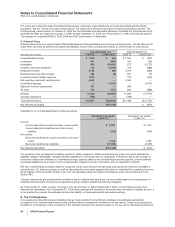

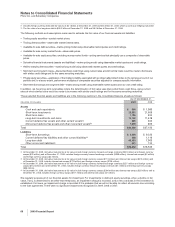

The following table presents supplemental pro forma information as if the acquisition of Wyeth had occurred on January 1, 2009 for

the year ended December 31, 2009 and January 1, 2008 for the year ended December 31, 2008:

UNAUDITED PRO FORMA

CONSOLIDATED RESULTS

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS, EXCEPT PER SHARE DATA) 2009 2008

Revenues $68,599 $71,130

Income from continuing operations attributable to Pfizer Inc. common shareholders 11,537 8,917

Diluted earnings per common share attributable to Pfizer Inc. common shareholders 1.43 1.11

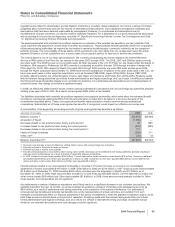

The unaudited pro forma consolidated results were prepared using the acquisition method of accounting and are based on the

historical financial information of Pfizer and Wyeth, reflecting both in 2009 and 2008 Pfizer and Wyeth results of operations for a

12-month period. The historical financial information has been adjusted to give effect to the pro forma events that are: (i) directly

attributable to the acquisition, (ii) factually supportable and (iii) expected to have a continuing impact on the combined results. The

unaudited pro forma consolidated results are not necessarily indicative of what our consolidated results of operations actually would

have been had we completed the acquisition on January 1, 2009 and on January 1, 2008. In addition, the unaudited pro forma

consolidated results do not purport to project the future results of operations of the combined company nor do they reflect the

expected realization of any cost savings associated with the acquisition. The unaudited pro forma consolidated results reflect

primarily the following pro forma pre-tax adjustments:

•Elimination of Wyeth’s historical intangible asset amortization expense (approximately $88 million in the pre-acquisition period in 2009

and $79 million in 2008).

•Additional amortization expense (approximately $2.4 billion in 2009 and $2.9 billion in 2008) related to the fair value of identifiable

intangible assets acquired.

•Additional depreciation expense (approximately $200 million in 2009 and $266 million in 2008) related to the fair value adjustment to

property, plant and equipment acquired.

•Additional interest expense (approximately $316 million in 2009 and $1.2 billion in 2008) associated with the incremental debt we

issued in 2009 to partially finance the acquisition and a reduction of interest income (approximately $320 million in 2009 and $857

million in 2008) associated with short-term investments under the assumption that a portion of these investments would have been

used to partially fund the acquisition. In addition, a reduction in interest expense (approximately $129 million in 2009 and $163 million in

2008) related to the fair value adjustment of Wyeth debt.

•Elimination of $904 million incurred in 2009 related to the fair value adjustments to acquisition-date inventory that has been sold, which

is considered non-recurring. There is no long-term continuing impact of the fair value adjustments to acquisition-date inventory, and, as

such, the impact of those adjustments is not reflected in the unaudited pro forma operating results for 2009 and 2008.

•Elimination of $834 million of costs incurred in 2009, which are directly attributable to the acquisition, and which do not have a

continuing impact on the combined company’s operating results. Included in these costs are advisory, legal and regulatory costs

incurred by both legacy Pfizer and legacy Wyeth and costs related to a bridge term loan credit agreement with certain financial

institutions that has been terminated.

In addition, all of the above adjustments were adjusted for the applicable tax impact. The taxes associated with the fair value

adjustments for acquired intangible assets, property, plant and equipment and legacy Wyeth debt, as well as the elimination of the

impact of the fair value step-up of acquired inventory reflect the statutory tax rates in the various jurisdictions where the fair value

adjustments occurred. The taxes associated with incremental debt to partially finance the acquisition reflect a 38.3% tax rate since

the debt is an obligation of a U.S. entity and is taxed at the combined effective U.S. federal statutory and state rate. The taxes

associated with the elimination of the costs directly attributable to the acquisition reflect a 28.4% effective tax rate since the costs

were incurred in the U.S. and were either taxed at the combined effective U.S. federal statutory and state rate or not deductible for

tax purposes depending on the type of expenditure.

58 2009 Financial Report