Pfizer 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

The unfavorable change in our international plans’ projected benefit obligations funded status from $1.5 billion underfunded in the

aggregate as of December 31, 2008, to $2.5 billion underfunded in the aggregate as of December 31, 2009, was largely driven by

the acquisition of the Wyeth international pension plans, a 0.4 percentage-point increase in the average rate of compensation

increases and weakening of the U.S. dollar against the U.K. pound, euro and Japanese yen, somewhat offset by the increase in

plan assets due to investment gains earned from the securities market recovery during 2009. Outside the U.S., in general, we fund

our defined benefit plans to the extent that tax or other incentives exist and we have accrued liabilities on our consolidated balance

sheet to reflect those plans that are not fully funded.

The unfavorable change in our postretirement plans’ accumulated benefit obligations (ABO) funded status from $1.7 billion

underfunded in the aggregate as of December 31, 2008, to $3.4 billion underfunded in the aggregate as of December 31, 2009, was

largely driven by the acquisition of the Wyeth postretirement plans.

The ABO for all of our U.S. qualified pension plans were $11.4 billion in 2009 and $7.0 billion in 2008. The ABO for our U.S.

supplemental (non-qualified) pension plans was $1.2 billion in 2009 and $762 million in 2008. The ABO for our international pension

plans was $8.0 billion in 2009 and $5.3 billion in 2008.

The U.S. qualified pension plans loan securities to other companies. Such securities may be onward loaned, sold or pledged by the

other companies, but they may be required to be returned in a short period of time. We also require cash collateral from these

companies and a maintenance margin of 103% of the fair value of the collateral relative to the fair value of the loaned securities. As

of December 31, 2009, the fair value of collateral received was $722 million and as of December 31, 2008, the fair value of collateral

received was $572 million. The securities loaned continue to be included in the table above in Fair value of plan assets at end of

year.

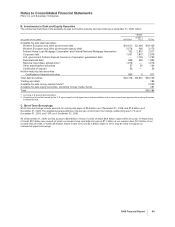

Amounts recognized in our consolidated balance sheet follow:

AS OF DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED

U.S. SUPPLEMENTAL

(NON-QUALIFIED) INTERNATIONAL

POSTRETIREMENT

PLANS

(MILLIONS OF DOLLARS) 2009 2008 2009 2008 2009 2008 2009 2008

Noncurrent assets(a) $—$— $— $— $ 146 $ 160 $— $—

Current liabilities(b) ——(203) (107) (58) (37) (120) (59)

Noncurrent liabilities(c) (2,601) (1,886) (1,165) (769) (2,626) (1,580) (3,243) (1,604)

Funded status $(2,601) $(1,886) $(1,368) $(876) $(2,538) $(1,457) $(3,363) $(1,663)

(a) Included primarily in Noncurrent deferred tax assets and other noncurrent assets.

(b) Included in Current deferred tax liabilities and other current liabilities.

(c) Included in Pension benefit obligations and Postretirement benefit obligations, as appropriate.

Amounts recognized in Accumulated other comprehensive income/(expense) follow:

AS OF DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED

U.S. SUPPLEMENTAL

(NON-QUALIFIED) INTERNATIONAL

POSTRETIREMENT

PLANS

(MILLIONS OF DOLLARS) 2009 2008 2009 2008 2009 2008 2009 2008

Actuarial losses $(2,391) $(3,173) $(405) $(433) $(2,231) $(1,231) $(226) $(204)

Prior service (costs)/credits

and other 15 14 18 23 (23) (23) 173 29

Total $(2,376) $(3,159) $(387) $(410) $(2,254) $(1,254) $ (53) $(175)

The actuarial losses primarily represent the cumulative difference between the actuarial assumptions and actual return on plan

assets, changes in discount rates and plan experience. These actuarial losses are recognized in Accumulated other comprehensive

income/(expense) and are amortized into net periodic pension costs over an average period of 10.6 years for our U.S. qualified

plans, an average period of 9.8 years for our U.S. supplemental (non-qualified) plans and an average period of 14.6 years for our

international plans.

2009 Financial Report 79