Pfizer 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

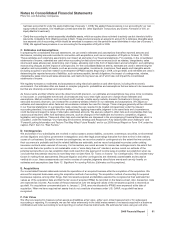

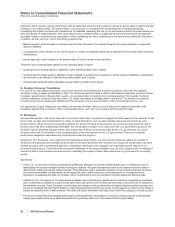

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

1. Significant Accounting Policies

A. Consolidation and Basis of Presentation

The consolidated financial statements include our parent company and all subsidiaries, including those operating outside the United

States (U.S.) and are prepared in accordance with accounting principles generally accepted in the United States of America (U.S.

GAAP). The decision whether or not to consolidate an entity requires consideration of majority voting interests, as well as effective

economic or other control over the entity. Typically, we do not seek control by means other than voting interests and we do not have

significant interests in non-consolidated entities. For subsidiaries operating outside the U.S., the financial information is included as

of and for the year ended November 30 for each year presented. Substantially all unremitted earnings of international subsidiaries

are free of legal and contractual restrictions. All significant transactions among our businesses have been eliminated. We made

certain reclassifications to prior-period amounts to conform to the December 31, 2009 presentations related to the presentation of

noncontrolling interests as a result of adopting a new accounting standard. Subsequent events have been evaluated through the

time of our filing on February 26, 2010.

On October 15, 2009, we completed our acquisition of Wyeth in a cash-and-stock transaction valued at approximately $68 billion.

Commencing from the acquisition date, our financial statements reflect the assets, liabilities and operating results of Wyeth. In

accordance with our domestic and international fiscal year-ends, approximately two-and-a-half months of the fourth calendar quarter

of 2009 in the case of Wyeth’s U.S. operations and approximately one-and-a-half months of the fourth calendar quarter of 2009 in

the case of Wyeth’s international operations are included in our consolidated financial statements for the year ended December 31,

2009. For additional information, see Note 2. Acquisition of Wyeth.

B. New Accounting Standards

As of January 1, 2009, we adopted a new accounting standard that retains the purchase method of accounting for acquisitions but

requires a number of changes to that method, including changes in the way assets and liabilities are recognized in purchase

accounting. Specifically, they require the capitalization of in-process research and development costs at fair value and require the

expensing of transaction costs as incurred. The adoption of these provisions did not have a significant impact on our consolidated

financial statements upon adoption, but they did significantly impact our accounting for the acquisition of Wyeth in 2009. For

additional information, see Note 2. Acquisition of Wyeth.

As of January 1, 2009, we adopted a new accounting standard that provides guidance for the accounting, reporting and disclosure

of noncontrolling interests, previously referred to as minority interests. A noncontrolling interest represents the portion of equity (net

assets) in a subsidiary not attributable, directly or indirectly, to a parent. The adoption of these provisions resulted in a number of

changes to the presentation of our consolidated financial statements, but the amounts associated with noncontrolling interests are

not significant.

In addition, throughout 2009, we adopted several other new accounting standards, none of which had a significant impact on our

consolidated financial statements upon adoption. Among other things, these standards:

•Require us to deconsolidate a subsidiary when we cease to have a controlling financial interest in the subsidiary and to recognize a

gain or loss on the transaction and measure any retained investment in the subsidiary at fair value (as of September 28, 2009).

•Provide qualifying criteria and guidance on using the net asset value per share provided by the investee to measure the fair value of

alternative investments (as of September 28, 2009).

•Provide additional guidance on measuring the fair value of liabilities in the absence of observable market information, transfer

restrictions and non-performance risk assessment (as of July 1, 2009).

•Amend the guidance for evaluating and measuring “other-than-temporary” impairments for available-for-sale or held-to-maturity debt

securities (as of March 30, 2009).

•Provide additional guidance for estimating fair value in inactive markets and the identification of disorderly transactions (as of March 30,

2009).

•Expand the use of fair value and related disclosure requirements and specify a hierarchy of valuation techniques used to develop the

fair value measures (as of January 1, 2009). We applied these provisions in our accounting for the acquisition of Wyeth in 2009.

•Provide guidance on the accounting for collaborative arrangements, as defined, such as: how costs incurred and revenues generated

on sales to third parties should be reported in the income statement; how an entity should characterize payments on the income

statement; and what participants should disclose in the notes to the financial statements about a collaborative arrangement (as of

January 1, 2009). We provided additional disclosures in Note 5. Collaborative Arrangements.

•Clarify how to account for certain transactions involving equity method investments in areas such as: how to determine the initial

carrying value of the investment; how to allocate the difference between the investor’s carrying value and the investor’s share of the

underlying equity of the investment; how to perform an impairment assessment of underlying intangibles held by the investee; how to

account for the investee’s issuance of additional shares; and how to account for an investment on the cost method when it previously

50 2009 Financial Report