Pfizer 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

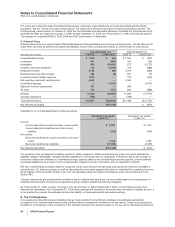

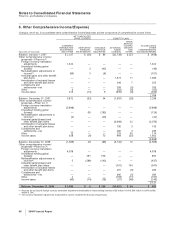

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

Income taxes are not provided for foreign currency translation relating to permanent investments in international subsidiaries.

As of December 31, 2009, we estimate that we will reclassify into 2010 income the following pre-tax amounts currently held in

Accumulated other comprehensive income/(expense): virtually none of the unrealized holding gains on derivative financial

instruments; $253 million of actuarial losses related to benefit plan obligations and plan assets and other benefit plan items; and

$(22) million of prior service credits related primarily to benefit plan amendments.

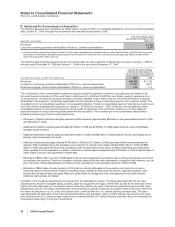

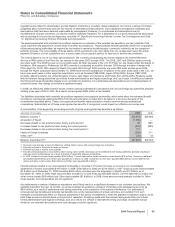

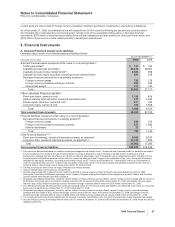

9. Financial Instruments

A. Selected Financial Assets and Liabilities

Information about certain of our financial assets and liabilities follows:

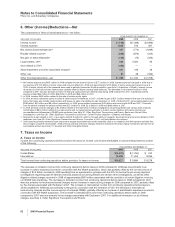

AS OF DECEMBER 31,

(MILLIONS OF DOLLARS) 2009 2008

Selected financial assets measured at fair value on a recurring basis(a):

Trading securities(b) $ 184 $ 190

Available-for-sale debt securities(c) 32,338 30,061

Available-for-sale money market funds(d) 2,569 398

Available-for-sale equity securities, excluding money market funds(c) 281 319

Derivative financial instruments in receivable positions(e):

Foreign currency swaps 798 128

Foreign currency forward-exchange contracts 502 399

Interest rate swaps 276 732

Total 36,948 32,227

Other selected financial assets(f):

Short-term loans, carried at cost 1,195 824

Held-to-maturity debt securities, carried at amortized cost(c) 812 2,349

Private equity securities, carried at cost 811 182

Long-term loans, carried at cost 784 1,568

Total 3,602 4,923

Total selected financial assets 40,550 37,150

Financial liabilities measured at fair value on a recurring basis(a):

Derivative financial instruments in a liability position(g):

Foreign currency swaps 528 153

Foreign currency forward-exchange contracts 237 1,083

Interest rate swaps 25 7

Total 790 1,243

Other financial liabilities(f), (h):

Short-term borrowings, carried at historical proceeds, as adjusted(i) 5,469 9,320

Long-term debt, carried at historical proceeds, as adjusted(j), (k) 43,193 7,963

Total 48,662 17,283

Total selected financial liabilities $49,452 $18,526

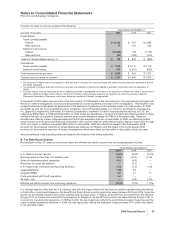

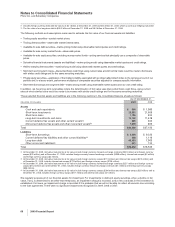

(a) Fair values are determined based on valuation techniques categorized as follows: Level 1 means the use of quoted prices for identical instruments

in active markets; Level 2 means the use of quoted prices for similar instruments in active markets or quoted prices for identical or similar

instruments in markets that are not active or are directly or indirectly observable; Level 3 means the use of unobservable inputs. Virtually all of our

financial assets and liabilities measured at fair value on a recurring basis use Level 2 inputs in the calculation of fair value, except that included in

available-for-sale equity securities, excluding money market funds, are $77 million as of December 31, 2009 and $87 million as of December 31,

2008 of investments that use Level 1 inputs in the calculation of fair value. None of our financial assets and liabilities measured at fair value on a

recurring basis is valued using Level 3 inputs at December 31, 2009 or 2008.

(b) Trading securities are held in trust for legacy Pharmacia severance benefits.

(c) Gross unrealized gains and losses are not significant.

(d) Includes approximately $1.2 billion of money market funds held in escrow to secure certain of Wyeth’s payment obligations under its 1999

Nationwide Class Action Settlement Agreement, which relates to litigation alleging that Wyeth’s former weight-loss products, Redux and Pondimin,

caused valvular heart disease and other conditions.

(e) Designated as hedging instruments, except for certain foreign currency contracts used as offsets; namely, foreign currency swaps with fair values of

$106 million and foreign currency forward-exchange contracts with fair values of $100 million at December 31, 2009; and foreign currency swaps

with fair values of $32 million and foreign currency forward-exchange contracts with fair values of $175 million at December 31, 2008.

(f) The differences between the estimated fair values and carrying values of our financial assets and liabilities not measured at fair value on a recurring

basis were not significant as of December 31, 2009 or December 31, 2008.

(g) Designated as hedging instruments, except for certain foreign currency contracts used as offsets, namely, foreign currency forward-exchange

contracts with fair values of $122 million and foreign currency swaps with fair values of $3 million at December 31, 2009; and foreign currency

forward-exchange contracts with fair values of $836 million and foreign currency swaps with fair values of $76 million at December 31, 2008.

(h) The carrying amounts may include adjustments for discount or premium amortization or for the effect of interest rate swaps designated as hedges.

(i) Includes foreign currency borrowings with fair values of $1.1 billion at December 31, 2009 and $1.6 billion at December 31, 2008, which are used as

hedging instruments.

2009 Financial Report 67