Pfizer 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

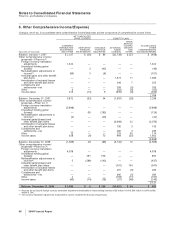

A. Components of Net Periodic Benefit Costs and Other Amounts Recognized in Other Comprehensive

(Income)/Expense

The annual cost and other amounts recognized in other comprehensive (income)/expense of the U.S. qualified, U.S. supplemental

(non-qualified) and international pension plans and postretirement plans follow:

YEAR ENDED DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED

U.S. SUPPLEMENTAL

(NON-QUALIFIED) INTERNATIONAL

POSTRETIREMENT

PLANS

(MILLIONS OF DOLLARS) 2009 2008 2007 2009 2008 2007 2009 2008 2007 2009 2008 2007

Service cost $ 252 $ 236 $ 282 $24 $23 $ 27 $ 188 $ 249 $ 292 $39 $39 $42

Interest cost 526 459 447 53 38 55 342 388 349 145 141 137

Expected return on

plan assets (527) (646) (693) ———(375) (437) (381) (26) (35) (36)

Amortization of:

Actuarial losses 212 32 65 31 29 45 30 43 96 18 28 42

Prior service

costs/(credits) 238(2) (2) (2) (3) 1— (3) 11

Curtailments and

settlements—net 110 32 58 (2) 120 5 43 (155) (3) 10 5

Special termination

benefits 61 30 16 137 —— 825 29 24 17 17

Less: Amounts

included in

discontinued

operations —— (27) ——— ——— ———

Net periodic benefit

costs 636 146 156 241 208 130 194 272 230 194 201 208

Other changes

recognized in

other

comprehensive

(income)/

expense(a) (783) 2,273 (582) (23) (52) (134) 806 415 (808) (122) (140) (311)

Total recognized in

net periodic

benefit costs and

other

comprehensive

(income)/expense $(147) $2,419 $(426) $218 $156 $ (4) $1,000 $ 687 $(578) $72 $ 61 $(103)

(a) For details, see Note 8. Other Comprehensive Income/(Expense).

The increase in the 2009 U.S. qualified pension plans’ net periodic benefit costs compared to 2008 was largely driven by the

securities market downturn during 2008 and by charges resulting from employee terminations associated with our cost-reduction

initiatives. The securities market downturn during 2008 contributed to a lower plan asset base and higher actuarial losses

recognized. The decrease in the 2008 U.S. qualified pension plans’ net periodic benefit costs compared to 2007 was largely driven

by the increase in the discount rate and the impact of our cost-reduction initiatives.

The increase in the 2009 U.S. supplemental (non-qualified) plans’ net periodic benefit costs compared to 2008 was largely driven by

the impact of special termination benefits recognized for certain executives as part of Wyeth-related restructuring initiatives. The

increase in the 2008 U.S. supplemental (non-qualified) plans’ net periodic benefit costs compared to 2007 was largely driven by

settlement charges recognized due to lump sum benefit payments made to certain former executives in 2008.

The decrease in the 2009 international plans’ net periodic benefit costs compared to 2008 was largely driven by an increase in

interest rates set at the beginning of the year and ongoing restructuring and certain acquisition-related activities, which was partially

offset by lower expected returns on plan assets. The increase in the 2008 international plans’ net periodic benefit costs compared to

2007 was attributable to a settlement gain of $106 million resulting from a transfer of pension obligations, along with the respective

plan assets, to the Japanese government in accordance with Japanese laws, which was partially offset by higher expected return on

plan assets during 2008.

76 2009 Financial Report