Pfizer 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

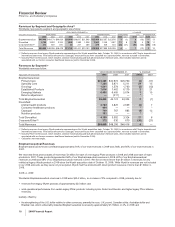

Financial Review

Pfizer Inc. and Subsidiary Companies

Contingencies

We and certain of our subsidiaries are involved in various patent, product liability, consumer, commercial, securities, environmental,

and tax litigations and claims; government investigations; and other legal proceedings that arise from time to time in the ordinary

course of our business. Except for income tax contingencies, we record accruals for contingencies to the extent that we conclude

their occurrence is probable and that the related liabilities are estimable, and we record anticipated recoveries under existing

insurance contracts when assured of recovery. For tax matters, we record accruals for income tax contingencies to the extent that

we conclude that a tax position is not sustainable under a “more-likely-than-not” standard and we record our estimate of the potential

tax benefits in one tax jurisdiction that could result from the payment of income taxes in another tax jurisdiction when we conclude

that the potential recovery is more likely than not (see Notes to Consolidated Financial Statements—Note 7D. Taxes on Income: Tax

Contingencies). We consider many factors in making these assessments. Because litigation and other contingencies are inherently

unpredictable and excessive verdicts do occur, these assessments can involve a series of complex judgments about future events

and can rely heavily on estimates and assumptions.

Acquisitions

Our consolidated financial statements include an acquired business’s operations after the completion of the acquisition. We account

for acquired businesses using the acquisition method of accounting. The acquisition method of accounting for acquired businesses

requires, among other things, that most assets acquired and liabilities assumed be recognized at their fair values as of the

acquisition date and that the fair value of acquired in-process research and development (IPR&D) be recorded on the balance sheet.

Also, transaction costs are expensed as incurred. Any excess of the purchase price over the assigned values of the net assets

acquired is recorded as goodwill. For acquisitions consummated prior to January 1, 2009, amounts allocated to acquired IPR&D

were expensed at the date of acquisition. When we have acquired net assets that do not constitute a business under accounting

principles generally accepted in the United States of America (U.S. GAAP), no goodwill has been recognized.

Fair Value

We often are required to measure certain assets and liabilities at fair value, either upon initial measurement or for subsequent

accounting or reporting. For example, we use fair value extensively in the initial measurement of net assets acquired in a business

combination and when accounting for and reporting on certain financial instruments. We estimate fair value using an exit price

approach, which requires, among other things, that we determine the price that would be received to sell an asset or paid to transfer

a liability in an orderly market. The determination of an exit price is considered from the perspective of market participants,

considering the highest and best use of assets and, for liabilities, assuming the risk of non-performance will be the same before and

after the transfer. Many, but not all, of our financial instruments are carried at fair value. In addition, as required under accounting

rules for business combinations, most of the assets acquired and liabilities assumed from Wyeth on October 15, 2009 have been

recorded at their estimated fair values as of the acquisition date. For additional information on the valuation approaches allowed

under U.S. GAAP to determine fair value, including a description of the inputs used, see Notes to Consolidated Financial

Statements—Note 1F. Significant Accounting Polices: Fair Value. Also, for information on the use of fair value for our financial

instruments, see Notes to Consolidated Financial Statements—Note 9. Financial Instruments.

Revenues

Revenue Recognition—We record revenues from product sales when the goods are shipped and title passes to the customer. At the

time of sale, we also record estimates for a variety of sales deductions, such as rebates, discounts and incentives, and product

returns. When we cannot reasonably estimate the amount of future product returns, we record revenues when the risk of product

return has been substantially eliminated. We record sales of certain of our vaccines to the U.S. government as part of the Pediatric

Vaccine Stockpile program; these rules require that for fixed commitments made by the U.S. government, we record revenues when

risk of ownership of the completed product has been passed to the U.S. government. There are no specific performance obligations

associated with products sold under this program.

Deductions from Revenues—As is typical in the biopharmaceutical industry, our gross product sales are subject to a variety of

deductions that generally are estimated and recorded in the same period that the revenues are recognized and primarily represent

rebates and discounts to government agencies, wholesalers, distributors and managed care organizations with respect to our

biopharmaceutical products. These deductions represent estimates of the related obligation and, as such, judgment and knowledge

of market conditions and practice are required when estimating the impact of these sales deductions on gross sales for a reporting

period.

Specifically,

•In the U.S., we record provisions for pharmaceutical Medicaid, Medicare and contract rebates based upon our experience ratio of

rebates paid and actual prescriptions written during prior quarters. We apply the experience ratio to the respective period’s sales to

determine the rebate accrual and related expense. This experience ratio is evaluated regularly to ensure that the historical trends are

as current as practicable. As appropriate, we will adjust the ratio to better match our current experience or our expected future

experience. In assessing this ratio, we consider current contract terms, such as changes in formulary status and discount rates. If our

ratio is not indicative of future experience, our results could be materially affected.

•Outside the U.S., the majority of our pharmaceutical rebates, discounts and price reductions are contractual or legislatively mandated,

and our estimates are based on actual invoiced sales within each period; both of these elements help to reduce the risk of variations in

the estimation process. Some European countries base their rebates on the government’s unbudgeted pharmaceutical spending, and

we use an estimated allocation factor (based on historical payments) and total revenues by country against our actual invoiced sales to

project the expected level of reimbursement. We obtain third-party information that helps us monitor the adequacy of these accruals. If

our estimates are not indicative of actual unbudgeted spending, our results could be materially affected.

•Provisions for pharmaceutical chargebacks (primarily reimbursements to wholesalers for honoring contracted prices to third parties)

closely approximate actual as we settle these deductions generally within two to five weeks of incurring the liability.

2009 Financial Report 9