Pfizer 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

We have exclusive rights to Enbrel outside the U.S. and Canada and co-promote Enbrel with Amgen Inc. (Amgen) in the U.S. and

Canada. Our co-promotion agreement with Amgen expires in October 2013, and we are entitled to a royalty stream for 36 months

thereafter, which is significantly less than our current share of Enbrel profits from U.S. and Canadian sales. Our rights to Enbrel

outside the U.S. and Canada will not be affected by the expiration of the co-promotion agreement.

•Prevnar/Prevenar 7 is our vaccine for preventing invasive pneumococcal disease in infants and young children.

•Our Premarin family of products remains the leading therapy to help women address moderate to severe menopausal symptoms.

•Zosyn/Tazocin, our broad-spectrum intravenous antibiotic. Zosyn/Tazocin faces generic competition in the U.S. and certain other

markets. Generic competition is expected to intensify in the U.S. after the expiration in March 2010 of the six months of generic

exclusivity granted to the first-to-file generic manufacturer.

See Notes to Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies for a discussion of certain

litigation relating to Zosyn.

•BeneFIX and ReFacto/Xyntha are our state-of-the-art hemophilia products that offer patients with this lifelong bleeding disorder the

potential for a near-normal life.

See Notes to Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies for a discussion of certain

patent litigation relating to ReFacto and Xyntha.

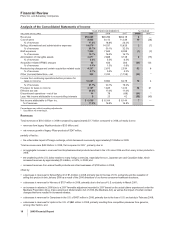

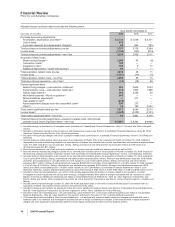

•Alliance revenues increased 30% in 2009 compared to 2008, due to the strong performance of Aricept, Spiriva and Rebif, as well as

the addition of sales of Enbrel, a legacy Wyeth product, in the U.S. and Canada.

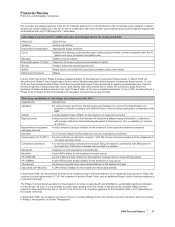

Product Developments

We continue to invest in R&D to provide potential future sources of revenues through the development of new products, as well as

through additional uses for existing in-line and alliance products, and we have taken important steps to prioritize our R&D portfolio to

maximize value. After a review in 2008 of all our therapeutic areas, we announced our decision to exit certain disease areas and

give higher priority to the following disease areas: oncology, pain, inflammation, Alzheimer’s disease, psychoses and diabetes. With

our acquisition of Wyeth, we also have added a focus on vaccines and biologics. While we continue to conduct research across a

broad range of diseases, approximately 70% of our research projects and 75% of our late-stage portfolio currently are focused on

our higher-priority areas. Notwithstanding our efforts, there are no assurances as to when, or if, we will receive regulatory approval

for additional indications for existing products or any of our other products in development.

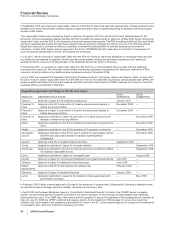

We achieved the 2008-2009 R&D goals that we announced in March 2008. We advanced 15 new molecular entities and new

indications to Phase 3 during the 2008-2009 period, which resulted in a total of 27 legacy Pfizer programs in Phase 3 at the end of

2009. In addition, we added seven Phase 3 programs through our acquisition of Wyeth, increasing our total number of Phase 3

programs at year-end 2009 to 34.

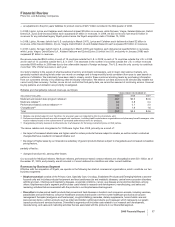

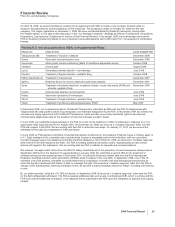

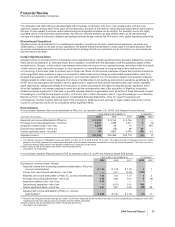

Below are significant regulatory actions by, and filings pending with, the FDA and regulatory authorities in the EU and Japan:

Recent FDA approvals:

PRODUCT INDICATION DATE APPROVED

Prevnar 13 Infant Prevention of invasive pneumococcal disease in infants and young children February 2010

Selzentry (maraviroc) HIV in treatment-naïve patients November 2009

Geodon Maintenance treatment of bipolar mania November 2009

24 2009 Financial Report