Pfizer 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

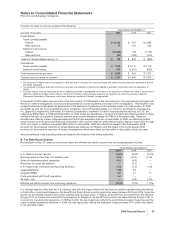

determining the amount that is greater than 50% likely of being realized upon settlement, presuming that the tax position is

examined by the appropriate taxing authority that has full knowledge of all relevant information. Under the benefit recognition model,

if our initial assessment fails to result in the recognition of a tax benefit, we regularly monitor our position and subsequently

recognize the tax benefit: (i) if there are changes in tax law, analogous case law or there is new information that sufficiently raise the

likelihood of prevailing on the technical merits of the position to more likely than not; (ii) if the statute of limitations expires; or (iii) if

there is a completion of an audit resulting in a favorable settlement of that tax year with the appropriate agency. We regularly

re-evaluate our tax positions based on the results of audits of federal, state and foreign income tax filings, statute of limitations

expirations, changes in tax law or receipt of new information that would either increase or decrease the technical merits of a position

relative to the “more-likely-than-not” standard. Liabilities associated with uncertain tax positions are classified as current only when

we expect to pay cash within the next 12 months. Interest and penalties, if any, are recorded in Provision for taxes on income and

are classified on our consolidated balance sheet with the related tax liability.

We are subject to income tax in many jurisdictions and a certain degree of estimation is required in recording the assets and

liabilities related to income taxes. All of our tax positions are subject to audit by the local taxing authorities in each tax jurisdiction.

Tax audits can involve complex issues and the resolution of issues may span multiple years, particularly if subject to negotiation or

litigation.

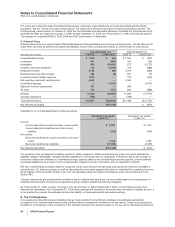

Q. Pension and Postretirement Benefit Plans

We provide defined benefit pension plans for the majority of employees worldwide. In the U.S., we have both qualified and

supplemental (non-qualified) defined benefit plans, as well as other postretirement benefit plans, consisting primarily of healthcare

and life insurance for retirees. We recognize the overfunded or underfunded status of each of our defined benefit plans as an asset

or liability on our consolidated balance sheet. The obligations generally are measured at the actuarial present value of all benefits

attributable to employee service rendered, as provided by the applicable benefit formula. Our pension and other postretirement

obligations may include assumptions such as long-term rate of return on plan assets, expected employee turnover and participant

mortality. For our pension plans, the obligation may also include assumptions as to future compensation levels. For our other

postretirement benefit plans, the obligation may include assumptions as to the expected cost of providing the healthcare and life

insurance benefits, as well as the extent to which those costs are shared with the employee or others (such as governmental

programs). Plan assets are measured at fair value. Net periodic benefit costs are recognized, as required, into Cost of sales, Selling,

informational and administrative expenses and Research and development expenses, as appropriate.

R. Share-Based Payments

Our compensation programs can include share-based payments. All grants under share-based payment programs are accounted for

at fair value and these fair values generally are amortized on an even basis over the vesting terms into Cost of sales, Selling,

informational and administrative expenses, and Research and development expenses, as appropriate.

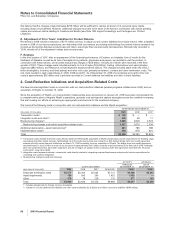

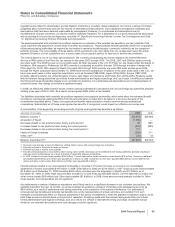

2. Acquisition of Wyeth

A. Description of the Transaction

On October 15, 2009 (the acquisition date), we acquired all of the outstanding equity of Wyeth in a cash-and-stock transaction,

valued at approximately $68 billion, in which each share of Wyeth common stock outstanding, with certain limited exceptions, was

canceled and converted into the right to receive $33.00 in cash without interest and 0.985 of a share of Pfizer common stock. The

stock component was valued at $17.40 per share of Wyeth common stock based on the closing market price of Pfizer’s common

stock on the acquisition date, resulting in a total merger consideration value of $50.40 per share of Wyeth common stock. While

Wyeth now is a wholly owned subsidiary of Pfizer, the merger of local Pfizer and Wyeth entities may be pending or delayed in

various jurisdictions and integration in these jurisdictions is subject to completion of various local legal and regulatory obligations.

Wyeth’s core business was the discovery, development, manufacture and sale of prescription pharmaceutical products, including

vaccines, for humans. Other operations of Wyeth included the discovery, development, manufacture and sale of consumer

healthcare products (over-the-counter products), nutritionals and animal health products. Our acquisition of Wyeth has made us a

more diversified health care company, with product offerings in human, animal, and consumer health, including vaccines, biologics,

small molecules and nutrition, across developed and emerging markets. The acquisition of Wyeth also added to our pipeline of

biopharmaceutical development projects endeavoring to develop medicines to help patients in critical areas, including oncology,

pain, inflammation, Alzheimer’s disease, psychoses and diabetes.

In connection with the regulatory approval process, we are required to divest certain animal health assets. Certain of these assets

were sold in 2009, while others, classified as Assets held for sale, are pending disposition.

2009 Financial Report 55