Motorola 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

software and hardware maintenance, security patches and upgrades, call center support, network monitoring, and

repair services. Managed services includes managing and operating customer systems and devices at defined

services levels. Smart Public Safety Solutions includes software and hardware solutions for our customers’ "Command

& Control" centers providing video monitoring support, data analytics, and content management with the objective of

enabling smart policing. iDEN services consists primarily of hardware and software maintenance services for our

legacy iDEN customers. In 2014, the segment’s net sales were $2.1 billion, representing 35% of the Company's

consolidated net sales.

For the years ended December 31, 2014, 2013 and 2012, no single customer accounted for more than 10% of the

Company's net sales.

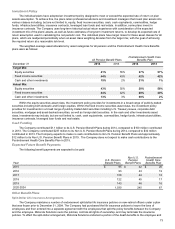

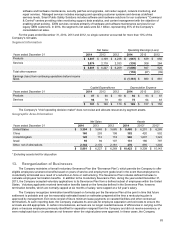

Segment Information

Net Sales Operating Earnings (Loss)

Years ended December 31 2014 2013 2012 2014 2013 2012

Products $ 3,807 $ 4,109 $ 4,236 $ (667) $ 639 $ 656

Services 2,074 2,118 2,033 (339) 308 264

$ 5,881 $ 6,227 $ 6,269 (1,006) 947 920

Total other expense (155) (67) (39)

Earnings (loss) from continuing operations before income

taxes $ (1,161) $ 880 $ 881

Capital Expenditures Depreciation Expense

Years ended December 31 2014 2013 2012 2014 2013 2012

Products $ 87 $ 90 $ 90 $ 94 $ 93 $ 87

Services 94 79 80 75 64 63

$ 181 $ 169 $ 170 $ 169 $ 157 $ 150

The Company's "chief operating decision maker" does not review and allocate resources by segment assets.

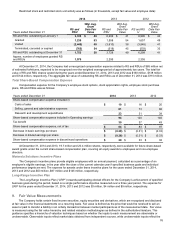

Geographic Area Information

Net Sales Assets

Years ended December 31 2014 2013 2012 2014 2013* 2012*

United States $ 3,354 $ 3,648 $ 3,685 $ 8,468 $ 6,201 $ 6,268

China 160 203 198 382 420 552

United Kingdom 128 112 118 966 1,607 1,323

Israel 95 94 107 131 186 797

Other, net of eliminations 2,144 2,170 2,161 476 895 1,203

$ 5,881 $ 6,227 $ 6,269 $ 10,423 $ 9,309 $ 10,143

* Excluding assets held for disposition

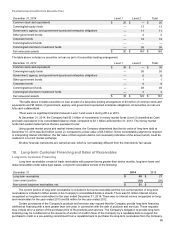

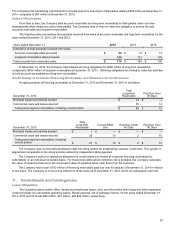

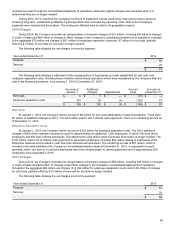

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”), which permits the Company to offer

eligible employees severance benefits based on years of service and employment grade level in the event that employment is

involuntarily terminated as a result of a reduction-in-force or restructuring. The Severance Plan includes defined formulas to

calculate employees’ termination benefits. In addition to the Involuntary Severance Plan, during the year ended December 31,

2013, the Company accepted voluntary applications to its Severance Plan from a defined subset of employees within the United

States. Voluntary applicants received termination benefits based on the formulas defined in the Severance Plan; however,

termination benefits, which are normally capped at six months of salary, were capped at a full year’s salary.

The Company recognizes termination benefits based on formulas per the Severance Plan at the point in time that future

settlement is probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is

approved by management. Exit costs consist of future minimum lease payments on vacated facilities and other contractual

terminations. At each reporting date, the Company evaluates its accruals for employee separation and exit costs to ensure the

accruals are still appropriate. In certain circumstances, accruals are no longer needed because of efficiencies in carrying out the

plans or because employees previously identified for separation resigned from the Company and did not receive severance, or

were redeployed due to circumstances not foreseen when the original plans were approved. In these cases, the Company