Motorola 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

The Company has applied forfeiture rates, estimated based on historical data, of 10%-50% to the option fair values

calculated by the Black-Scholes option pricing model. These estimated forfeiture rates are applied to grants based on their

remaining vesting term and may be revised in subsequent periods if actual forfeitures differ from these estimates.

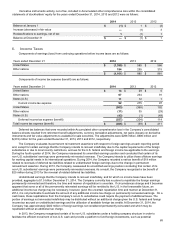

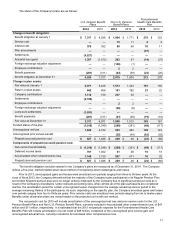

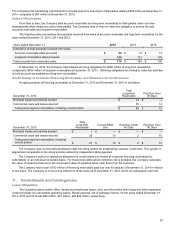

Stock option activity was as follows (in thousands, except exercise price and employee data):

2014 2013 2012

Years ended December 31

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Options outstanding at January 1 10,937 $ 79 13,132 $ 70 15,729 $ 63

Options granted 1,340 66 1,652 57 1,286 51

Options exercised (1,526) 39 (2,950) 31 (2,831) 29

Options terminated, cancelled or expired (1,067) 65 (897) 65 (1,052) 60

Options outstanding at December 31 9,684 85 10,937 79 13,132 70

Options exercisable at December 31 7,282 94 7,628 91 9,242 81

Approx. number of employees granted options 118 123 115

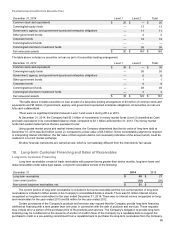

At December 31, 2014, the Company had $21 million of total unrecognized compensation expense, net of estimated

forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized over the weighted

average period of approximately two years. Cash received from stock option exercises and the employee stock purchase plan

was $135 million, $165 million and $133 million for the years ended December 31, 2014, 2013 and 2012, respectively. The total

intrinsic value of options exercised during the years ended December 31, 2014, 2013 and 2012 was $38 million, $85 million and

$59 million, respectively. The aggregate intrinsic value for options outstanding and exercisable as of December 31, 2014 was

$119 million and $103 million, respectively, based on a December 31, 2014 stock price of $67.08 per share.

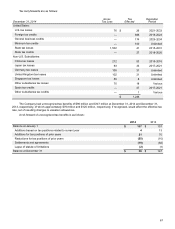

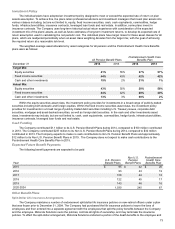

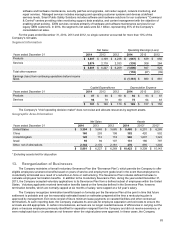

The following table summarizes information about stock options outstanding and exercisable at December 31, 2014 (in

thousands, except exercise price and years):

Options Outstanding Options

Exercisable

Exercise price range No. of

options

Wtd. avg.

Exercise

Price

Wtd. avg.

contractual

life (in yrs.) No. of

options

Wtd. avg.

Exercise

Price

Under $30 699 $ 27 5 699 $ 27

$30-$40 2,222 39 5 2,222 39

$41-$50 231 45 6 222 45

$51-$60 1,786 54 8 584 54

$61-$70 1,430 66 8 239 65

$71-$80 197 74 2 197 74

$81 and over 3,119 161 0 3,119 161

9,684 7,282

As of December 31, 2014 and 2013, the weighted average contractual life for options outstanding and exercisable was five

and four years, respectively.

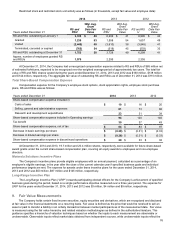

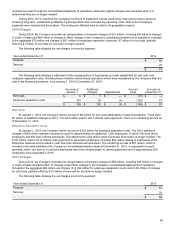

Restricted Stock and Restricted Stock Units

Restricted stock (“RS”) and restricted stock unit (“RSU”) grants consist of shares or the rights to shares of the Company’s

common stock which are awarded to employees and non-employee directors. The grants are restricted such that they are

subject to substantial risk of forfeiture and to restrictions on their sale or other transfer by the employee. Shares of RS and RSUs

assumed or replaced with comparable shares of RS or RSUs in conjunction with a change in control will only have the

restrictions lapse if the holder is also involuntarily terminated (for a reason other than cause) or quits for good reason within

24 months of a change in control.