Motorola 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

reflected increased order activity and faster-than-expected conversion of certain orders. The segment’s backlog was $1.2 billion

at December 31, 2014 and $1.1 billion at December 31, 2013.

The segment had an operating loss of $667 million in 2014, compared to operating earnings of $639 million in 2013 driven

by an allocation of $1.3 billion of expense related to the settlement of a U.S pension plan. As a percentage of net sales in 2014

compared to 2013, gross margin decreased, SG&A expenditures decreased, R&D expenditures decreased, and Other charges

increased. The decrease in operating earnings was primarily driven by: (i) an increase in Other charges, reflecting $1.3 billion of

allocated charges related to the settlement of a U.S. pension plan and (ii) a decrease in net sales, resulting in lower gross

margin, partially offset by lower SG&A and R&D expenditures as a result of cost savings actions taken and lower variable

compensation expenses.

Segment Results—2013 Compared to 2012

In 2013, the segment’s net sales were $4.1 billion, a 3% decrease compared to 2012 reflecting a decrease in: (i) devices

sales in North America and APME, partially offset by an increase in devices sales within EA and Latin America and (ii) system

sales in Latin America and APME, partially offset by an increase within North America and EA. On a geographic basis, net sales

declined in North America, Latin America and APME, and increased in EA in 2013 compared to 2012. The segment’s backlog

was $1.1 billion at December 31, 2013 and $1.6 billion at December 31, 2012.

The segment had operating earnings of $639 million in 2013, compared to operating earnings of $656 million in 2012. As a

percentage of net sales in 2013 as compared to 2012, gross margin was down slightly, SG&A, and R&D expenditures

decreased. The decrease in operating earnings was primarily due to an increase in Other charges as a result of increased

reorganization of business charges in 2013 as compared to 2012, partially offset by a decrease in SG&A expenses as a result of

lower variable compensation expenses and reduced defined benefit plan expenses.

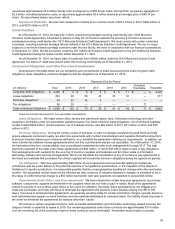

Services Segment

In 2014, the Services segment’s net sales represented 35% of our consolidated net sales, compared to 34% in 2013 and

32% in 2012.

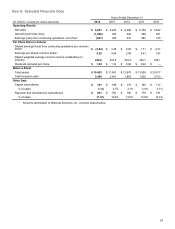

Years ended December 31 Percent Change

(Dollars in millions) 2014 2013 2012 2014—2013 2013—2012

Segment net sales $ 2,074 $ 2,118 $ 2,033 (2)% 4%

Operating earnings (loss) (339) 308 264 (210)% 17%

Segment Results—2014 Compared to 2013

In 2014, the segment’s net sales were $2.1 billion, a 2% decrease compared to 2013 reflecting a decrease in sales of: (i)

iDEN services in North America and Latin America and (iii) Lifecycle Support services in APME and EA, partially offset by an

increase in Managed services sales in APME and EA. On a geographic basis, net sales for 2014 declined in North America and

APME, increased in EA, and remained relatively constant in Latin America, compared to 2013. Overall, Integration services

remained flat due to the timing of certain projects in 2014, as compared to 2013. Lifecycle Support services decreased slightly;

however, demand increased in the fourth quarter of 2014 for our software maintenance and hardware upgrade offerings.

Managed services grew modestly as increasing complexity and the need for enhanced capabilities to support software-centric,

information technology-based networks continued to drive demand in all regions. The segment’s backlog was $4.6 billion at

December 31, 2014, compared to $4.3 billion at December 31, 2013.

The segment had an operating loss of $339 million in 2014, compared to operating earnings of $308 million in 2013. As a

percentage of net sales in 2014 as compared to 2013, gross margin, SG&A expenditures, and R&D expenditures decreased,

and Other charges increased. The decrease in operating earnings was primarily driven by: (i) an increase in Other charges,

reflecting $584 million of allocated charges related to the settlement of a U.S. pension plan and (ii) a decrease in net sales,

resulting in lower gross margin, partially offset by lower SG&A and R&D expenditures as a result of cost savings actions taken

and lower variable compensation expenses.

Segment Results—2013 Compared to 2012

In 2013, the segment’s net sales were $2.1 billion, a 4% increase compared to 2012 reflecting an increase in sales of: (i)

Integration services in North America and EA, and (ii) Lifecycle Support services in North America, partially offset by a decrease

in sales of Managed services in APME. On a geographic basis, net sales for 2013 increased in North America, EA and Latin

America and decreased in APME, compared to 2012. The segment’s backlog was $4.3 billion at December 31, 2013, compared

to $3.4 billion at December 31, 2012.

The segment had operating earnings of $308 million in 2013, compared to operating earnings of $264 million in 2012. As

a percentage of net sales in 2013 as compared to 2012, gross margin was slightly higher and SG&A and R&D expenditures

decreased. The increase in operating earnings was primarily due to: (i) an increase in gross margin as a result of higher margin

from Integration services and (ii) decreases in SG&A expenses as a result of lower variable compensation expenses and

reduced defined benefit plan expenses, partially offset by higher Other charges as a result of higher reorganization of business

charges.