Motorola 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

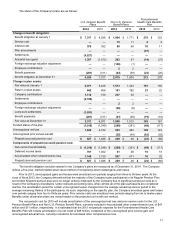

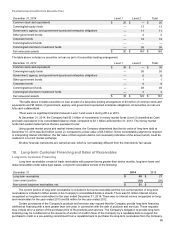

Non-U.S. Pension Benefit Plans

December 31, 2014 Level 1 Level 2 Total

Common stock and equivalents $ 194 $ — $ 194

Commingled equity funds — 569 569

Government, agency, and government-sponsored enterprise obligations — 26 26

Corporate bonds — 316 316

Commingled bond funds — 399 399

Commingled short-term investment funds — 9 9

Total investment securities $ 194 $ 1,319 $ 1,513

Cash 233

Accrued income receivable 5

Insurance contracts 55

Fair value plan assets $ 1,806

The table above includes securities on loan as part of a securities lending arrangement of $16 million of common stock

and equivalents and $12 million of corporate bonds. All securities on loan are fully collateralized.

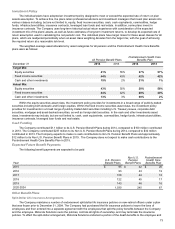

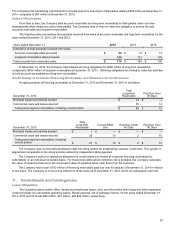

The following table summarizes the changes in fair value of the Level 3 assets:

2014

Balance at January 1 $ 26

Transfers to Level 2 (14)

Loss on assets held (1)

Payments received for securities sold (10)

Purchases 1

Other (2)

Balance at December 31 $ —

December 31, 2013 Level 1 Level 2 Level 3 Total

Common stock and equivalents $ 172 $ — $ — $ 172

Commingled equity funds — 558 — 558

Government, agency, and government-sponsored enterprise

obligations — 21 3 24

Corporate bonds — 289 23 312

Commingled bond funds — 361 — 361

Commingled short-term investment funds — 11 — 11

Total investment securities $ 172 $ 1,240 $ 26 $ 1,438

Accrued income receivable 61

Insurance contracts 14

Fair value plan assets $ 1,513

The table above includes securities on loan as part of a securities lending arrangement of $8 million of common stock and

equivalents, and $13 million of corporate bonds. All securities on loan are fully collateralized.

There were no significant transfers between Level 1 and Level 2 during 2014 or 2013.