Motorola 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

• Compensation and Leadership Committee Charter

• Governance and Nominating Committee Charter

All of our reports and corporate governance documents may also be obtained without charge by contacting Investor

Relations, Motorola Solutions, Inc., Corporate Offices, 1303 East Algonquin Road, Schaumburg, Illinois 60196, E-mail:

[email protected]. This annual report on Form 10-K and Definitive Proxy Statement are available on the Internet

at www.motorolasolutions.com/investors and may also be requested in hardcopy by completing the on-line request form

available on our website at www.motorolasolutions.com/investors. Our Internet website and the information contained therein or

incorporated therein are not intended to be incorporated into this Annual Report on Form 10-K.

Item 1A: Risk Factors

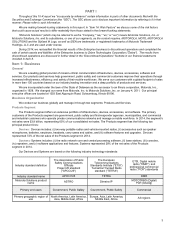

We face a number of risks related to current global economic and political conditions, including low economic growth

rates in certain markets, the impact of currency fluctuations, falling oil prices, and unstable political conditions that

have and could continue to unfavorably impact our business.

Global economic and political conditions continue to be challenging for many of our government and commercial markets,

as economic growth in many countries, particularly in Europe and in emerging markets, has remained low, currency fluctuations

have impacted profitability, credit markets have remained tight for certain of our counterparties and many of our customers

remain dependent on government grants to fund purchases of our products and services. Falling global oil prices are also

impacting government customers in oil-dependent economies, particularly in the Middle East, South America and Russia. In

addition, conflicts in the Middle East and elsewhere have created many economic and political uncertainties that continue to

impact worldwide markets. The length of time these adverse economic and political conditions may persist is unknown. These

global economic and political conditions have impacted and could continue to impact our business in a number of ways,

including:

• Requests by Customers for Vendor Financing by Motorola Solutions: Certain of our customers, particularly, but

not limited to, those who purchase large infrastructure systems, request that their suppliers provide financing in

connection with equipment purchases and/or the provision of solutions and services, particularly as the size and length

of these types of contracts increases and as we increase our business in developing countries. Requests for vendor

financing continue to increase in volume and scope, including in response to reduced tax revenue at the state and local

government level and ongoing tightening of credit for certain commercial customers. Motorola Solutions has continued

to provide vendor financing to both our government and commercial customers. We have been faced with and expect

to continue to be faced with choosing between further increasing our level of vendor financing or potentially losing

sales, as some of our competitors, particularly those in Asia, have been more willing to provide vendor financing to

customers around the world, particularly customers in Africa and Latin America. To the extent we are unable to sell

these receivables on terms acceptable to us we may retain exposure to the credit quality of our customers who we

finance.

• Customers' Inability to Obtain Financing to Make Purchases from Motorola Solutions and/or Maintain Their

Business: Some of our customers require substantial financing, including public financing or government grants, in

order to fund their operations and make purchases from us. The inability of these customers to obtain sufficient credit or

other funds, including as a result of lower tax revenues, falling oil prices, currency fluctuations or unavailability of

government grants, to finance purchases of our products and services and/or to meet their payment obligations to us

could have, and in some cases has had, a negative impact on our financial results. This risk increases as the size and

length of our contracts increase. In addition, if global economic conditions result in insolvencies for our customers, it

will negatively impact our financial results.

• Challenges in Budgeting and Forecasting: It is difficult to estimate changes in various parts of the U.S. and

world economy, including the markets in which we participate. Components of our budgeting and forecasting are

dependent upon estimates of demand for our products and estimates of foreign exchange rates. The prevailing

economic uncertainties render estimates of future income and expenditures challenging.

• Potential Deferment or Cancellation of Purchases and Orders by Customers: Uncertainty about current and

future global economic conditions may cause, and in some cases has caused, businesses and governments to defer or

cancel purchases in response to tighter credit, decreased cash availability and de-prioritization of communications

equipment within the budgeting process. If future demand for our products declines due to economic conditions, it will

negatively impact our financial results.

• Inability to operate and grow in certain markets: We operate in a number of markets with a risk of intensifying

political instability, including Russia, the Middle East and Africa. If political instability continues in these markets and in

other parts of the world in which we operate it could have a significant impact on our ability to grow and operate in

those locations, which will negatively impact our financial results.