Motorola 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of

Operations

The following is a discussion and analysis of our financial position as of December 31, 2014 and 2013 and results of

operations for each of the three years in the period ended December 31, 2014. This commentary should be read in conjunction

with our consolidated financial statements and the notes thereto appearing under “Item 8: Financial Statements and

Supplementary Data.”

Executive Overview

Recent Developments

On April 14, 2014, we entered into a Master Acquisition Agreement (the “Acquisition Agreement”) with Zebra Technologies

Corporation to sell our Enterprise business for $3.5 billion in cash. The transaction closed on October 27, 2014. As a result of the

sale, we have reported the Enterprise business as a discontinued operation in our consolidated financial statements and

footnotes for all periods presented.

Our Business

We are a leading global provider of mission-critical communication infrastructure, devices, accessories, software, and

services. Our products and services help government, public safety and commercial customers improve their operations through

increased effectiveness, efficiency, and safety of their mobile workforces. We serve our customers with a global footprint of sales

in more than 100 countries based on our industry leading innovation and a deep portfolio of products and services.

We conduct our business globally and manage it by two segments:

Products: The Products segment offers an extensive portfolio of infrastructure, devices, accessories, and

software. The primary customers of the Products segment are government, public safety and first-responder agencies,

municipalities, and commercial and industrial customers who operate private communications networks and manage a

mobile workforce. Our Products segment is comprised of Devices and Systems. Devices includes two-way portable and

vehicle mounted radios, accessories, and software features and upgrades. Systems includes the radio network core

and central processing software, base stations, consoles, repeaters, and software applications and features. In 2014,

the segment’s net sales were $3.8 billion, representing 65% of our consolidated net sales.

Services: The Services segment provides a full set of service offerings for government, public safety and

commercial communication networks including: (i) Integration services, (ii) Lifecycle Support services, (iii) Managed

services, (iv) Smart Public Safety Solutions, and (v) iDEN services. Integration services includes implementation,

optimization, and integration of networks, devices, software, and applications. Lifecycle Support services includes

lifecycle planning, software and hardware maintenance, security patches and upgrades, call center support, network

monitoring, and repair services. Managed services includes managing and operating customer systems and devices at

defined services levels. Smart Public Safety Solutions includes software and hardware solutions for our customers'

"Command & Control" centers providing video monitoring support, data analytics, and content management with the

objective of enabling smart policing. iDEN services consists primarily of hardware and software maintenance services

for our legacy iDEN customers. In 2014, the segment’s net sales were $2.1 billion, representing 35% of our

consolidated net sales.

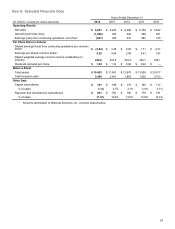

What were our 2014 financial results?

• Net sales were $5.9 billion in 2014 compared to $6.2 billion in 2013.

• We had an operating loss of $1.0 billion in 2014, compared to operating earnings of $947 million in 2013. Included in

the 2014 operating loss was a $1.9 billion pension settlement loss, including related expenses.

• Loss from continuing operations was $697 million, or $(2.84) per diluted common share in 2014, compared to earnings

of $933 million, or $3.45 per diluted common share in 2013.

• Cash used for operating activities was $685 million in 2014, compared to cash provided by operating activities of $555

million in 2013. We contributed $1.3 billion to our pension plans during 2014, compared to $182 million in 2013.

• We provided cash to shareholders through repurchases of $2.5 billion in shares and $318 million in cash dividends

during 2014.

What were the financial results for our two segments in 2014?

• In the Products segment, net sales were $3.8 billion in 2014, a decrease of $302 million, or 7%, compared to $4.1

billion in 2013. On a geographic basis, net sales decreased in North America, Latin America and Asia Pacific and

Middle East ("APME") and increased in Europe and Africa ("EA") compared to 2013. Operating losses were $667

million in 2014, compared to operating earnings of $639 million in 2013. Operating margin decreased in 2014 to

(17.5)% from 15.6% in 2013. Approximately $1.3 billion of pension settlement losses were allocated to the Products

segment in 2014.

• In the Services segment, net sales were $2.1 billion in 2014, a decrease of $44 million, or 2%, compared to $2.1 billion

in 2013. On a geographic basis, net sales decreased in North America, Latin America and APME and increased in EA,

compared to 2013. Operating losses were $339 million in 2014, compared to operating earnings of $308 million in