Motorola 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

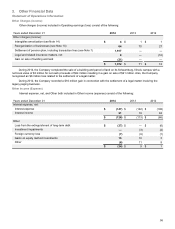

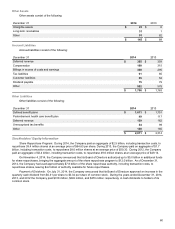

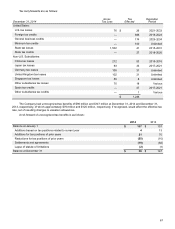

Inventories, Net

Inventories, net, consist of the following:

December 31 2014 2013

Finished goods $ 163 $ 157

Work-in-process and production materials 313 315

476 472

Less inventory reserves (131) (125)

$ 345 $ 347

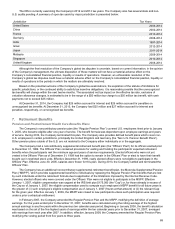

Other Current Assets

Other current assets consist of the following:

December 31 2014 2013

Costs and earnings in excess of billings $ 417 $ 405

Tax-related deposits and refunds receivable 103 107

Zebra receivable for cash transferred 49 —

Other 171 123

$ 740 $ 635

In conjunction with the sale of the Enterprise business to Zebra, the Company transfered legal entities which maintained

cash balances. Approximately $49 million of cash balances will be reimbursed by Zebra in accordance with the Acquisition

Agreement.

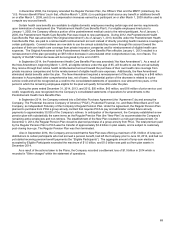

Property, Plant and Equipment, Net

Property, plant and equipment, net, consist of the following:

December 31 2014 2013

Land $ 18 $ 22

Building 559 582

Machinery and equipment 1,672 1,642

2,249 2,246

Less accumulated depreciation (1,700) (1,636)

$ 549 $ 610

Depreciation expense for the years ended December 31, 2014, 2013 and 2012 was $169 million, $157 million and $150

million, respectively.